Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

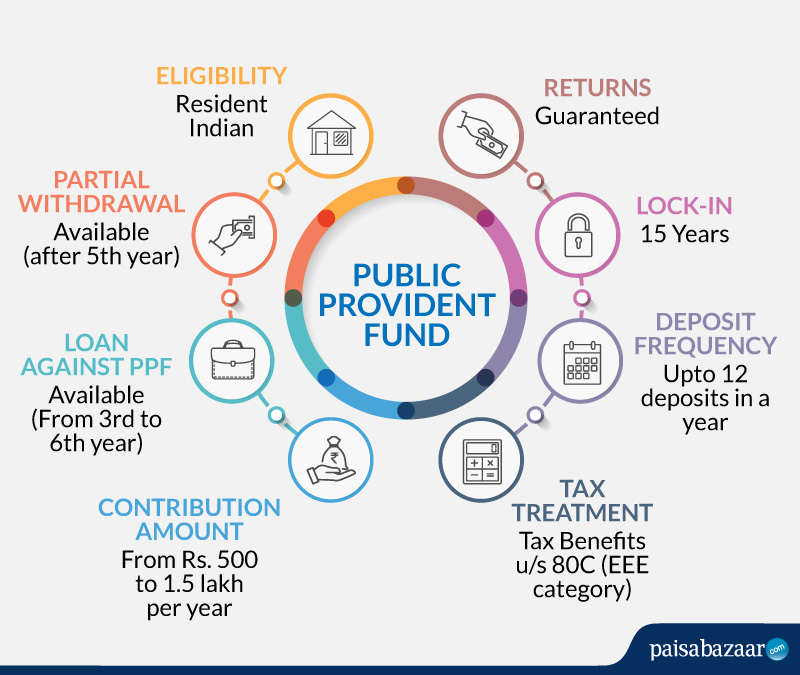

Public Provident Fund (PPF) account is one of the most popular long term investment options for individuals with low-risk appetite as both the money in the PPF account and the returns it generates are guaranteed. This account can be opened with a minimum investment of Rs. 500 and the current PPF interest rate for Q3 FY 2025-26 is 7.1%.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

PPF or Public Provident Fund, like all other small saving schemes, including Senior Citizens Savings Scheme (SCSS), Sukanya Samriddhi Yojana, and the National Savings Certificate (NSC), was launched by the government to encourage small savings and to provide returns on those savings. Since the PPF scheme comes under the Exempt-Exempt-Exempt (EEE) category of tax policy, the principal amount, the maturity amount, as well as the interest earned is exempt from taxes.

| PPF – Key Highlights | |

| PPF Interest Rate | 7.1% (Q3 FY 2025-26) |

| Minimum Investment Amount | Rs. 500 |

| Maximum Investment Amount | Rs. 1.5 lakh p.a. |

| Tenure | 15 Years (Can be extended in blocks of 5 years thereafter) |

| Tax Benefit | Up to Rs.1.5 lakh under Section 80C |

Also Check: PPF Calculator to calculate returns on your investment

Know More: PPF Account for Minors: Eligibility, Documents Required & Taxation

Get Free Credit Report with Complete Analysis of Credit Score Check Now

Here is a list of documents that should be procured at the time of opening a PPF account:

To download the forms required to open a PPF account, Click Here

Individuals can open a PPF account at post offices or through nationalized banks and major private banks like ICICI, Axis, HDFC, etc.

| Indian Overseas Bank | Axis Bank | State Bank of India | IDBI Bank |

| ICICI Bank | Bank of Baroda | HDFC Bank | Corporation Bank |

| Oriental Bank of Commerce | Bank of India | Allahabad Bank | Central Bank of India |

| Canara Bank | Union Bank of India | Indian Bank | United Bank of India |

| Bank of Maharashtra | Punjab National Bank | Dena Bank | Vijaya Bank |

Please Note: The Banks are only intermediaries that help you open the PPF account, the money you deposit still goes to the Government, and not to the particular Bank.

If you have an account with any of the above banks, you can use their net banking service to open a PPF account:

It must be noted that each bank may have a relatively different process for opening a PPF account. The general steps to be followed, however, remain the same.

Compare and Apply for Credit Cards from Top Banks Online

If the PPF account has been opened through the net banking service of a bank, the PPF balance can be easily checked online:

The bank provides a separate passbook for PPF account which comprises your account balance, account number, bank branch details, credits/debits to your account, etc. You can check your PPF account balance offline by updating this passbook.

In case you have a PPF account opened through the Post Office, you would need to visit the same post office to update your passbook.

PPF works under a mandatory lock-in period of 15 years. However, partial withdrawals can be made in emergency cases. Partial withdrawals from the account can be made after the completion of the 5th Financial year from the year in which the account is opened. For example, if the account was opened in Feb 2015, withdrawal can be made from the financial year 2020-21 onwards. Only one partial withdrawal is allowed per financial year. The maximum amount that can be withdrawn per financial year is the lower of the following:

Application Form for Withdrawal from PPF Account should be submitted to withdraw a partial amount from the PPF account.

Related Article: PPF Withdrawal rules: How to withdraw your partial & complete PPF

The facility to avail loan against the PPF account is available after expiry of one year but before expiry of five years (from the end of the FY in which the initial subscription was made). Only one loan can be availed in a financial year and a second loan can be obtained only after the closure of the first loan.

For example, if the PF account is opened on Jan 1, 2012 (FY 2011-12), the end of the financial year in which the account was opened is Mar 31, 2012. The loan can be taken from 1st April 2013 (FY 2013 – 14) onwards. Five years from the end of the financial year in which account was opened on March 31, 2018 (FY 2017 – 18). Thus, the loan can be obtained from Mar 31, 2013, to Mar 31, 2018.

Must Read: Other Investment Alternatives to PPF

Get Free Credit Report with monthly updates. Check Now

Nomination can be made in favour of one or more person(s). In case, more than one person is appointed as a nominee, the percentage share of each nominee should be specified.

After being duly filled, the form must be submitted at the appropriate bank/post office branch.

The PPF account can be transferred from the bank to the post office or vice versa. It can also be transferred between different branches of the same bank.

The PPF Account becomes inactive if the minimum contribution of Rs 500 per year is not made. To revive an inactive PPF account,

Also Read: How to Reactivate Inactive PPF Account

Premature closure of PPF accounts is not permitted within 5 years of opening the account. Thereafter it can only be closed on specific grounds such as life-threatening ailments affecting the account holder, spouse, dependent children or parents. Supporting medical documents have to be produced to support a claim on these grounds.

A PPF account matures after 15 years from the end of the financial year in which the account was opened. At the time of maturity, the account holder has the option to extend the tenure in the blocks of 5 years:

A subscriber can extend the life of the PPF account indefinitely in blocks of 5 years at a time. The subscriber has to submit a request to extend the account, with further contributions by submitting Form H.

If no choice is made, then the default choice, .i.e. extension without further contribution applies.

Once the PPF account is renewed with/without contribution, the option cannot be switched, i.e. from with contribution to without contribution or vice versa.

In case the amount is deposited in the account without choosing the correct option, no interest will be payable on such amount. Also, no deduction under the Income Tax Act will be available on such contributions.

Due to its guaranteed returns and tax benefits, PPF is preferred by many individuals, particularly small savers who have a low appetite for risk. However, there are several other savings and investment options available to those who want better returns in the long-run or more liquidity with their investments. Some of the common alternatives to PPF are ELSS, Tax-Saver FDs and NPS.

| POPULAR TAX SAVING INVESTMENT SCHEMES | ||||

| Name of Scheme | Rate Of Returns (p.a.) | Tax Treatment | Lock-in Period | Minimum Investment Per Annum(Rs.) |

| Public Provident Fund | 7.1% | Principal and interest amount qualifies for tax deduction under section 80C Interest earned is tax free |

15 years | 500 |

| Equity Linked Saving Scheme | Category average return: 1 year: 19.67% 3 Year: 6.59% 5 Year: 13.39% |

Principal amount qualifies for tax deduction under section 80C LTCG tax @ 10% on gains above Rs 1 lakh booked in a financial year |

3 years | 500 |

| National Pension Scheme (All Citizen Model) | 1 year return: Tier 1 Equity : 16.68-20.18% Tier 1 Govt bond : 13.43-14.91% Tier 1 Corporate Bond : 12.64-14.70% 3 year return: Tier 1 Equity : 8.17-11.16% Tier 1 Govt bond : 11.20-12.77% Tier 1 Corporate Bond : 8.87-10.41% 5 year return: Tier 1 Equity : 13.04-15.61% Tier 1 Govt bond : 10.26-11.83% Tier 1 Corporate Bond : 9.25-10.16% |

Principal amount qualifies for tax deduction under section 80C and an additional deduction of Rs 50,000 under section 80CCD (1B). Interest earned is tax free |

Up to retirement | 500 |

| National Saving Certificate | 7% | Principal and interest both qualify for tax deduction under section 80C (except interest received in the final year ) | 5 years | 1000 |

| Tax Saver Fixed Deposit | 3.50-7.50% | Principal amount qualifies for tax deduction under section 80C Interest earned is taxable as per income tax slab |

5 years | 1000 onwards, varies from bank to bank |

| Sukanya Samriddhi Yojana | 7.60% | Principal amount qualifies for tax deduction under section 80C Interest earned is tax free |

21 years from date of opening of account or upon marriage of account holder, whichever is earlier | 250 |

| Unit Linked Insurance Plan | 5 year returns (category average for different funds): 5.41-13.25% | Premium paid qualifies for tax deduction under section 80C Interest earned is tax free if the annual premium does not exceed 10% of the sum assured* |

5 years | 1000 (Monthly Premium) |

| 5 Year Post Office Time Deposit Account | 7% | Principal amount qualifies for tax deduction under section 80C Interest earned is taxable as per income tax slab |

5 years | 1000 |

*For a policy issued after 1st April 2012, ULIP premium should not exceed 10% of the total sum assured. For a policy issued before 1st April 2012, ULIP premium should not exceed 20% of the total sum assured.

Our recommendation is that if you are not ready to take risks and only want guaranteed and safe returns, then PPF should be your choice. However, if you are willing to take the moderate risk, you should consider ELSS, as equity over the long run (5 years or more) has historically given much higher returns than PPF, despite the capital gains tax associated with it. At 3 years, ELSS also has a significantly shorter lock-in period.

Those with a low-risk appetite can also look at Tax-Saver FDs as an alternative to PPF if they want a shorter lock-in period. But, please note, interest in PPF has been traditionally higher than FDs. Also, tax-saver FDs are best suited for only those who can make a lumpsum investment; small savers who want to deposit small amounts through the year and also, save taxes, should choose PPF.

Given below is a brief account of the historical PPF interest rates:

| Period | Interest Rates |

| October to December 2022 | 7.1% |

| July to September 2022 | 7.1% |

| April to June 2022 | 7.1% |

| January to March 2022 | 7.1% |

| October to December 2021 | 7.1% |

| July to September 2021 | 7.1% |

| April to June 2021 | 7.1% |

| January to March 2021 | 7.1% |

| October to December 2020 | 7.1% |

| July to September 2020 | 7.1% |

| April to June 2020 | 7.1% |

| January to March 2020 | 7.90% |

PPF is used primarily to earn relatively higher rate of interest and save tax at the same time. People having low risk appetite invest in PPF and can claim tax deductions up to Rs. 1.5 Lakh under Section 80C while filing the Income Tax Return.

No, interest is not calculated for the year(s) the account remains inactive. Once the account is revived, interest will be calculated on the total balance available at the time of revival.

Rs. 1.50 lakh is the maximum total investment that you can make to your account, your spouse’s and/ or your minor child’s account cumulatively in a financial year. Also, only amounts up to Rs. 1.50 lakh can be claimed as deductions under Section 80C of the Income Tax Act.

No, only parents/ legal guardians can open and operate a PPF account a PPF account on behalf of their minor child/ward.

No. Extensions can only be made in blocks of 5 years.

Yes, you can transfer your PPF account to another branch or office.

You can use the PPF calculator available on the Paisabazaar website to check the year-wise PPF returns that you can earn by contributing to your PPF account over a pre-determined period and with a specific deposit frequency. You can also use a bank specific calculator such as the SBI PPF Calculator to check your PPF returns.

The nominees can claim the PPF account using Form G. Subscribers must attach the death certificate, succession certificate, PPF Passbook, Letter of Indemnity, and Affidavit along with the form. A succession certificate is not required if the account balance is less than Rs. 1 lakh. A legal heir can also claim the account without the presence of any nominee by producing all the documents mentioned above.