Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Customers of UCO Bank can transfer funds through UPI using the BHIM UCO UPI app and other third-party applications. On this page, we will understand how one can register on the BHIM UCO Bank UPI app, transfer funds through UPI and other details.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Unified Payments Interface (UPI) is an instant, safe, and secure transaction platform. It allows customers to make fund transfers directly from their bank account. Therefore, eliminating the need to load money in wallets. Off late, customers can also make UPI payments from their RuPay credit card. UCO Bank customers can avail UPI services through BHIM UCO UPI App. Let us know about UCO Bank UPI in detail.

UCO Bank offers the BHIM UCO UPI app which allows customers to make UPI payments. The app is dedicated to providing customers with all services related to UPI. Customers can register on the app for UPI, send/receive money, check their account balance, etc. The application allows you to make direct payments just by scanning the UPI QR code of the merchant or using their UPI ID. The customer can also request/collect money using this application.

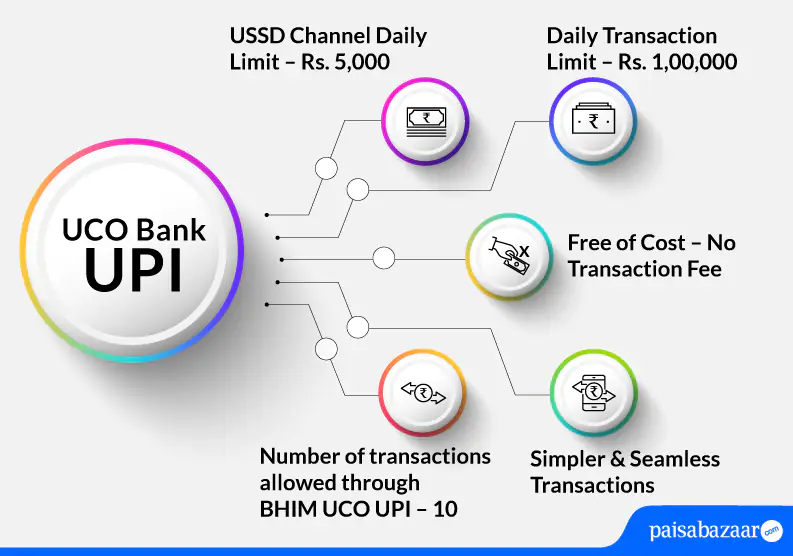

BHIM UCO UPI app offers various features to customers. Some of the features are discussed below:

Also Read: Unified Payments Interface

Get FREE Credit Report from Multiple Credit Bureaus Check Now

| Type of Transaction | Transaction Limit |

| Per transaction limit | Rs. 1,00,000 |

| Per day total transaction limit | Rs. 1,00,000 |

| USSD channel daily limit | Rs. 5,000 |

| Number of transactions allowed through BHIM UCO UPI | 10 |

| Number of transactions allowed through third-party apps | 10 |

| IPO limit | Rs. 5,00,000 |

| For categories like Capital Markets, Collections, Insurance, Foreign Inward Remittances | Rs. 2,00,000 |

Customer having UCO Bank savings account can follow the below-mentioned steps to know how to register on BHIM UCO UPI:

Step 1: Download and install the BHIM UCO UPI app from Google Play Store or Apple Store.

Step 2: As you open the app, accept the ‘Terms and Conditions’.

Step 3: On the next page, tap on the ‘Send SMS’ option. As you do so, you will receive an SMS on your registered mobile number. Mobile verification will be done on your registered mobile number. Click on ‘Proceed’ after verification.

Step 4: Fill in your personal details such as your first and last name, select your gender, add date of birth, email id, and phone number. Click on ‘Proceed’.

Step 5: Enter your 4-digit login PIN and confirm the PIN. Add a security question and click on ‘Proceed’.

Step 6: Your registration will be successful.

Step 7: Upon successful registration, click on the ‘Manage Accounts’ option on the home screen.

Step 8: As you select your bank, your account will appear on the next page. Select your bank account and tap on ‘Continue’.

Step 9: Your bank account will be successfully linked. Click on ‘Save’.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Step 1: On the home screen of the app, tap on ‘UPI PIN Management’.

Step 2: Select the ‘Set UPI PIN’ option and tap on ‘Ok’.

Step 3: Enter the last 6 digits of your debit card and the expiry date of your card. Click on ‘Submit’.

Step 4: An OTP will be sent to your registered mobile number. Enter the OTP and set your UPI PIN. Confirm the UPI PIN.

Step 5: Your UPI PIN will be set successfully.

Step 1: Login to the BHIM UCO UPI app and on the home screen of the app, tap on the ‘Pay’ option.

Step 2: Add the VPA of the receiver, amount, and comments. Click on ‘Submit’.

Step 3: Enter the UPI PIN to complete your transaction. Money will be sent successfully.

Step 1: Login to the BHIM UCO UPI app and on the screen of the app, tap on the ‘Collect’ option.

Step 2: Add the virtual address of the payer, amount, request expiry time, comments and the minimum amount to be requested. Click on ‘Submit’.

Step 3: Your request will be initiated and you will be provided with a reference number on your screen.

Suggested Read: UCO Bank Customer Care

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Q. Can I check my account balance through BHIM UCO UPI application?

Ans. Yes. You can check your account balance through BHIM UCO UPI application.

Q. Can any bank customer access BHIM UCO UPI app?

Ans. Yes. Customers of any bank can access BHIM UCO UPI app.

Q. What is the eligibility to avail UPI QR code service in UCO Bank?

Ans. To avail the UPI QR code service in UCO Bank, the customer must have one operative account with the bank namely: Savings account, current account or cash credit account.

Q. Is it mandatory to register for UPI services with the registered mobile number in the bank?

Ans. Yes. UPI services can be availed on the registered mobile number with the bank.

Q. Does UCO Bank allow cardless cash withdrawals from ATMs using UPI? If yes, what is the maximum limit of the cash withdrawal per day?

Ans. Yes. UCO Bank customers can withdraw cash from UCO Bank ATMs using UPI. The maximum limit of cash that can be withdrawn in a day is Rs. 10,000 and the total number of transactions allowed in a day are three.