Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Note: The information on this page may not be updated. Kindly refer to the bank website to check the latest information.

Your ideal savings bank account in India should offer good interest rates, flexibility in deposits and withdrawals, reasonable minimum balance mandate in the account, substantial number of branches across the country (particularly the city you live and hold account in), personalized services and overall convenience. Choosing the best bank for saving account can help you to manage your finances well without paying a lot for services you have availed.

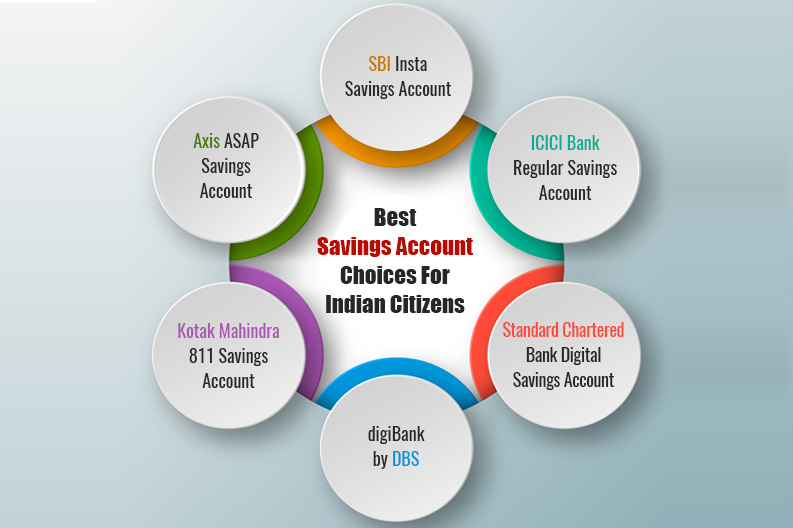

With numerous bank choices for you to open a savings account, getting bit confused is a natural phenomenon. To know which bank gives highest interest rate in India, go through the following list of six best savings bank account options.

| Best Savings Bank Account | Debit Card | Product Features | Offers & Discounts |

| ASAP Instant Savings Account | Virtual Visa Debit Card

Daily Withdrawal Limit Rs. 1 lakh Online Rewards Debit Card Daily Withdrawal Limit Rs. 50,000 Purchase limit Rs. 1 lakh |

Zero Balance Savings Account

Auto Sweep in Feature i.e. Balances above Rs. 10000 automatically become an FD |

Rs. 150 discount on BookMyshow

Rs. 1,000 cashback on Cleartrip App Airtel Wynk 2 Months Free subscription |

| Kotak Mahindra Bank 811 | 811 Virtual Debit Card / Classic Debit Card | Zero Balance Savings Account

Earn up to 4%* interest annually on your account balance |

Get exclusive offers and discounts on Jabong, BigBasket, PVR, Swiggy, Goibibo and much more |

| digiBank by DBS | Complimentary VISA Debit Card

Unlimited free withdrawals |

Zero Balance Savings Account

Earn up to 6% p.a. interest on account balance above Rs. 1 lakh and up to Rs. 2 lakh |

Cashback of up to 10% on shopping from a wide range of online merchants |

| Standard Chartered Bank Digital Account | International Platinum Debit Card

Free for first year |

Earn 2x reward points on every online transaction

Earn 3.50% interest p.a. on savings bank balance above Rs.50 lakh & up to Rs.150 crore |

Complimentary 3 months Saavn Pro Subscription

15% discount on 600+ restaurants |

| SBI Insta Savings Account | Rupay Debit Card | Paperless account opening (OTP based e-KYC)

Free Rupay debit card Earn up to 2.70% interest p.a. on savings bank balance up to and above Rs. 1 lakh |

With SBI Rewardz get exclusive offers & discounts on shopping, travel and much more |

| ICICI Bank Regular Savings Account | Smart Shopper Silver Debit card

Cash withdrawal limit of Rs. 50,000 Daily Purchase Limit of Rs. 1,00,000 |

Free Internet and Mobile Banking

Money Multiplier Facility (Auto Sweep Facility) |

Amazon voucher up to Rs. 1,200 off for household needs from the 1st to the 3rd of every month

Get 10% instant discount on shopping at Myntra |

Out of all the savings accounts offered by Axis Bank, ASAP Instant Savings Account stands out at the top in terms of features and benefits. Axis Bank is considered as the best bank for savings account in India as it provides customers with various features and benefits to make banking experience hassle-free. Some of the features & benefits are as follows:

|

|

|

|

|

Fees & Charges

Check the fees and charges of the Axis ASAP account.

| Axis ASAP Account | Fees / Charges |

| Primary Card: Issuance Fees | Virtual Visa Debit Card (No charge) / Visa Online Rewards Debit Card (Rs. 300) |

| Primary Card: Annual Fees | Virtual Visa Debit Card (No Charge) / Visa Online Rewards Debit Card (Rs. 500) |

| Account Closure | Rs. 500** |

| Fees on Cash Deposits and Withdrawals above limits | Rs. 5 per Rs. 1000 or Rs. 150, whichever is higher |

| Axis Bank ATM: No. of Free Transactions | First 5 transactions – No charges |

| Non- Axis Bank ATM: No of Free Transactions |

First 3 transactions free in Metro Locations (Mumbai, Delhi-NCR, Chennai, Kolkata, Bangalore and Hyderabad ) First 5 transactions free in all Other Locations |

**Charges are levied if account is closed between 14 days and 6 months. No charges would be levied if account is closed within 14 days of account opening or after 6 months.

Second in the list is the 811 Digital savings account offered by Kotak Mahindra Bank. 811 is a zero balance savings account which offers 4% interest per annum on account balance above Rs. 1 lakh. Kotak 811 account is considered as the best savings account in India and provides customers with various features and benefits, which are as follows:

|

|

|

|

|

Note: The interest rates are updated as on 12th October 2020.

Fees & Charges

Check the fees and charges of Kotak Mahindra Bank 811 Savings Account.

| Kotak 811 Account | Fees / Charges |

| Primary Card: Issuance Fees | Virtual Visa Debit Card (No charge) |

| Primary Card: Annual Fees | Virtual Visa Debit Card (No Charge) |

| Fees on Cash Deposits | Nil charges for 1 Deposit / month up to Rs. 10,000 (Rs. 3.5 / 1000 with minimum Rs. 50) |

| Kotak Mahindra Bank ATM: No. of Free Transactions |

First 5 transactions – No charges After First 5 (Financial Transaction) – Rs. 20.00 per transaction After First 5 (Non-Financial Transaction) – Rs. 8.50 per transaction |

| Non- Kotak Bank ATM: No of Free Transactions |

Maximum 5 transactions – No charges in a month with a cap of Maximum 3 transactions – No charges in Top 6 Cities Thereafter Financial Transaction – Rs. 20.00 per transaction Non-Financial Transaction – Rs. 8.50 per transaction |

DigiBank by DBS is a zero balance savings account, which brings a complete digital banking ecosystem to your mobile. DBS is the best bank in India when it comes to high interest rate with a zero balance savings account. You can easily set up an e-wallet in just 90 seconds and convert it to a digiSavings account Aadhaar based e-KYC to earn interest on your funds and enjoy various features on your savings as well. Following are the features & benefits of a digiBank savings account:

|

|

|

|

Note: The interest rates are updated as on 12th October 2020.

Fees & Charges

Check the fees and charges of the digiBank savings account by DBS / digiSavings.

| DBS digiSavings Account | Fees / Charges |

| Account closure (within 6 months of opening) | Rs. 500 |

| Debit card replacement (lost, stolen, damaged) | Rs. 150 |

| Debit card annual fee (second year onwards) | Rs. 150 |

| International cash withdrawal | Rs. 125 |

Standard Chartered Digital Savings Account can be opened instantly using your PAN and Aadhaar based e-KYC. Standard Chartered is also considered as the best bank to open savings account instantly. Following are the features & benefits of Digital Savings Account:

|

|

|

|

|

Note: The interest rates are updated as on 12th October 2020.

Fees & Charges

Check the fees and charges of the Standard Chartered Digital Savings Account.

| Standard Chartered Bank Digital Savings Account | Fees / Charges |

| Platinum Debit Card (First year fee) | Nil |

| Platinum Debit Card (Annual fee) | Rs. 199 |

| First 5 (Financial & Non-Financial) transactions in a month | Nil |

|

Above first 5 (Financial & Non-Financial) transactions in a Month (Per Transaction) |

Rs. 20 |

SBI Insta Savings Account is a complete digital account, which can be opened in minutes with SBI Yono mobile application or Yono online portal in a matter of minutes. The features and benefits are as follows:

|

|

|

|

|

Fees & Charges

Check the fees and charges of the SBI Insta Savings Account.

| SBI Insta Savings Account | Fees / Charges |

| Rupay Debit Card | Nil |

| Penalty for Non-maintenance of AMB – Metro &Urban (AMB= Rs. 3000/-) | Up to Rs. 15 + GST |

| Penalty for Non-maintenance of AMB – Semi-Urban (AMB Rs. 2000/-) | Up to Rs. 12 + GST |

| Penalty for Non-maintenance of AMB – Rural (AMB) Rs. 1,000/-) | Up to Rs. 10 + GST |

With ICICI Bank Regular Savings Account, you can do your routine transactions like bill payments, FD creation requests and balance enquiry. ICICI Bank is also considered as the best bank in India when it comes to provide various features, benefits and rewards to its customers. Following are various features and benefits of ICICI Regular Savings Account:

|

|

|

|

|

Fees & Charges

Check the fees and charges of the ICICI Bank Regular Savings Account.

| ICICI Bank Regular Savings Account | Fees / Charges |

| Charges for non-maintenance of minimum monthly average balance (Metro/Urban/Semi-Urban/Rural) | Rs. 100 + 5% of the shortfall in required MAB |

| Charges for non-maintenance of minimum monthly average balance (Gramin locations) | 5% of the shortfall in required MAB |

| Debit Card Fees for first Account Holder | Rs. 150 p.a. (For Gramin locations – Rs. 99 p.a.) |

| ATM Transaction Charges (Transactions at Non ICICI Bank ATMs) | Free First 3 transactions in metro locations* in a month

Free First 5 transactions in other locations in a month Thereafter, Rs. 20 per financial transaction and Rs. 8.50 per non-financial transaction |

| Transactions at ICICI Bank ATMs | First 5 transactions in a month – Free

Thereafter, Rs. 20 per financial transaction & Rs. 8.50 per non-financial transaction |

*Metro Locations – Mumbai, New Delhi, Chennai, Kolkata, Bengaluru and Hyderabad

Your ideal savings bank account option should offer higher interest rates; have a good branch and ATM network, diverse savings account choices and personalized services. To know which bank offers the highest interest rate on saving account with wide bank network, check the 7 best savings bank account choices listed below.

|

Branch Network

|

Number of ATMs

|

Interest Rate

|

Savings Accounts

|

Additional Features

|

*Axis Bank provides 3.50% p.a. interest on savings account balance less than Rs. 50 lakh. On balance above Rs. 50 lakh and up to Rs. 10 crore, Axis Bank provides 3.50% p.a. interest. The interest rates are updated as on 12th October 2020.

Listed below are the best savings bank accounts offered by Axis Bank:

|

Axis Bank Savings Accounts |

|||

|

ASAP Instant Savings Account |

EasyAccess Savings Account | Prime Plus Savings Account |

Prime Savings Account |

|

Women’s Savings Account |

Senior Privilege Savings Account | Future Star Savings Account |

Pension Savings Account |

|

Trust / NGO Savings Account |

Insurance Agent Account | YOUth Account (For minors) |

Basic Savings Account |

|

Small Basic Savings Account |

Inaam Personal Account | Axis Republic Salary Account |

Easy Access Salary Account |

| Prime Salary Account | Priority Salary Account | Defence Salary Account (Power Salute) |

Employee Reimbursement Account |

|

Branch Network

|

Number of ATMs

|

Interest Rate

|

Savings Accounts

|

Additional Features

|

*Kotak Mahindra Bank provides 3.50% p.a. interest on balance up to Rs. 1 lakh and 4.00% on balance above Rs. 1 lakh. The interest rates are updated as on 12th October 2020.

One of the best savings account banks in India, Kotak Mahindra Bank offers diverse savings accounts to cater to various customer’s needs.

| Kotak Mahindra Bank Savings Accounts | |||

| 811 Digital Bank Account | 811 Edge Digital Bank Account | Edge Savings Account | Junior – The Savings Account for Kids |

| My Family Savings Account | Silk Women’s Savings Account | Pro Savings Account | Ace Savings Account |

| Sanman Savings Account | Grand – Savings Programme | Classic Savings Account | Nova Savings Account |

| Alpha – The Savings & Investment Programme | Kotak 3-in-1 Account | Edge Salary Account | Platina Salary Account |

| Neo Salary Account | Ace Salary Account | Kotak Basic Savings Bank Deposit Account (BSBDA) | Kotak Small Savings Account |

|

Branch Network

|

Number of ATMs

Use Any Bank ATMs in India (Free 10 transactions per month) |

Interest Rate

|

Savings Accounts

|

Additional Features

|

*DBS Bank provides 3.50% p.a. interest on balance up to Rs. 1 lakh; 6.00% p.a. on balance above Rs. 1 lakh and up to Rs. 2 lakh; 4.00% p.a. on balance above Rs. 2 lakh and up to Rs. 5 lakh; 4% p.a. on balance above Rs. 5 lakh.The interest rates are updated as on 12th October 2020.

Customers can open DBS Savings Account to earn the highest interest rates on savings accounts. Following are the best savings bank account offered by the Development Bank of Singapore:

| DBS Bank Savings Accounts | |||

| digiBank by DBS (digiSavings) | DBS Global Indian Account | DBS Auto Saver (Auto Sweep in) | Basic Savings Bank Deposit Account |

|

Branch Network

|

Number of ATMs

|

Interest Rate

|

Savings Accounts

|

Additional Features

|

*Standard Chartered Bank provides 3.00% p.a. interest on account balance up to Rs. 50 lakh; 3.50% p.a. interest on balance above Rs.50 lakh & up to Rs.150 crore. The interest rates are updated as on 12th October 2020.

One of the best saving account bank in India, Standard Chartered Bank offers diverse savings accounts to cater various customer’s needs.

| Standard Chartered Bank Savings Accounts | |||

| SC Digital Account | Employee Banking Account | aXcessPlus Account | SuperValue Account |

| Parivaar Account | eSaver Account | 2-in-1 Savings Account | 3-in-1 Account |

| Basic Banking Account | Aasaan Account | ||

|

Branch Network

|

Number of ATMs

|

Interest Rate

|

Savings Accounts

|

Additional Features

|

*State Bank of India provides 2.70% p.a. interest on account balance up to Rs. 1 lakh and 2.70% p.a. interest on balance above Rs. 1 lakh. The interest rates are updated as on 12th October 2020.

SBI is considered as the best bank to open savings account in India. Following are the different savings account offered by SBI:

| State Bank of India Savings Accounts | |||

| Insta Savings Account | Digital Savings Account | General Savings Account | Savings Plus Account |

| Special Salary Account | 3-in-1 Demat & Online Trading | Basic Savings Bank Account | Small Savings Account |

|

Branch Network

|

Number of ATMs

|

Interest Rate

|

Savings Accounts

|

Additional Features

|

*ICICI Bank provides 3.00% p.a. interest on account balance below Rs. 50 lakh; 3.50% p.a. interest on account balance of Rs. 50 lakh and above. The interest rates are updated as on 12th October 2020.

Listed below are the best savings bank accounts offered by ICICI Bank:

| ICICI Bank Savings Accounts | |||

| Titanium Privilege Account | Gold Privilege Banking | Gold Plus Savings Account | Silver Savings Account |

| Regular Savings Account | Advantage Woman Savings Account | Seniors Club Savings Account | Young Stars Account |

| 3-in-1 Account | Smart Secure Savings Account | Basic Savings Bank Account | No Frills Account |

| Family Banking | Professional Savings Account | Resident Foreign Currency Account | Easy Receive Savings Account |

|

Branch Network

|

Number of ATMs

|

Interest Rate

|

Savings Accounts

|

Additional Features

|

*HDFC Bank provides 3.00% p.a. interest on account balance less than Rs. 50 lakh; 3.50% p.a. interest on balance of Rs. 50 lakh and above. The interest rates are updated as on 12th October 2020.

One of the best saving account bank in India, HDFC Bank provides various savings accounts to fulfill several customer’s needs.

| HDFC Bank Savings Accounts | |||

| SavingsMax Account | Women’s Savings Account | Regular Savings Account | Senior Citizens Account |

| DigiSave Youth Account | Kids Advantage Account | Family Savings Group Account | Government / Institutional Savings Account |

| Basic Savings Bank Deposit Account | Government Scheme Beneficiary Savings Account | BSBDA Small Account | Premium Salary Account |

| Regular Salary Account | Defence Salary Account | Classic Salary Account | Basic Savings Bank Deposit Account – Salary |

| Salary Family Account | Reimbursement Account | Pension Accounts | |