Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Checking your EPF balance was once a difficult task but now you can check EPFO passbook balance by various modes available online and offline. Know how to check EPF balance online, via SMS, UMANG app and via the EPFO missed call number/toll-free number.

‘How to check EPF balance’ is one of the most asked questions by EPF account holders. Being an employee and a member of the EPFO (Employees’ Provident Fund Organisation), it is your right to know your PF balance at any point. Employees can easily check their respective EPF balance both offline and online. PF balance check/EPFO balance check offline can be done via SMS or missed call service/EPF balance check number and online using the EPF Portal on mobile or desktop or through UMANG app.

Checking your EPF balance becomes particularly essential if you plan to withdraw your PF amount for any expenses, know the interest accumulated in your EPF account or want to secure a loan against the EPF balance.

EPF balance or EPFO passbook balance is the amount of money in your EPF account at any given point of time. It is the available portion of your salary that is deposited every month in your EPF account for the purpose of building your retirement savings.

It is important because it acts as a corpus for your retirement. It may also be utilized to meet financial needs if you are unemployed for more than a month or may be withdrawn in case of unforeseen circumstances, medical emergencies, etc.

On this page:

The following are the various methods to check your PF balance online and offline, both with and without UAN:

You can receive the SMS in 10 different languages, viz.

| Language and Code | |

| English (Default) | Hindi (HIN) |

| Gujarati (GUJ) | Punjabi (PUN) |

| Marathi (MAR) | Kannada (KAN) |

| Malayalam (MAL) | Tamil (TAM) |

| Telugu (TEL) | Bengali (BEN) |

E.g. If you need balance details in Hindi or Marathi or Bengali, send SMS like:

Note that this facility to check your EPFO passbook balance can be used only if your UAN is active and seeded with your Aadhaar, bank account and PAN.

If you have not seeded your UAN with the above-mentioned documents, first you have to complete the eKYC with UAN.

You can also do an EPF balance check without your UAN. To do so, you need to simply give a missed call on the EPFO balance check number/EPF balance check number –

You will receive details of the last contribution along with the PF balance. To use the EPF balance check missed call number facility or PF balance enquiry number, make sure the following requirements are met with:

Suggested Read: What is UAN and how to register for UAN?

EPFO provides various services through the government’s centralized mobile app called UMANG App. You can check your EPF balance and get your PF passbook on the UMANG App by simply logging in using your UAN and OTP.

Steps to check PF balance using UMANG App:

Step 1: Install the application from Play Store/App Store or directly by clicking on this link: UMANG App (Link will open in a new tab).

Step 2: Open the UMANG app on your smartphone and choose your preferred language. Also, read the terms and conditions of the “End to End License Agreement”.

Step 3: Get your mobile number verified and register.

Step 4: Click on the ‘All Services’ option at the bottom.

Step 5: Find and select ‘EPFO’ from the list of options.

Step 6: Click on ‘View Passbook‘ to check your EPF balance.

Step 7: Enter your UAN and click on the name of your current organization. Your passbook will be displayed on the screen along with your EPF balance/EPFO passbook balance.

Suggested Read: UMANG App: Download, Registration, Login, Services & Benefits

Members of the EPFO can check their balance by visiting the official website of the Employees’ Provident Fund Organization (EPFO). Follow the steps given below to check your EPF balance online at EPFO Portal:

Step 1: Visit the official EPFO Website (copy this in a new tab – www.epfindia.gov.in)

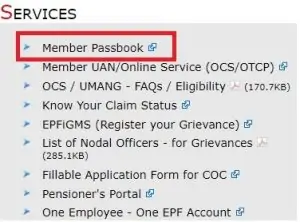

Step 2: From the ‘Services’ drop-down menu, click on ‘For Employees’

Step 3: From the ‘Services’ menu, click on ‘Member Passbook’ (You will be redirected to the login page. You can also directly visit the page by clicking on this link: EPF India – Member Passbook)

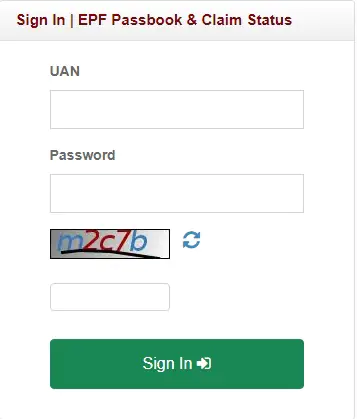

Step 4: Log in with your UAN, password and the OTP that you receive on your registered mobile number.

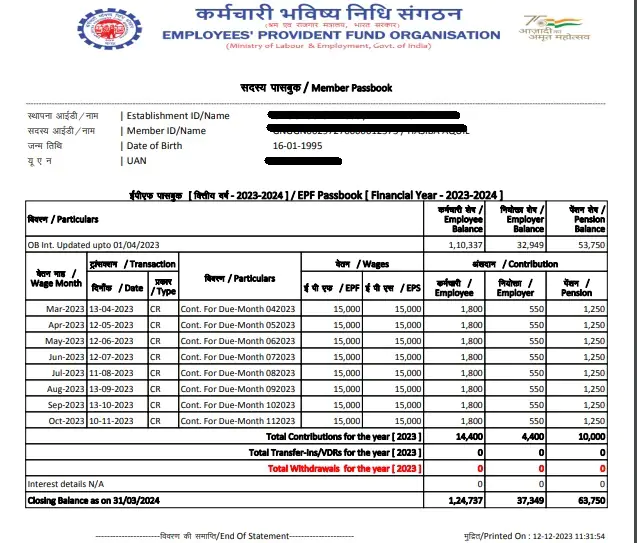

Step 5: After you login to the EPF passbook portal, click on the “Passbook” tab and choose the member ID from the various EPF accounts linked with your UAN to view and download your EPF passbook in PDF format.

Suggested Read: How to register on EPFO Portal

The following are a few points that members should consider when doing the EPFO balance check using the EPFO website:

Suggested Read- EPFO Member Portal – Login, Registration, Services, Password Reset & Passbook

Also Read: EPF Balance Transfer

Must Read: Steps to withdraw EPF balance online

Suggested Read: Rules Regarding EPF Balance Withdrawal

The EPFO Central Board of Trustees reviews the EPF interest rates every year. After the recent consultation with the Ministry of Finance, the EPF interest rate for the financial year 2024-25 has been set at 8.25%.

Know more details about How is interest calculated on EPF balance?

In case of an exempted establishment/private trusts, you cannot check the EPF Balance or put a request for online withdrawal. However, the information can be drawn by checking the salary slips or by raising a request to the HR department.

An inoperative EPF account is that EPF account in which no PF contribution has been received for 3 years after retirement/death/permanent migration. On being declared inoperative, no interest shall be payable on that account. Please note that currently, if the member is up to 58 years of age, the interest will be credited to the account (including inoperative accounts).

The employer’s contribution to EPF is tax-free. As far as employee’s contribution to EPF is concerned, the employee can take advantage of tax deductions under Section 80C of the Income Tax Act.

In other words, EPF investment, interest earned on EPF balance as well as the money withdrawn after the mandatory specified period of 5 years are all completely tax-free for the employee.

Here are a few EPF balance check issues that you could face along with their solutions:

In case you wish to check your EPF balance and don’t remember your UAN, you can recover it online by using the “Know your UAN” option available on the EPFO member portal. Simply provide the necessary details such as your name, date of birth, Aadhaar/PAN/member ID, etc. to find out your UAN.

Click to know more about UAN, UAN activation and registration online

Sometimes your EPF balance may not be visible or your EPF account may show zero balance.

This may be because at times, UAN based contributions to PF accounts are delayed. In such a situation, you should wait for 2-3 days of your account being credited. However, in case the issue persists, you need to contact the HR department of your company or raise a query at the EPFO helpdesk.

No, you cannot check your balance using Aadhaar. You have to provide your UAN to check your EPF account balance.

EPF number is not asked for checking the EPF balance. You have to use your UAN and password to check the balance online.

No. PAN is not required to check the EPF balance. However, you should link your UAN with EPF to avail various online facilities related to EPF.

EPF balance check by SMS can be done only when it is sent through the mobile number registered with UAN. You have to link your mobile number with UAN.

Suggested Read: How to link my mobile number to my UAN?

All EPF accounts linked to a UAN will be displayed on the screen when you log in to the EPF portal. You can select the respective Member ID to check balance.

EPF Account balance can be transferred from one EPF account to another. But, you cannot transfer the balance to your bank account if you are currently employed.

However, the transfer or withdrawal is possible if you are unemployed for more than two months. (75% of the amount can be withdrawn after the first month of unemployment and the remaining 25% after the second month)

Individuals having a registered EPF account are eligible to check their account balance. If you are someone above the age of 55 and your account is declared inoperative by the EPFO, you can access your account balance by filing a request at the EPFO helpdesk.

The EPF passbook is updated within 24 hours from the time of credit made. You are advised to wait for at least 24 hours.

If your balance is not updated after 2 days, you should contact your HR department or file a complaint at the EPFO helpdesk.

EPF Balance is updated in your respective passbook after 24 hours of making the contribution.

At times, the UAN based contributions to PF accounts are delayed. You can wait for 2 or 3 days after the date on which your account was credited. However, if the issue continues, you should contact the HR department in your company or raise a query at the EPFO helpdesk.

You can visit EPFO Passbook portal to check EPF balance in passbook after logging in to your account using the UAN and password.

There is no maximum limit for EPF contributions.

Yes, TDS may be deducted if your withdraw the amount in your EPF account when your employment period (with an EPF registered employer) is less than 5 years.

It is advisable to check your EPF balance at least once a year to keep track of your savings and ensure that the contributions are being credited to your account correctly.

No, you are not required to pay any fee/charges to check your EPF balance.

You can transfer your EPF balance from one employer to another, that is, to a new EPF account by using the ‘One Member – One EPF Account (Transfer Request)’ option on the EPFO member portal.

However, beginning April 1st 2024, existing PF accounts of member employees will automatically be transferred to new accounts by EPFO every time they change their jobs without raising a request or filling up a form. This transfer would include the transfer of both the EPF as well as EPS amount in their new account.

Know more details about: How to Transfer EPF Online

Yes, you can withdraw your entire PF corpus if you have been unemployed for two months. Moreover, after a month of unemployment, you are allowed to withdraw up to 75% of your EPF balance.

However, PF withdrawals are tax-exempt only after completion of five consecutive years of EPF membership.

To check your EPF balance without using your UAN, you need to give a missed call on 9966044425. However, to avail this facility your UAN must be activated and mobile number should be registered with EPFO.

Yes, you can check your EPF balance using the UMANG app or by logging into the EPFO member portal without linking your Aadhaar with your UAN.

There is no minimum balance that needs to be maintained in your EPF account. However, the amount of money that you can withdraw from your EPF account is subject to meeting the specific withdrawal criteria for that specific requirement.

Read more about: EPF Withdrawal Rules 2025

EPF balance is generally updated after 24 hours of the contribution being made.

Yes, you can withdraw your EPF balance before you retire in case you are unemployed for more than a month or need funds to pay your home loan, medical expenses, wedding related expenses, etc.

You need to first re-register the new mobile number with your UAN.

EPF passbook is a cumulative record of all the transactions made into your EPF account. You can download your EPF passbook online by logging into the UMANG app or EPFO member portal.

Earlier you had to transfer your EPF balance from your old employer to the new/existing one by logging into your EPF account online. However, 1st April 2024 onwards EPFO has started automatically transferring old PF accounts of member employees to new accounts every time they change their jobs without filling up a form or raising a request.

16th Dec 2024: As per a recent update, EPFO subscribers will soon be able to withdraw claim amounts from their EPF accounts through ATMs. The move will come in effect as part of the labour ministry’s effort to upgrade information technology infrastructure to provide enhanced services to the Indian workforce.

12th July 2020

In a meeting held to address the issues related to migrant labour force during COVID-19 pandemic, the parliamentary panel has put forth their support for removal of the criteria on the minimum number of employees and wages to avail ESI and EPF benefits, so that the migrant workers who are affected by the lockdown can also benefit from the schemes. Also, this extension of coverage of both schemes will provide better social security to workers from the unorganised sector.

Both Employees State Insurance (ESI) and the Employees Provident Fund (EPF) are self-financing welfare schemes meant for employees and workers. Employees earning up to Rs. 21,000 per month can contribute 1.75% towards ESI while the employer’s contribution is 4.75%. In the case of EPF, employer and employee contribute 12% of basic wages towards the scheme.

The panel headed by BJD MP Bhartruhari Mahtab believes that better measures regarding social security must be taken in favour of the workforce in the unorganized sector especially after the unprecedented situation of lockdown in the country.

Mahtab is of the view that it is very important to safeguard the social security of the workforce and stands strong against the dilution of labour laws by some states amidst the pandemic. He also believes that ‘Industry cannot be pampered at the cost of labourer’s rights’.

8th July 2020

The Union Cabinet approved the extension of Employee’s Provident Fund support for small businesses and workers earning less than or equal to Rs. 15,000 per month till August. This decision is aimed at facilitating a higher take-home salary for the employees and for employers to make the required contribution.

The Union minister Prakash Javadekar further elucidated that the extension will offer relief to more than 3 lakh establishments and 72 lakh employees. An overall expenditure of Rs. 4,867 crore has been estimated for the same which will pay for both the 12% share of employee and employer under EPF.

Besides this, the centre has also approved free supply of three LPG cylinders till September to 7.4 crore poor women. Oil Minister Dharmendra Pradhan believes that ‘this decision of extending the free LPG cylinders will benefit the poor mothers and sisters who are affected by COVID-19 situation and are not able to consume the three refills allotted to PMUY beneficiaries’.

Moreover, it is decided that the supply of free grains and pulses under PM Garib Kalyan Yojana will be extended till November.

16th June 2020

EPF withdrawal claims are now processed at a faster rate than before as the Employees’ Provident Fund Organisation (EPFO) has launched multi-location claim settlement facility and a new artificial intelligence (AI) tool which auto-processes the claims.

Hitherto, each provident fund account was linked to the nearest local or regional office and all the claims were processed through the respective office falling under its geographical jurisdiction. This centralised structure made the entire claim settlement process slower because the regional office would get overburdened most of the times.

After the launch of multi-location claim settlement facility, all accounts are delinked from regional offices. Now, any regional office across India can settle the claims related to provident fund, pension, partial withdrawal and transfer. This initiative is aimed at making the process of claim settlement transparent, more efficient and quicker pursuant to Digital India.

Moreover, EPFO has also made a shift towards artificial intelligence with a new AI tool. This tool is made to process all COVID related claims in a short span of 3 days automatically. Since lockdown, EPFO has settled more than 80,000 claims with an average daily payout of Rs. 270 crore.