Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

YES Bank Current Account is a type of demand deposit account that fulfills all the banking and financial needs of individuals. The account allows smooth withdrawal and transfer of funds and limitless transactions on the part of an individual. One can open a YES Bank Current Account online or via visiting the nearest bank branch.

| Table of Content |

In consideration with the different banking needs of individuals for different kinds of businesses, YES Bank offers a variety of accounts which are customised to serve the specific requirements. Below given is the list of Current Account variants provided by YES along with their primary features.

| YES Bank Current Account Variants | |

| Account Name | Primary Features |

| Business Value Current Account |

|

| Business Growth Current Account |

|

| Business Benefit Current Account |

|

| Business Edge Current Account |

|

| YES Head Start-Up |

|

| YES Pragati Current Account |

|

| Business Banking Current Account |

|

| YES Premia Current Account |

|

The account comes with low minimum balance requirement and provides the users with free cash withdrawal within India, free cash deposit up to Rs.2 lakh per month, free 60 DD per month and more.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Rs.10,000 |

| Non-maintenance of balance | Rs.1000 |

| Cash deposit limit | Free up to Rs.2 lakh per month |

| Cash withdrawal | Free within India |

| NEFT / RTGS payment (via net banking) | NEFT – Rs.4 on transactions above Rs.10,000

RTGS – Rs.25 per transaction |

| Demand Drafts | Free up to 60 DD per month |

| Cheque Leaves | Rs.2 / leaf (first cheque book of 50 leaves free on account opening) |

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Rs.30,000 |

| Non-maintenance of balance | Rs.1500 |

| Cash deposit limit | Free up to Rs.5 lakh per month |

| Cash withdrawal | Free within India |

| NEFT / RTGS charges (via netbanking) | Free NEFT and RTGS payments |

| Demand Drafts | Free up to 60 DD per month |

| Cheque Leaves | 100 cheque leaves free per month |

With the product, the users can avail privileges including free cash withdrawal within India, unlimited and free demand draft, free NEFT and RTGS payments and more.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Rs.70,000 |

| Non-maintenance of balance | Rs.1500 |

| Cash deposit limit | Free up to Rs.20 lakh per month |

| Cash withdrawal | Free within India |

| NEFT / RTGS charges | Free NEFT and RTGS payments |

| Demand Draft | Unlimited + Free DD every month |

The customers can get added advantages including unlimited and free DD every month, free cash withdrawal, free cash deposit up to Rs.50 lakh per month and more.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Rs.2 lakh |

| Non-maintenance of balance | Rs.1500 |

| Cash deposit limit | Free up to Rs.50 lakh per month |

| Cash withdrawal | Free within India |

| NEFT / RTGS charges | Free NEFT and RTGS payments |

| Demand Draft | Unlimited + Free DD every month |

This account variant is a zero balance current account provided by YES Bank. The variant provides users with facilities including free NEFT, RTGS collection and payment, free 50 DDs per month, free 100 cheque leaves per month and more.

|

Primary Features |

Charges |

| Average Quarterly Balance (AQB) | No balance commitment for 1st year

Post 1 year- Rs.25,000 |

| Non-maintenance of balance | Rs.1500 |

| Cash deposit limit | Free up to Rs.10 lakh per month |

| Cash withdrawal | Free across all YES Bank branches |

| NEFT / RTGS payment & collection (any channel) | Free |

| Demand Drafts | 50 instruments free per month |

| Cheque Leaves |

100 cheque leaves free per month |

The account variant comes with low minimum balance requirement and hence is suitable for low wage earners. The product provides users with free cash withdrawal, free NEFT / RTGS collection and payment and more.

| Primary Features | Charges |

| Half-Yearly Average Balance | Rs.5000 |

| Non-maintenance of balance | Rs.500 |

| Cash deposit limit | Free up to Rs.5 lakh per month |

| Cash withdrawal | Free across all YES Bank branches |

| NEFT / RTGS payment & collection (any channel) | Free |

| Demand Drafts | 25 instruments free per month |

| Cheque Leaves | 50 cheque leaves free per month |

This current account variant provides users with added privileges including unlimited and free NEFT / RTGS collections, unlimited and free demand drafts and cheque leaves and more.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | N.A. |

| Non-maintenance of balance | N.A. |

| Cash deposit limit | Free up to Rs.1 lakh per month |

| Cash withdrawal | Free across all YES Bank branches |

| NEFT / RTGS collections | Unlimited and Free |

| Demand Drafts | Unlimited and Free |

| Cheque Leaves | Unlimited and Free |

The account holders of this variant provides users with facilities including free NEFT / RTGS collections and payments, zero account balance maintenance charges, free 50 DD per month and more.

| Primary Features | Charges |

| Eligibility Criteria | Rs.2 lakh CASA or Rs.10 lakh NRV |

| Non-maintenance of balance | Nil |

| Cash deposit limit | Free up to 10 times of current month AMB |

| Cash withdrawal | Free across all YES Bank branches |

| NEFT / RTGS collections & payments | Free |

| Demand Drafts | 50 per month is free |

| Cheque Leaves | 300 cheque leaves free per month |

The YES Bank Current Account comes with a lot of features and benefits to the users. Below listed are some:

YES Bank provides its customers with a special three-tier structure for Current Accounts:

1. Edge Business – This product is ideal for new startup or a business with less volume transactions and with rather low balance expectation.

2. Prime Business – This current account variant is best suited for handling large value transactions. Here, one can choose from a variety of value-added services in accordance with the specific business needs.

3. Exclusive Business – This product offers maximum benefits and cost-saving features to its customers. It provides the best in-class services to meet all the business and financial needs.

| Three-tier structure for Current Accounts | |||

| Primary Features | Edge Business | Prime Business | Exclusive Business |

| Average Quarterly Balance (AQB) | Rs.25,000 | Rs.1 lakh | Rs.5 lakh |

| Non-Maintenance Charges | Rs.1500 | Rs.1500 | Rs.1500 |

| Cash Deposit | Free up to Rs.5 lakh | Free up to Rs.10 lakh | Free up to Rs.25 lakh |

| Cash Withdrawal (across all YES Bank branches) | Free | Free | Free |

| NEFT & RTGS (online payments & collection) | Free | Free | Free |

| Cheque Book | 100 cheque leaves free per month | 300 cheque leaves free per month | 500 cheque leaves free per month |

| Demand Draft (payable at YES Bank) | 25 instruments free per month | 50 instruments free per month | Free |

| Card Type | EMV Chip Business Gold Debit Card | EMV Chip Business Gold Debit Card | YES First World Business Card |

| Cheque pick-up | Rs.100 per visit | Free | Free |

Below mentioned is the list of entities eligible for a Current Account in YES Bank:

YES Bank Current Account can be opened by the above mentioned entities online or by visiting the nearest bank branch or by calling the YES Bank 24-hour contact centre.

Online

Step 1: Visit the official website of YES Bank.

Step 2: Click on the ‘Business Banking’ option.

Step 3: In the drop-down menu, Click on ‘Current Account’

Step 4: Choose the preferred YES Bank Current Account variant.

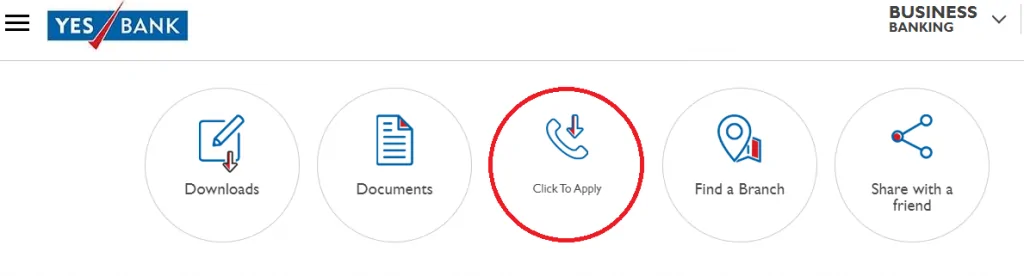

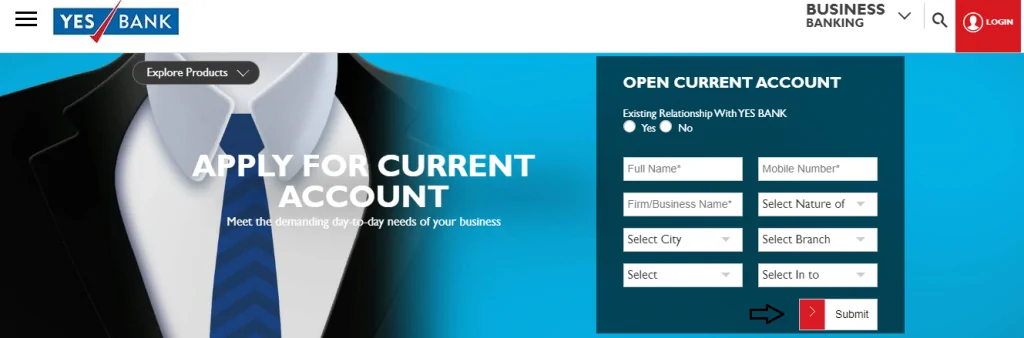

Step 5: In the newly opened page Enter the ‘Click to Apply’ section.

Step 6: Provide the required details like name, state, city, mobile number, email id and proceed further and click on ‘Submit’. Have a look at the below displayed picture

Step 7: After successful completion, a YES Bank representative will give a call or send an SMS to the person in regards to the application.

Offline

The users can visit the nearest bank branch with all the required KYC acceptable documents. One needs to fill the YES Bank Current Account opening form and submit it to the bank along with all the documents. The users can also download the YES Bank Current Account opening form available at the bank’s official website and submit the duly filled form along with all the documents to the nearest bank branch. For online form download follow the below mentioned steps:

Step 1: Visit the official website of YES Bank.

Step 2: Click on the ‘Business Banking’ option.

Step 3: In the drop-down menu, click on the ‘Current Account’ section.

Step 4: Choose the preferred YES Bank Current Account type.

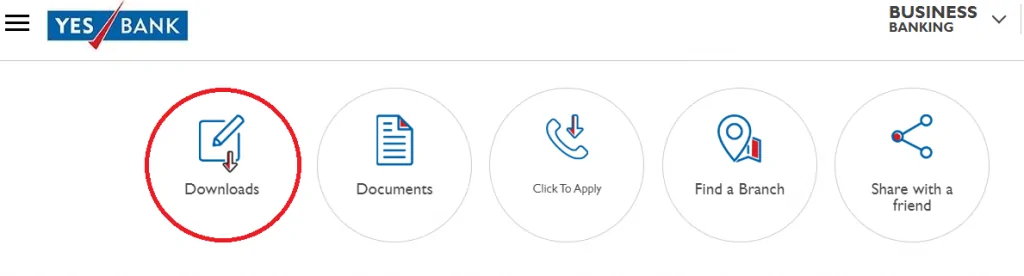

Step 5: In the newly opened page, click on the ‘Downloads’ option. Look at the below displayed picture.

Step 6: Download the current account opening form in the preferred language.

Step 7: Take a print out and fill the form.

Step 8: Visit the nearest bank branch with the filled form and all required KYC acceptable documents for account opening.

The required documents to be presented before applying for a preferred Current Account variant depends on the category one belongs to. For Individual account, the following documents are required:

|

Individual |

|

It is to be noted that there are varying requirements for other categories as well. Also, in addition to the self-attested copies of the identity proof, address proof and photograph the following additional documents are required for other categories.

|

Hindu Undivided Families |

|

|

Sole Proprietorship |

|

|

Partnership Firms |

|

|

Limited Liability Partnership |

|

|

Private and Public Limited Companies |

|

Q. How to close Current Account in YES Bank?

A. The YES Bank Current Account closure form in available on the official bank website. The user needs to download the form, print it, fill out and submit the form to the branch.

Q. What is the minimum balance requirement in YES Bank Current Account?

A. YES Bank Current Account minimum balance requirement varies from one account variant to another. For Business Value account it is Rs.10,000 while for Business Growth account it is Rs.30,000.

Q. Can one open YES Bank zero balance Current Account?

A. One can go for YES Head Start-Up Current Account that offers zero balance requirement for 1st year post which the minimum balance of Rs.25,000 needs to be maintained.

Q. How to proceed for online Current Account opening in YES Bank?

A. Follow the below mentioned steps-