Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

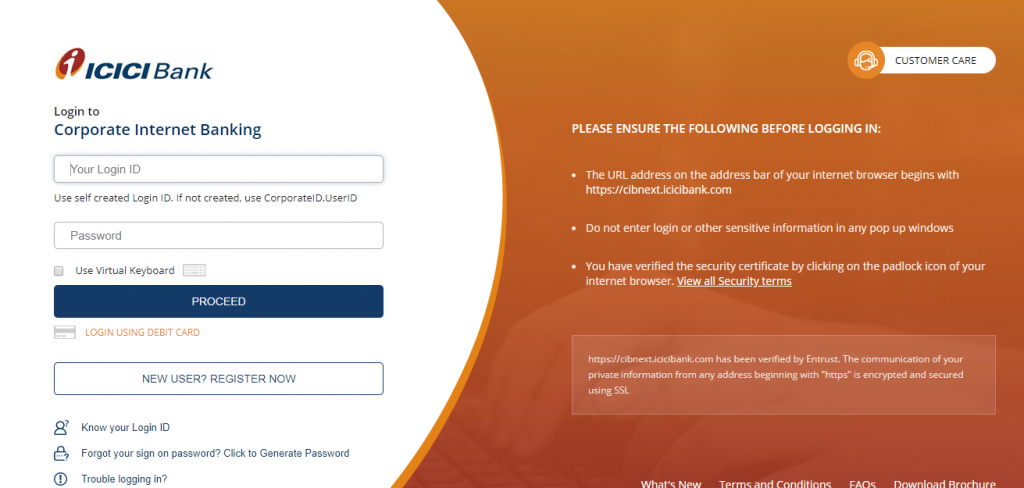

Banking operations have now become faster and more secure with the help of internet and sophisticated technologies. While personal internet banking saves an individual’s time and effort, ICICI corporate net banking increases the efficiency of organizations associated with the bank. The corporates can focus more on their growth strategies than spending more time on banking matters.

ICICI Banks corporate net banking, also known as Corporate Internet Banking (CIB) is the three-time award winner feature of the bank. You can perform a number of financial transactions right from your office. It reduces your paperwork drastically and gives you an efficient, economical and easy option to perform corporate banking transactions.

| Account Balance information on Real Time Bases | Open Fixed Deposit online | Fund Transfer from Channel Partners | E-Payment Gateways |

| Six Formats of Account statements (for download) | Trade MIS | NEFT, RTGS transfers | Cash Management Services |

| Subscribe Account statement by Email | Fund Transfer to self-accounts | Utility Bill Payments ( More than 302 billers registered) | Global Trade Services |

| Request Cheque book and stop payment of cheque online | Fund Transfer to Channel Partners | Online Tax Payment | Current Account Management |

ICICI corporate net banking comes with the sophistication of user-friendly interface, efficient execution of transactions and advanced security features. It understands the business needs of corporates and strikes the right balance between ease of doing transactions and security. Below are notable features of ICICI corporate net banking.

| Real-Time Information | · The information is the key in business.

· You can access your account information and track in a single view. |

| Easy Reconciliation | · Download account information into several convenient formats.

· Simplified reconciliation of your accounts. |

| Supply Chain Management | · Pay your all vendors with single file upload.

· Electronic Bill Payment/Presentment and e-payment gateway services. · Real-time and customized MIS · Manage your collections effectively |

| Transaction by Employees | · Multi-Level Approval Process

· Authorization rights and limits for your employees · Information Access solutions · User id monitoring to prevent the misuse of access |

| Safe and Secure Banking | · Firewalls and Filtering

· Secured Socket Layer with 128-bit encryption · Audit trails · Access with authorization only · Separate login and transaction password for two-level security |

For any net banking, fund transfer is a basic and essential feature. However, when it comes to corporate net banking, situations demand far more sophistication than mere fund transfer. Below mentioned are unique ways of fund transfer through ICICI net banking:

Ans. You can apply on company letterhead with complete transactions details at your branch. ICICI bank will do needful to reverse transactions subject to prevailing laws and factors within the control of the bank.

Ans. Usually “404 error” is due to technical issues and it is temporary. You can try using ICICI corporate net banking after some time. If you get the same error repeatedly, you can take a screenshot of the error and send to corporatecare@icicibank.com from your registered email id.

Ans. For your security, it is recommended to mention user wise limit for fund transfer transactions. However, if it is not mentioned, the bank sets a limit of Rs. 5 Lakhs per transaction for each user if you are a non-company user of ICICI corporate net banking. If you are a company user, the limit is Rs. 1 Crore per transaction.

Ans. “Tax Payment” and other third-party services requires to open in the new browser called “Pop-Ups.” If your internet browser setting does not allow pop-ups, you may not be able to see a new window. You can click on the address bar and disable popup blocker (hence allowing popups) for ICICI Bank websites.