What is a Bank Statement?

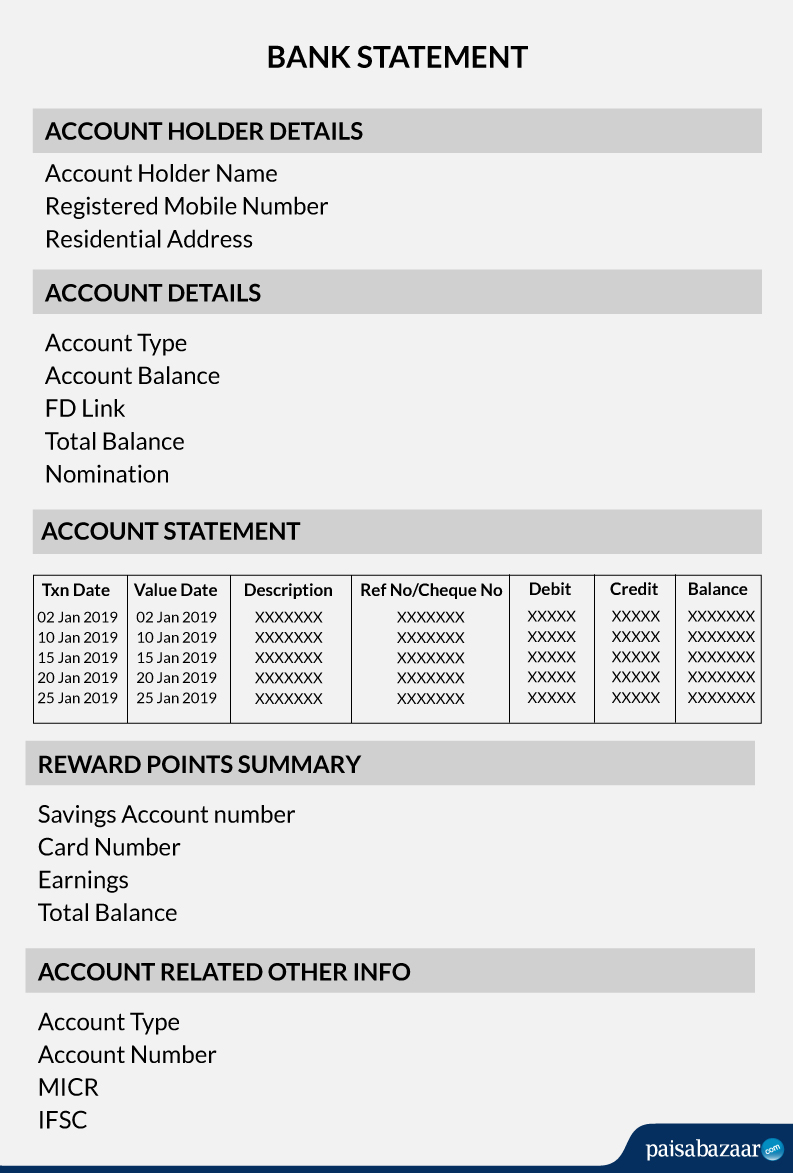

A bank statement or account statement is a document issued by a bank describing the activities in a depositor’s savings account or current account during the period. Account holders can keep a track of their transactions and account through the bank statements.