Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

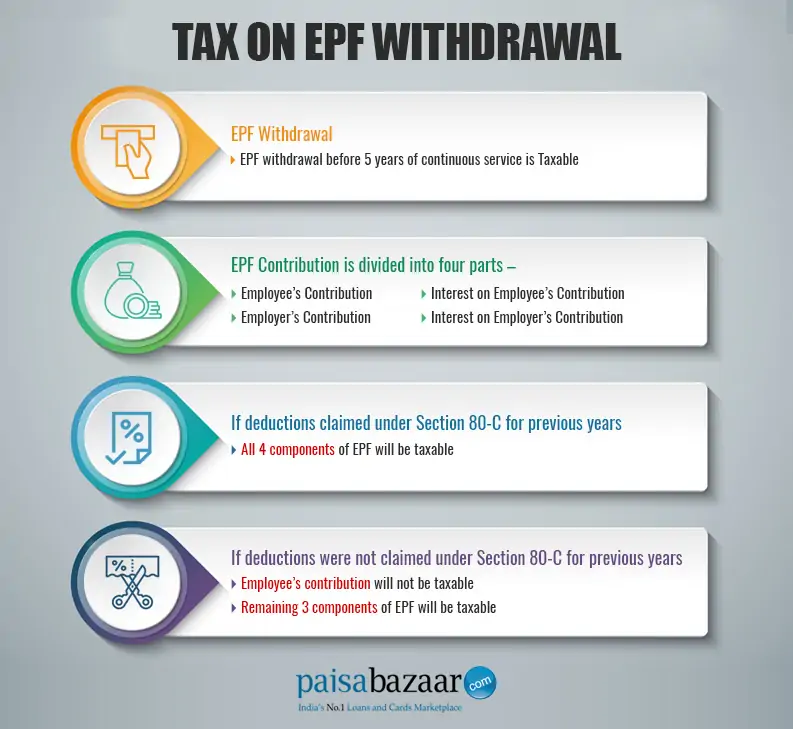

As per the latest media reports, the Income Tax Department has revised Form 2 and Form 3 that are being used for filing ITR for the FY 2017-18. The forms contain detailed break-up of contributions made towards EPF. It should be noted that a member has to pay tax on EPF withdrawal before 5 years of continuous service. The updated forms will be used to analyse if the assessee should be taxed based on the withdrawal made in the financial year or not. The department will also check whether your income from previous years has to be assessed for which you may have to pay additional tax.

If you have not already filed the income tax, you will have to use the updated utilities to calculate the tax and pay a penalty as well.

EPF contributions consist of four parts – Employee’s contribution, employer’s contribution, interest on employee’s contribution and interest on employer’s contribution.

In case you have claimed deductions on employee’s contribution as per Section 80-C of the Income Tax Act for previous years, all four components of EPF will be taxed and the rate applicable will be as per the income slab you fall in.

In case you have not claimed deductions on your PF contributions for previous years, then the contribution will not be taxable at the time of withdrawal. The employer’s contribution and the interest earned on the employee’s and employer’s contributions attract tax on EPF withdrawal. The tax rate will, however, depend on the income slab that you will fall in each of the financial years.

The withdrawal of the EPF corpus will be taxable in the financial year when the withdrawal is made but taxes will be calculated for the financial years for which contributions had been made.

Don’t Know your Credit Score? Now Get it for FREE Check Now

Why has the Income Tax Department Revised ITR Forms?

There are two primary reasons why the ITD has revised ITR Forms 2 and 3:

These steps will help the Income Tax Department to make ITR filing more transparent and also make it easier for people to calculate taxes on EPF withdrawals.