Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Axis Bank offers a wide range of current account products to cater to the business needs of its customers. With Axis Current Account, the users can access the feature of ‘Anywhere Banking’ and process bulk transactions instantly and conveniently. The users can also avail digital services like SMS alerts and free NEFT / RTGS transactions. It is to be noted that the Axis Bank Current Account minimum balance requirement may vary from one account variant to another.

| Table of Content |

Given below is the list of Axis Bank Current Account variants. The Axis Bank current account charges and minimum balance requirements may vary from one product to another. All the factors should be kept in mind before opting for the preferred Axis current account type.

| Types of Axis Bank Current Accounts | |

| Value-Based Current Accounts | |

| Account Type | Primary Features |

| Normal Current Account |

|

| Business Advantage Current Account |

|

| Business Select Current Account |

|

| Business Classic Current Account |

|

| Business Privilege Current Account |

|

| Channel One Current Account |

|

| Club 50 Current Account |

|

|

Other Axis Current Account |

|

| Local Current Account

(Axis Bank Zero Balance Current Account) |

|

| Business Global Current Account

(Axis Bank Zero Balance Current Account) |

|

| Tailor Made Current Account |

|

| Current Account for Government Societies

(Zero Balance Current Account) |

|

| Sweeps Current Account |

|

| Current Account for Societies |

|

| Current Account for Banks

(Axis Bank Zero Balance Current Account) |

|

| Resident Foreign Currency Account |

|

| Current Account for Pharma |

|

| Capital Market Current Account

(Zero Balance Current Account) |

|

This account variant comes with low minimum balance requirement and provides users with added advantages including unlimited intercity cash withdrawal, free fund transfer from one bank account to another and more.

| Key Features | Charges |

| Monthly Average Balance | Rs.10,000 |

| Non-maintenance of balance | Rs.1000 |

| Cash deposit limit (Home & Non-Home branch) | Free up to Rs.2 lakh per month |

| Cash withdrawal | Unlimited daily intercity withdrawal |

| Cheque Book leaves | Rs.2 per leaf |

| Demand Drafts / Pay Orders | Rs.2 / 1000 |

| Account maintenance charges | Rs.50 per month |

| NEFT / RTGS fees | Free for both inward & outward transactions |

| Account Closure charges | Less than 1 year: Rs.500

More than 1 year: Rs.250 |

With this account variant, the users get added privileges including free 50 cheque leaves, free cash deposit limit of up to Rs.3 lakh per month, free NEFT and RTGS inward & outward transactions and more.

| Key Features | Charges |

| Monthly Average Balance | Rs.25,000 |

| Non-maintenance of balance | Rs.1200 |

| Cash deposit limit (Home & Non-Home branch) | Free up to Rs.3 lakh per month |

| Cash withdrawal | Unlimited intercity withdrawal |

| Cheque Book leaves | Free 50 cheque leaves |

| Demand Drafts / Pay Orders | Rs.2 / 1000 |

| Account maintenance charges | Rs.50 per month |

| NEFT / RTGS fees | Free for both inward & outward transactions |

| Account Closure charges | Less than 1 year: Rs.500

More than 1 year: Rs.250 |

The customers get free and unlimited intercity cash withdrawal, NEFT and RTGS inward and outward transactions free, free 100 cheque leaves and more.

| Key Features | Charges |

| Monthly Average Balance | Rs.50,000 |

| Non-maintenance of balance | Rs.1500 |

| Cash deposit limit (Home & Non-Home branch) | Free up to 12 times of MAB |

| Cash withdrawal | Unlimited intercity withdrawal |

| Cheque Book leaves | Free limit of 100 cheque leaves |

| Demand Drafts / Pay Orders | Rs.2 / 1000 |

| Account maintenance charges | Rs.50 per month |

| NEFT / RTGS fees | Free for both inward & outward transactions |

| Account Closure charges | Less than 1 year: Rs.500

More than 1 year: Rs.250 |

This account variant is best suited for high wage earners as it comes with a high minimum balance requirement. The account provides users with free demand drafts and pay orders, free cash deposit limit of up to Rs.12 lakh per month and more.

| Key Features | Charges |

| Monthly Average Balance | Rs.1 lakh |

| Non-maintenance of balance | Rs. 2000 |

| Cash deposit limit (Home & Non-Home branch) | Free up to Rs.12 lakh per month |

| Cash withdrawal | Unlimited intercity withdrawal |

| Cheque Book leaves | Free limit of 200 cheque leaves |

| Demand Drafts / Pay Orders | Free |

| Account maintenance charges | Rs. 50 per month |

| NEFT / RTGS fees | Free for both inward & outward transactions |

| Account Closure charges | Less than 1 year: Rs.500

More than 1 year: Rs.250 |

The account holders need to maintain a high minimum balance in the account. The users get the added advantage of free DD / PO, zero account maintenance charges, free 500 cheque leaves, free fund transfer facility and more.

| Key Features | Charges |

| Monthly Average Balance | Rs.5 lakh |

| Non-maintenance of balance | Rs.3000 |

| Cash deposit limit (Home & Non-Home branch) | Free up to Rs.60 lakh per month across any Axis Bank branch |

| Cash withdrawal | Up to Rs.25 lakh per month (intercity) |

| Cheque Book leaves | Free limit of 500 cheque leaves |

| Demand Drafts / Pay Orders | Free |

| Account maintenance charges | Nil |

| NEFT / RTGS fees | Free for both inward & outward transactions |

| Account Closure charges | Less than 1 year: Rs.500

More than 1 year: Rs.250 |

The customers are required to maintain a rather high minimum balance for this account variant. However they can avail extra privileges including free 1000 cheque leaves, free DD / PO, free NEFT and RTGS inward and outward transactions and more.

| Key Features | Charges |

| Monthly Average Balance | Rs.10 lakh |

| Non-maintenance of balance | Rs.7000 |

| Cash deposit limit (Home & Non-Home branch) | Free up to Rs.1.2 crore per month across any Axis Bank branch |

| Cash withdrawal | Up to Rs.60 lakh per month |

| Cheque Book leaves | Free limit of 1000 cheque leaves |

| Demand Drafts / Pay Orders | Free |

| Account maintenance charges | Nil |

| NEFT / RTGS fees | Free for both inward & outward transactions |

| Account Closure charges | Less than 1 year: Rs.500

More than 1 year: Rs.250 |

The users get advantages including free cheque book leaves, free demand drafts / pay orders, zero account maintenance charges, free and unlimited cash withdrawal and more.

| Key Features | Charges |

| Quarterly Average Balance | Rs.50 lakh |

| Non-maintenance of balance | Rs.25,000 |

| Cash deposit limit (Home & Non-Home branch) | Free up to Rs.2 crore per month across any Axis Bank branch |

| Cash withdrawal | Free unlimited cash withdrawal at any non-home branch |

| Cheque Book leaves | Free |

| Demand Drafts / Pay Orders | Free |

| Account maintenance charges | Nil |

| NEFT / RTGS fees | Free for both inward & outward transactions |

| Account Closure charges | Less than 1 year: Rs.500

More than 1 year: Rs.250 |

The users are not required to maintain any monthly average balance plus they can avail added advantages including free cash deposit limit of Rs.3 lakh per month, free 75 cash withdrawal transactions and more.

| Key Features | Charges |

| Monthly Average Balance | Nil |

| Annual Charges | Rs.1999 + Service Tax |

| Cash deposit limit (Home branch) | Free up to Rs.3 lakh per month |

| Cash withdrawal (Home branch) | Free within 75 transaction limit |

| Cash Withdrawal (inter-branch) | Rs.50 charges above free limit |

| NEFT / RTGS fees | NEFT- Rs.25 on transactions above Rs.2 lakh

RTGS- Rs.50 on transactions of Rs.5 lakh & above |

This is a zero balance current account provided by Axis Bank. The users get added privileges including free demand drafts / paye order, free account statement, free NEFT and RTGS inward and outward transactions and more.

| Key Features | Charges |

| Monthly Average Balance | Nil |

| Annual Charges | Rs.1000 |

| Cash deposit limit (Non-Home branch) | Maximum of Rs.1 lakh per day |

| Cash withdrawal (Home Branch) | Rs.1 lakh on daily basis |

| Third Party Cash withdrawal | Rs.50,000 on daily basis |

| Demand Drafts / Pay Orders | Free |

| Account statement | Free |

| NEFT / RTGS fees | Free for both inward & outward transactions |

| Account Closure charges | Less than 1 year: Rs.500

More than 1 year: Rs.250 |

This account variant allows users to customise his or her account according to their preference. The users can even decide the average account balance they wish to maintain.

| Key Features | Charges |

| Monthly Average Balance | Customisable Average Balance |

| Cash deposit limit (Home & Non-Home branch) | Decide the free monthly cash deposit limit |

| Cash withdrawal | Decide the free monthly cash withdrawal limit |

| Monthly Transactions | Choose the number of free transactions per month |

| Debit Card | Design Debit Card option available |

| Cheque leaves | Select the number of free cheque leaves |

This is a zero balance current account provided by Axis Bank. The users get the privilege of free cheque book leaves, free withdrawals, free DD / PO, unlimited and free transaction limit and more.

| Key Features | Charges |

| Monthly Average Balance | No minimum balance requirement |

| Cash deposit limit (Home & Non-Home branch) | Free |

| Cash withdrawal | Free withdrawals |

| Cheque Book leaves | Free |

| Demand Drafts / Pay Orders | Free |

| Transaction Limit | Unlimited + Free transactions |

| NEFT / RTGS fees | Free for both inward & outward transactions |

The users can avail added advantages including free cash deposit limit of Rs.1 lakh per day, free fund transfer within Axis Bank accounts, unlimited cash withdrawals from home branch and more.

| Key Features | Charges |

| Monthly Average Balance | Rs.25 lakh for the whole pool |

| Cash deposit limit (Home Branch) | Free up to Rs.1 crore per pool |

| Cash deposit limit (Non-Home Branch) | Free up to Rs.1 lakh per day, per account |

| Cash withdrawal (Home Branch) | No limit |

| Cash withdrawal (Non-Home Branch) | Maximum of Rs.2 lakh per day |

| Fund Transfer | Free fund transfers within Axis Bank accounts |

| NEFT / RTGS fees | NEFT- Rs.25 on transactions above Rs.2 lakh

RTGS- Rs.50 on transactions of Rs.5 lakh and above |

With this account variant, the users can avail privileges including zero non-maintenance charges, free cash deposit limit of Rs.50 lakh per month, unlimited and free transactions and mor

| Key Features | Charges |

| Monthly Average Balance | Rs.25,000 |

| Non-maintenance of balance | Nil |

| Cash deposit limit (Home & Non-Home branch) | Rs.50 lakh per month |

| Cash withdrawal (Non-Home branch) | Up to Rs.25 lakh per month |

| Cheque Book leaves | Free 2000 cheque leaves per month |

| Total free transactions | Unlimited |

| NEFT charges | Free if MAB is maintained |

| Account Closure charges | Less than 1 year: Rs.500

More than 1 year: Rs.250 |

This is a zero balance current account provided by Axis Bank. The users can get the extra advantages including free at par cheque drawing, free fund transfer limit of Rs.25 lakh per month and more.

| Key Features | Charges |

| Monthly Average Balance | Nil |

| Cash transactions (Home & Intercity branch) | 8 times of MAB (maximum of Rs.50 lakh) |

| Third Party deposit | Not permitted |

| Fund Transfer / Inter SOL clearing | Free up to Rs.25 lakh per month |

| Remote Pay Order charges | Minimum Rs.100 per Pay Order |

| Account maintenance charges | Free for MAB above Rs.10 lakh |

| NEFT outside Axis Bank | Up to Rs.1 lakh- Rs.5

Above Rs.1 lakh- Rs.25 |

| At Par Cheque Drawing | Free |

This account variant is available in 4 types. The user can choose from the specific currency available and has the option to maintain the desired amount in the foreign currency balance.

| Key Features | Charges |

| Hold account in 4 currencies | USD, EURO, GBP and Japanese Yen |

| Foreign currency balance | Maintain the desired amount |

| Low minimum opening deposit | USD 100 / GBP 60 / EURO 100 / Japanese Yen 20,000 |

| Non-maintenance of MAB | 5% quarterly charges on failure |

| Foreign currency transaction charges | Zero commission charges |

The customers can avail extra privileges including free and unlimited monthly transactions, free DD / PO, free 200 cheque leaves, free NEFT & RTGS inward and outward transactions and more.

| Key Features | Charges |

| Monthly Average Balance | Rs.50,000 |

| Non-maintenance of balance | Rs.1500 |

| Cash deposit limit (Home & Non-Home branch) | Up to 12 times of MAB |

| Free monthly transactions | Unlimited |

| Cheque Book leaves | Free limit of 200 cheque leaves |

| Demand Drafts / Pay Orders | Free |

| Account maintenance charges | Rs.50 per month |

| NEFT / RTGS fees | Free for both inward & outward transactions |

| Account Closure charges | Less than 1 year: Rs.500

More than 1 year: Rs.250 |

This is a zero balance current account provided by Axis Bank. The customers can avail facilities including free fund transfer across all locations, free mobile alerts, free cash deposit limit of Rs.2 lakh per day.

| Key Features | Charges |

| Monthly Average Balance | Nil |

| Cash deposit limit (Non-Home branch) | Rs.2 lakh per day |

| Maximum third party deposit | Rs.50,000 per day |

| Cash withdrawal (Non-Home branch) | Rs.5 lakh per day |

| Fund Transfers | Free fund transfers across all locations |

| Mobile Alerts | Free |

| Account Closure charges | Less than 1 year: Rs.500

More than 1 year: Rs.250 |

All individuals possessing acceptable KYC documents are eligible for opening a Current Account in Axis Bank. Below given is the list of business entities (customers) who can open Axis Current Account:

Given below is the list of documents required for opening a current account at Axis Bank.

|

Basic Common documentation |

|

|

Documents for Public or Private Limited Companies |

|

|

Documents for Partnership Firms |

|

|

Documents for Proprietorship Firms |

|

|

Documents for HUF |

|

|

Documents for Trusts |

|

The users can apply for Axis Bank Current Account via phone banking or by visiting the nearest bank branch. Below listed are the steps one needs to follow for Axis Bank Current Account opening.

Via Phone Banking

Step 1: Visit the official website of Axis Bank & Go to the ‘Current Account’ section.

Step 2: Choose one from the different variants available.

Step 3: Click on the ‘Apply Now’ section and proceed further.

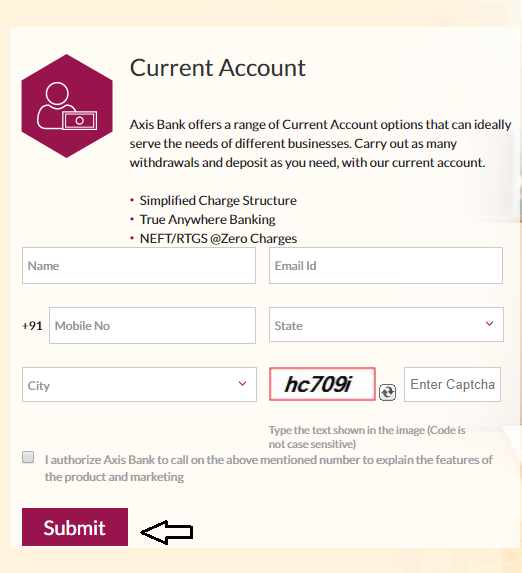

Step 4: In the drop-down menu, fill the required details like name, address, email, state, city, etc. and click on ‘Submit’. The Axis Bank Current Account application status can be tracked by all users. Have a look at the below-displayed picture –

Step 5: Once the application is submitted successfully, the Axis Bank representative will give a call to the user for further assistance and documentation.

By Visiting Bank Branch

Step 1: Users can visit the nearest bank branch and fill the Axis Bank Current Account opening form.

Step 2: After completion, the form needs to be submitted along with the required KYC acceptable documents.

The Axis Bank Current Account opening form can be downloaded from the official bank’s website. The form can then be submitted along with the required KYC acceptable documents at the nearest bank branch. Also, Axis Bank Current Account closure form can also be downloaded from the bank’s official website.

Q. What is the average monthly balance for Sweeps Current Account?

A. The minimum average balance for Sweeps Current Account is Rs.25 lakh.

Q. Are the fund transfer free between Axis Bank Accounts?

A. Yes, Fund Transfers are free for Axis Bank accounts.

Q. Is there a penalty for not maintaining Average Monthly Balance?

A. Yes, the bank levies penalty for non-maintenance of account balance. However the amount differs from one account variant to another.

Q. What is the charge for applying to mobile alerts for day end balance?

A. The charge for applying to mobile alerts is Rs.10/ month.

Q. Who can open Axis Bank Current Account?

A. Current Accounts can be opened by individuals, partnership firms, private and public limited companies, HUFs/ specified associations, societies, trusts etc.