Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Click Here to Check Credit Score and Get Monthly Updates for Free

Let’s Get Started

The entered number doesn't seem to be correct

Transferring funds from one account to another by visiting a bank branch is the least chosen option nowadays. Though the transfer of funds through mobile banking and net banking are the most preferred options, the transfer of funds through ATMs is also widely practiced. Let us check how to transfer money from ATM below.

|

Increase your purchasing power and get easy access to immediate funds, get yourself a credit card now! Click here to check pre-approved card offers! |

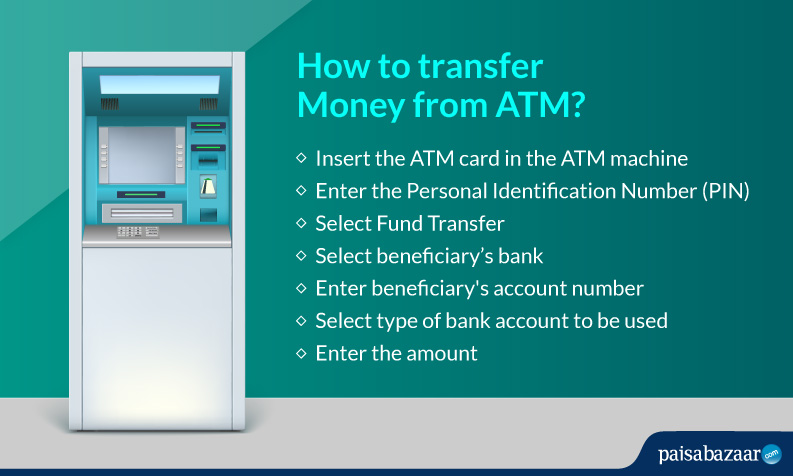

Funds can be transferred from one bank account to another bank account through ATM. Any account holder who is wondering how to transfer money from ATM should follow the steps mentioned below:

Step1: Visit an ATM and insert the ATM/debit card

Step 2: Choose the preferred language

Step 3: Enter the debit card PIN and click ‘Yes’ to continue

Step 4: Then choose the “Fund Transfer” option provided at the bottom most corner of the ATM display

Step 5: Enter the beneficiary’s bank and account number

Step 6: Choose the type of account – Savings Bank Account or Current Account

Step 7: Enter the amount to be transferred and click ‘Correct’. Then click ‘Yes’ to confirm the amount entered

Step 8: After providing the fund transfer amount, the fund will be transferred successfully. If a transaction is not completed within the time limit provided then a ‘time out’ message will appear. In such a case, the account-to-account transfer from the ATM process has to be repeated

|

Debit cards come along with great benefits, but credit cards can offer you more! Get extensive rewards, cashback, offers, and discounts on all your purchases, by getting the right credit card for you. Click here to check pre-approved card offers! |

Suggested Read:Transferring Money from Credit Card to Bank Account Online

Below are some of the key benefits of transferring money through an ATM:

Check Free Credit Report with Complete Analysis of Credit Score Check Now

To avail net banking services, account holders need to register and sign up for the same. Once registered for the internet banking facility, the account holder can login using the User ID / Customer ID and net banking password to transfer funds anytime during the day.

Following details would be required during internet banking:

Customers can transfer money through mobile banking by downloading the official mobile banking application provided by the bank. Using the mobile banking application, account holders can avail services like balance enquiry, mini statement, fund transfer, utility bill payments, and much more on-the-go.

Customers can visit their respective bank branch as well and fill the fund transfer form for fund transfer. Account holders can opt for NEFT, RTGS, IMPS or intra bank fund transfer depending upon their requirement.