Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Employee Provident Fund (EPF) is one of the most popular and trusted scheme for securing a long-term retirement fund. It is managed by Employees’ Provident Fund Organization under the Employees’ Provident Fund and Misc. Provisions Act, 1952. Both the employer as well as the employee contribute to the EPF account and one can withdraw the accumulated corpus at the age of 58 after the retirement.

Also Read : All You Need to Know About EPF Contributions

Also Read : EPF Withdrawal Before Retirement: Is It Right For You?

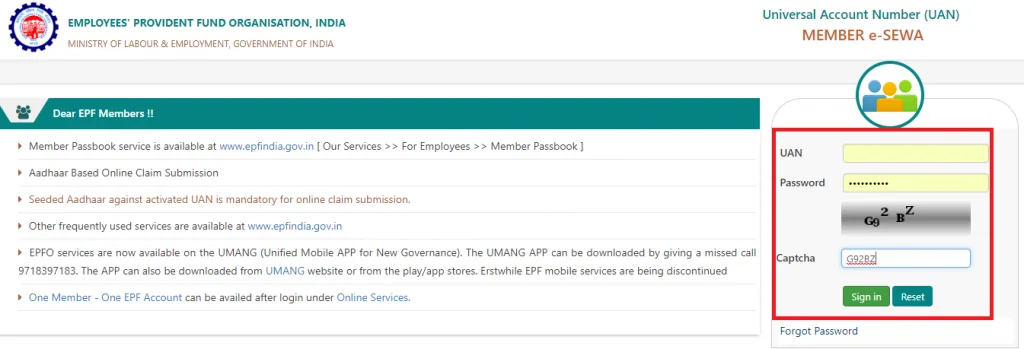

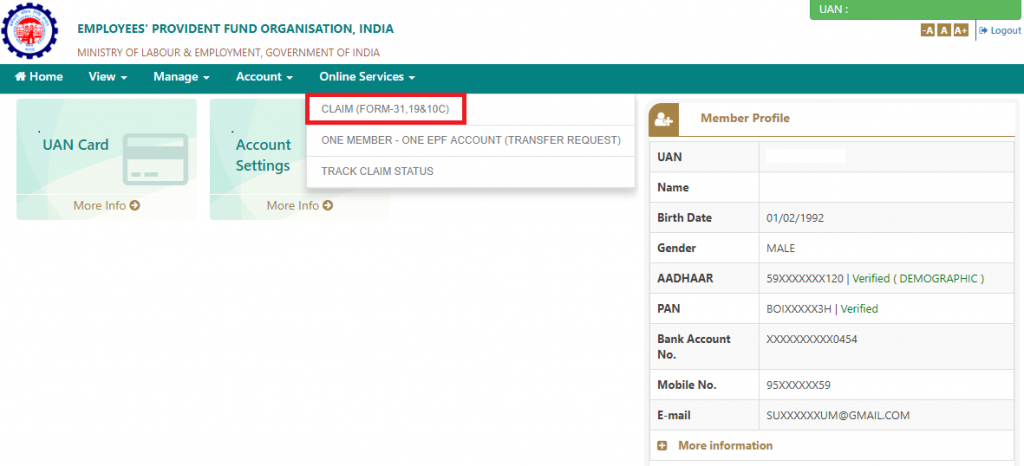

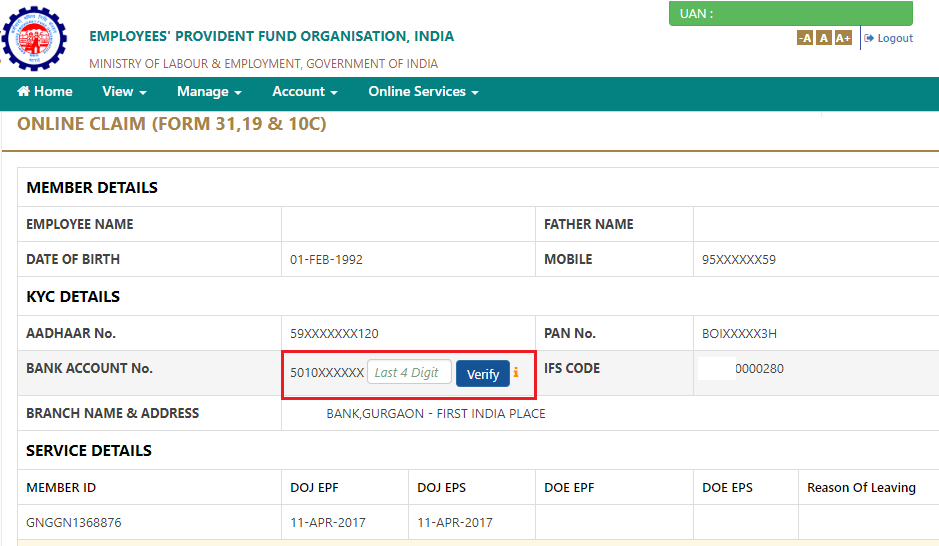

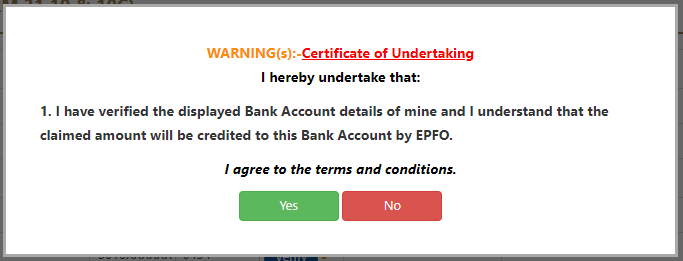

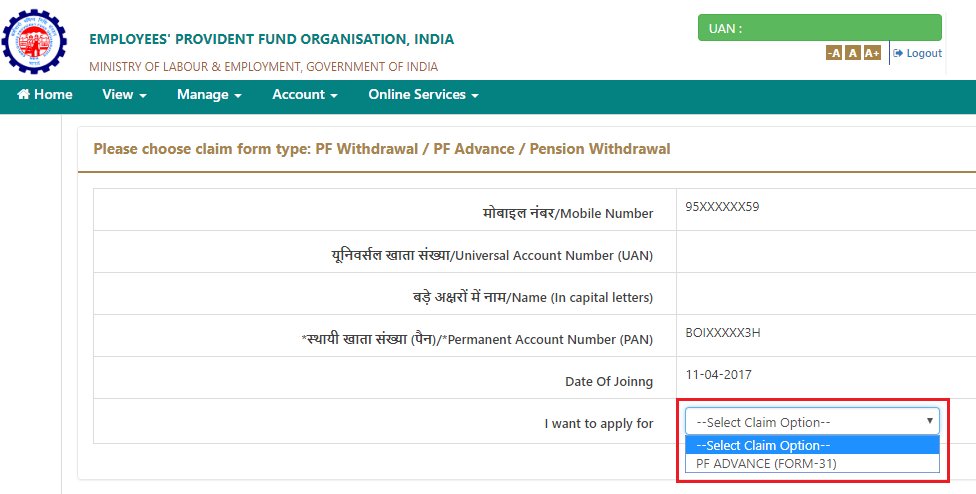

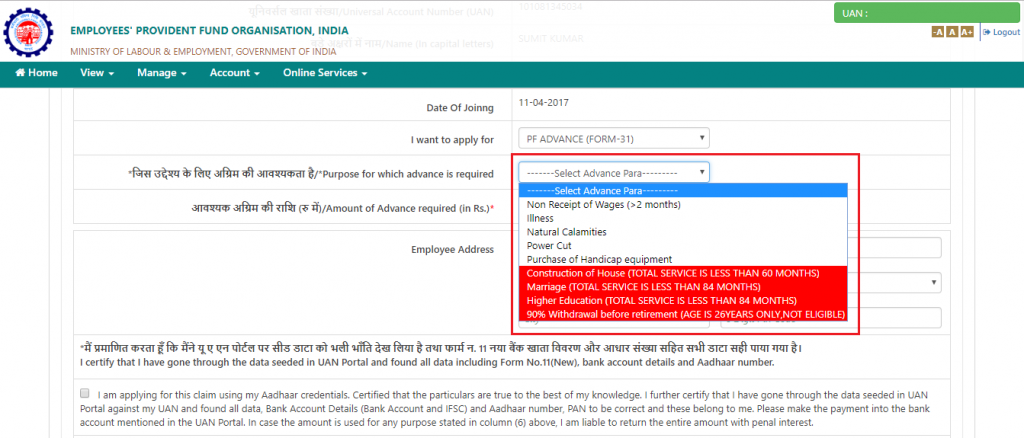

You can withdraw EPF funds online by using UAN Member e-Sewa Portal. You can raise claims like partial withdrawal or full settlement for EPF by using the online portal. However, you can use the online withdrawal claim facility only when your Aadhaar is linked with your UAN.