Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

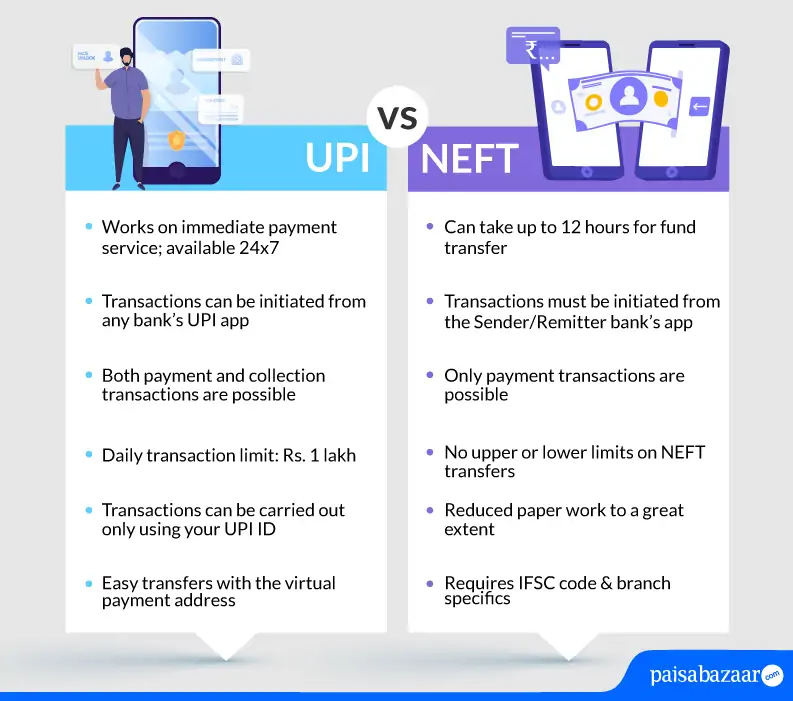

UPI or the Unified Payments Interface is a digital money transfer option that has fast gained popularity recently. Along with that, the original options such as the National Electronics Funds Transfer (NEFT) to have undergone significant improvements to become much faster and efficient than before.

Banks too have either significantly reduced NEFT charges or have waived them off completely. However, to understand both these means of money transfer, it is important to compare the two.

A Good Credit Score can help in getting Loan Approvals Easily

Check Now

| Parameters | UPI | NEFT |

| Platform | A mobile app-based system that brings you multiple bank accounts on one platform for a unique effortless funds transfer experience | A process that is possible through mobile banking, internet banking and on-ground NEFT transactions |

| Transfer Time | Works on Immediate Payment Service; available 24×7 | Can take up to 12 hours for fund transfer |

| Transfer cost | Currently free of cost; some banks may charge Rs.0.5 on every transaction | Currently free of cost via online platforms Rs. 2.50 < Rs. 10,000 Rs. 5.00 < Rs. 10,000 – Rs. 1 Lakh Rs. 15.00 < Rs. 1-2 Lakh Rs. 25.00 above Rs. 2 Lakh |

| Transfer initiation | Can be initiated from any bank’s UPI app | Must be initiated from the Sender/Remitter bank’s app |

| Transfer Type | Both payment and collection transactions are possible | Only payment transactions are possible |

| Per Transaction Limit | Daily limit: Rs. 1 Lakh | No upper or lower limits |

| Beneficiary Details | Requires only Virtual ID | Requires bank account no., IFSC code, etc. |

| Bank Account Requirement | UPI payment or collection of money is possible even if you do not have a bank account | NEFT is possible only if you have a bank account |

| Adding a beneficiary | No need of pre-addition/approval of beneficiary; transfer made to beneficiary’s virtual ID | Pre-addition and bank’s approval of beneficiary required before transfer |

Get Free Credit Report with monthly updates. Check Now

UPI has been integrated with the banking apps of many banks. To use UPI follow the steps given below –

Get Free Credit Report with monthly updates. Check Now

NEFT can be activated for your bank account once you activate online banking facilities. For this, you need to speak to your bank officials. If you already have an account with the bank your documents will already be submitted and it will be a simple process. Once your internet banking is activated:

Q.Can I use UPI to transfer money from one bank account to another just like NEFT?

Yes, UPI allows you to transfer money from one bank account to another. It is called push money mechanism or sending money.

Q.What are UPI and NEFT?

UPI or Unified Payments Interface is a digital payment system which allows different bank accounts to use a single mobile application. It is a seamless platform which facilitates real-time money transfer with a UPI ID and PIN. On the other hand, NEFT or the National Electronic Funds Transfer facilitating electronic one to one fund transfers from any bank branch to any individual having an account with any other bank branch in the country.

Q.Which fund transfer is better UPI or NEFT?

Both platforms have some pros and cons. UPI facilitates instant transfer for free (currently). However, there is a capping of Rs. 1 Lakh per day transfer. NEFT, on the other hand, facilitates the electronic transfer of funds from any bank branch to any individual having an account with any other bank branch in the country. Also, there is no capping on NEFT transfers per day. But, its cost is higher than of UPI and it takes about 12 hours for one NEFT transfer.

Q.Can I transfer funds offline in NEFT and UPI?

Offline transfers are available for NEFT but not in case of UPI.

Q.What is the service timing for both NEFT and UPI?

Both UPI and NEFT transactions can be initiated at any time of the day i.e. 24×7 for 365 days.