Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

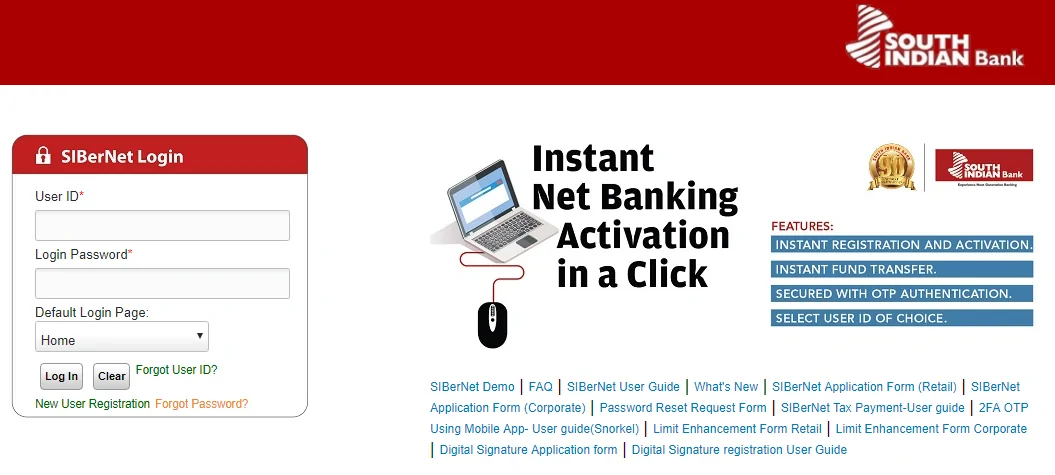

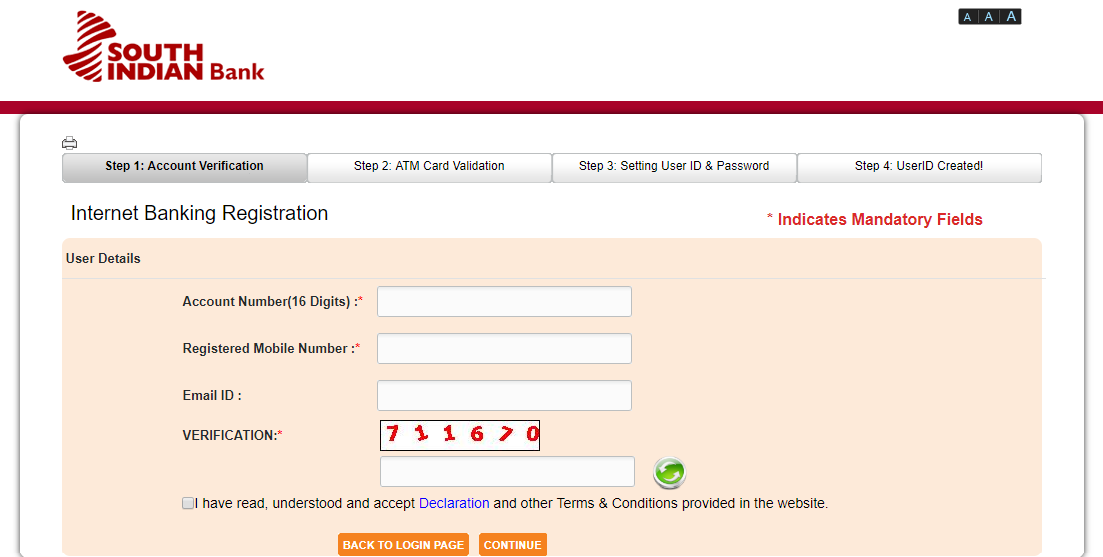

Net banking or online banking enables one to manage money online using mobile devices, tablets or computers. South Indian Bank allows users to carry out net banking activities through ‘SIBerNet’ which is the South Indian Bank Internet Banking Service. An account holder has to go for South Indian Bank net banking login to avail this facility.

Corporations can apply to various officials responsible for operating in bank accounts for the Internet Banking facility. Companies can also restrict account access to different users according to their requirements. Through internet banking, companies may also be issued on SIBerNet with a view only on request.

Corporate customers can increase their daily transfer limit on request. By default, customers in companies have the default transfer limit as follows:

| Transaction Type | Daily Default Limit-Corporate Customers |

| Self-Fund Transfer | Rs. 25 Lakhs |

| Third Party Fund Transfer | Rs. 15 Lakhs |

| External Fund Transfer | Rs. 15 Lakhs |

| IMPS Fund Transfer | Rs. 2 Lakhs in P2A |

Immediate Payment Service (IMPS) is an electronic money transfer service provided by the Indian National Payments Corporation (NPCI) 24 x 7 instantly. All internet banking customers and corporate customers can make 24 x 7 bank transfers even on bank holidays through the IMPS facility offered by Internet Banking on South Indian Bank. As with the personalized transfer limit for NEFT/RTGS transactions, customers can reduce their IMPS transfer limit via internet banking by using the option customize transaction limit provided under other services.