Axis Bank offers personal loans up to Rs. 15 lakh that customers can avail to meet various financial needs like medical emergencies, home renovation, travelling expenses, etc. The loans come with flexible repayment tenure and can be availed easily with minimum documentation. Axis Bank also offers its customers a feature-rich Internet banking portal which allows them to track personal loan applications, generate a statement of your loan account, along with a host of other features. Some key aspects of this portal like how to register/login into this portal and how to access the services offered are discussed below.

Table of Contents :

How to Register on Axis Personal Loan Online Portal

Customers can register themselves for Axis Bank Internet banking to avail various personal loans related services from the bank. The registration process involves the following steps:

- Visit the official website of Axis Bank www.axisbank.com

- Click on ‘Login’ and choose the ‘Register’ link listed under Internet Banking.

- Enter your ‘Login ID’. (Your Customer ID becomes your Login ID. It is mentioned in the welcome letter and cheque book.)

- Keep your Customer ID, account number, debit card and registered mobile number handy before you proceed.

- Enter your Customer ID, registered mobile number and account number and then click on ‘Proceed’.

- Enter your 16 digit debit card number, the ATM PIN and expiry date. Under the card currency, choose Indian Rupee – INR option. Accept the terms and conditions and click on ‘Proceed’.

- Enter a login password of your choice keeping the rules in mind and re-enter it to confirm the password. You will receive an OTP on the registered mobile number. Enter the OTP and click on ‘Submit’.

- This completes the Axis Bank Internet Banking registration process. You can now log on to the Axis online banking portal using your login ID and password.

Transfer Your Personal Loan at Lower Interest Rates Apply Now

In case of NRI customers:

- Once you login, you will receive a message asking you to register for Netsecure (Netsecure is a 2 factor authentication system that enables you to enjoy an additional layer of security for all your online transactions like bill payment, fund transfer, etc.)

- Choose the mode of Netsecure that you wish to avail.

- Enter your registered mobile number, agree to the terms and conditions and click on ‘Register’.

In case you do not have username and password or debit card:

- Visit the nearest branch office and submit a duly filled and signed internet banking registration form.

- At the same time, also register your mobile number for Netsecure at the branch office. Your mobile number can also be registered for internet banking by visiting the nearest Axis Bank ATM.

- After this the bank will send you the password by mail. Once you receive the password you can log into Internet banking. This completes the registration process.

How to Login at Axis Bank Portal

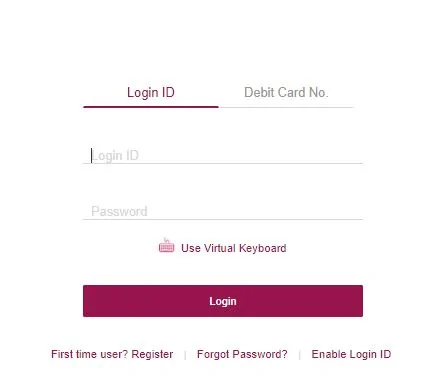

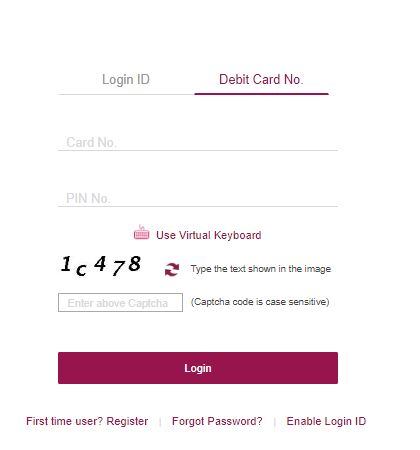

Once you have successfully registered yourself for internet banking, you can login to Axis bank portal using your Login ID and password. In case you have an Axis Bank debit card, you can directly login to internet banking using your card credentials (your debit card number and PIN No.) as shown below:

Registered Users:

The following steps need to be followed in case you have registered yourself for internet banking or are already an existing customer of the bank and wish to login using your Login ID and password:

- Visit the official website of Axis bank www.axisbank.com

- On the homepage, click on ‘Login’ and select ‘Login’ under Internet Banking.

Enter your Login ID and Password and click on ‘Login’ to avail various personal loan related services like checking your loan status, repayment schedule, etc.

Enter your Login ID and Password and click on ‘Login’ to avail various personal loan related services like checking your loan status, repayment schedule, etc.

Or

Or

In case you have an Axis bank debit card, you can directly login to internet banking using your card credentials.

New Users:

New users need to first register themselves with internet banking to access and log into the portal. Once done, they need to follow the steps mentioned above for registered users to login to the bank’s online banking portal.

In Case You Have Forgotten Username/UserID:

Your Username/User ID (Login ID) is the same as your Customer ID, which is mentioned in the welcome letter and the checkbook that you receive on opening an account with the bank. In case you forget/lose your Login ID, you can retrieve those by either of following means:

- SMS “CUSTID<account no.>” to 5676782 from your registered mobile number to get your customer/Login ID

- NRI customers can get their customer ID by sending an SMS stating CUSTID <AccountNumber> to +919717000002 using their registered mobile number

In Case You Have Forgotten Your Password:

In case you forget your internet banking password, you can generate the same online. If you have a debit card, you will need the 16 digit debit/ATM card number and ATM PIN. In case you do not have a debit card, then you can request for a PIN by visiting the nearest branch office or by calling up the customer care department. The following steps need to be followed if you wish to generate your internet banking password online:

- Visit the official website of Axis Bank www.axisbank.com

- On the top right corner of the homepage, click on ‘Login’ and select ‘Login’ under Internet Banking.

- On the page that opens next, click on ‘Forgot Password?’ as shown below:

- On the Online Password Regeneration page, enter your Login ID, the required details and set a new password.

- Once done, you can login using your Login ID and the new password.

Services Available on Axis Bank Portal

A range of services like the provision to track your loan application, check the status of your loan, locate the nearest loan centre, bill payment, etc. are available on Axis Bank Online Portal. Some key details about the services offered are given below:

- Account Details: You can check your bank account details, download statements, account balance. You can also view your Demat, Deposits, home/personal loan & Card Account Details at one place.

- Check Personal Loan Statement: You can check your personal loan statement by logging into the online portal. Details included in such a statement include the total loan amount, principal outstanding, last payment details, etc.

- Request Services: You can request for Demand Drafts, Cheque book, Credit Card, Redemption of Loyalty points, etc.

- Fund Transfer: You can transfer funds to your own Axis Bank accounts, other Axis Bank accounts or other bank accounts easily.

- Investment Services: You can create deposits, view your complete Portfolio held with the bank, apply for mutual funds and IPO, etc.

- Value Added Services: You can recharge your mobile phone, pay Visa Credit Card bills, register for SMS banking and submit e-statement, etc.

Important Aspects

Some important things to keep in mind when using the Axis bank portal are given below:

- When setting a password for internet banking, make sure you set up a strong password and change it at regular intervals.

- Make sure you check the web address carefully before sharing any sensitive information. Ensure that the URL begins with https and not http.

- Install the latest version of anti-spyware, antivirus, security patch and personal firewalls on your mobile phones and laptop to ensure that your online banking account is well protected.

- Whenever you end a session make sure that you logout from the Internet banking portal and also close the tab in which it was opened.

- Avoid banking online on unprotected computers or using a public Wi-Fi hotspot.

- Avoid using the “remember password” feature of your browser to save your Internet banking passwords.

- Avoid responding to links on emails. Do not disclose any sensitive information like your user id, password, date of birth, credit and debit card PINs, etc. to anyone.

FAQs

Q1. How to check Axis Bank personal loan status?

To check the status of your personal loan online, follow the steps given below:

- Visit the official website of Axis Bank

- Click on ‘Explore Products’ and select ‘Personal Loan’ listed under the ‘Loans’ tab.

- On the page that opens next, under ‘Important Links’ tap on ‘Related Links’ and click on ‘Check your Loan Status’.

- Select ‘Customer’ and click on ‘Proceed’ to check the status of your personal loan.

Q2. How can I login in case I forget my user id?

In case you forget your User ID you can log into your account using your Axis Bank debit card number and PIN. You can also recover your User ID via any of the following means given below:

- SMS “CUSTID<account no.>” to 5676782 from your registered mobile number to get your customer/Login ID

- NRI customers can get their login ID by sending an SMS stating CUSTID <Account Number> to +919717000002

Q3. How to login to Axis Bank personal loan account?

Visit the official website of Axis bank, click on login and enter your credentials to log in the bank’s net banking portal.

Q4. What services are available on Axis Bank personal loan online portal?

Axis Bank personal loan online portal offers an array of services including the provision to check your loan status, generate your loan account statement, make bill payment, grievance redressal, etc.

Q5. What is the customer care number for Axis Bank personal loan?

In case of Axis bank personal loan related queries, customers can call at 1860–419–5555 or 1–860–500-5555 between 9 AM to 9 PM (Monday to Saturday, excluding national holidays).

Q6. Can I raise a complaint relating to personal loans online?

Yes, simply visit the official website of the bank, click on ‘Complaints and Grievance Redressal’ and enter your complaint, query or request.

Q7. Can I generate the loan account statement without logging in to my account?

Yes, you can generate the loan account statement without logging into net banking by following the steps given below:

- Visit the official website of Axis Bank www.axisbank.com

- Click on ‘Explore Products’ and select ‘Personal Loan’ listed under the ‘Loans’ menu.

- On the page that opens next, click on ‘Related Links’ and select ‘Generation of loan account statement’.

- Enter the Loan Account Number, other necessary details, fill in the captcha code and click on ‘Submit’ to generate the loan account statement.

Q8. Can I track my personal loan application using my mobile number?

Yes, you can track your personal loan application online using your mobile number. Simply visit the official website of the bank>>Explore Products>>Personal Loan>>Useful Links>>Track Application>>Customer>>Mobile number provided to the bank.