Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Start Income Tax Filing Now

Let’s Get Started

The entered number doesn't seem to be correct

| To invest in NPS through Paisabazaar, Click Here |

| Already have an NPS account through us? For Subsequent Contribution, Click Here To Set up SIP, Click Here |

The National Pension System (NPS) is a pension system open to all citizens of India. The NPS invests the contributions of its subscribers into various market-linked instruments such as equities and debts and the final pension amount depends on the performance of these investments.

An Indian citizen in the age group of 18-70 can open an NPS account. NPS is administered and regulated by the Pension Fund Regulatory Authority of India (PFRDA). The superannuation age in NPS is 60, however, individuals can continue until the age of 75.

Partial withdrawals of up to 25% of your contributions can be made from the NPS after three years of account opening but for specific purposes like home buying, children’s education, or serious illness. Partial withdrawal is allowed for three times in the entire life cycle. Further, there is no lock-in period to execute the second and the third partial withdrawal, however, the same applies only to the incremental investment.

The National Pension System has four asset classes. Asset Class E invests in equities or stocks. Asset Class C invests in Corporate Bonds. Asset Class G invests in Government-issued Bonds and Asset Class A invests in alternative assets like Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InVITs).

| Class | Investment Asset |

| E | Equity |

| C | Corporate Bonds |

| G | Government Bonds |

| A | Alternative Assets like REITs & InVITs |

Under National Pension System, you can either pick your own asset allocation by selecting Active Choice, else you can opt for Auto choice where the investments are allocated across the asset class in a pre-defined matrix and rebalance every year.

In Active Choice, the subscriber picks the desirable split of his NPS deposits between equities, corporate bonds, government bonds and alternative assets on his own. Accordingly, the subscriber needs to provide Pension Fund Managers (PFMs), and the percentage allocation to each of the asset classes of NPS, as given below.

| Subscribers have to decide the allocation pattern amongst E, C, G & A. |

| Asset Class | Cap on Investment |

| Equity (E) | 75% |

| Corporate Bonds (C) | 100% |

| Government Securities (G) | 100% |

| Alternate Investment Fund (A) | 5% |

NPS offers an easy option for those subscribers who do not have the required knowledge to manage their NPS investments. In this option, funds are automatically allocated across asset classes as per a pre-defined matrix and it is rebalanced every year as per the age of the subscriber.

Please see the table below for asset allocation in each life-cycle fund:

| Aggressive | Moderate | Conservative | |||||||||

| Age | E | C | G | E | C | G | E | C | G | ||

| Up to 35 years | 75% | 10% | 15% | 50% | 30% | 20% | 25% | 45% | 30% | ||

| 40 | 55% | 15% | 30% | 40% | 25% | 35% | 20% | 35% | 45% | ||

| 45 | 35% | 20% | 45% | 30% | 20% | 50% | 15% | 25% | 60% | ||

| 50 | 20% | 20% | 60% | 20% | 15% | 65% | 10% | 15% | 75% | ||

| 55 | 15% | 10% | 75% | 10% | 10% | 80% | 5% | 5% | 90% | ||

| Age | Aggressive Life Cycle Fund (LC – 75) | ||

| Asset Class (In %) | |||

| E | C | G | |

| Up to 35 years | 75 | 10 | 15 |

| 36 years | 71 | 11 | 18 |

| 37 years | 67 | 12 | 21 |

| 38 years | 63 | 13 | 24 |

| 39 years | 59 | 14 | 27 |

| 40 years | 55 | 15 | 30 |

| 41 years | 51 | 16 | 33 |

| 42 years | 47 | 17 | 36 |

| 43 years | 43 | 18 | 39 |

| 44 years | 39 | 19 | 42 |

| 45 years | 35 | 20 | 45 |

| 46 years | 32 | 20 | 48 |

| 47 years | 29 | 20 | 51 |

| 48 years | 26 | 20 | 54 |

| 49 years | 23 | 20 | 57 |

| 50 years | 20 | 20 | 60 |

| 51 years | 19 | 18 | 63 |

| 52 years | 18 | 16 | 66 |

| 53 years | 17 | 14 | 69 |

| 54 years | 16 | 12 | 72 |

| 55 years & Above | 15 | 10 | 75 |

| Age | Moderate Life Cycle Fund (LC – 50) | ||

| Asset Class (In %) | |||

| E | C | G | |

| Up to 35 years | 50 | 30 | 20 |

| 36 years | 48 | 29 | 23 |

| 37 years | 46 | 28 | 26 |

| 38 years | 44 | 27 | 29 |

| 39 years | 42 | 26 | 32 |

| 40 years | 40 | 25 | 35 |

| 41 years | 38 | 24 | 38 |

| 42 years | 36 | 23 | 41 |

| 43 years | 34 | 22 | 44 |

| 44 years | 32 | 21 | 47 |

| 45 years | 30 | 20 | 50 |

| 46 years | 28 | 19 | 53 |

| 47 years | 26 | 18 | 56 |

| 48 years | 24 | 17 | 59 |

| 49 years | 22 | 16 | 62 |

| 50 years | 20 | 15 | 65 |

| 51 years | 18 | 14 | 68 |

| 52 years | 16 | 13 | 71 |

| 53 years | 14 | 12 | 74 |

| 54 years | 12 | 11 | 77 |

| 55 years & Above | 10 | 10 | 80 |

| Age | Conservative Life Cycle Fund (LC – 25) | ||

| Asset Class (In %) | |||

| E | C | G | |

| Up to 35 years | 25 | 45 | 30 |

| 36 years | 24 | 43 | 33 |

| 37 years | 23 | 41 | 36 |

| 38 years | 22 | 39 | 39 |

| 39 years | 21 | 37 | 42 |

| 40 years | 20 | 35 | 45 |

| 41 years | 19 | 33 | 48 |

| 42 years | 18 | 31 | 51 |

| 43 years | 17 | 29 | 54 |

| 44 years | 16 | 27 | 57 |

| 45 years | 15 | 25 | 60 |

| 46 years | 14 | 23 | 63 |

| 47 years | 13 | 21 | 66 |

| 48 years | 12 | 19 | 69 |

| 49 years | 11 | 17 | 72 |

| 50 years | 10 | 15 | 75 |

| 51 years | 9 | 13 | 78 |

| 52 years | 8 | 11 | 81 |

| 53 years | 7 | 9 | 84 |

| 54 years | 6 | 7 | 87 |

| 55 years & above | 5 | 5 | 90 |

Subscribers can change the scheme preference/asset allocation up to four times in a financial year and PFM once in a financial year.

Note: Asset Class E stands for Equity, Asset Class C stands for Corporate Bonds and Asset Class G invests in Government-issued Bonds.

NPS does not have a fixed interest rate but the returns are market-linked. Contributions in the NPS account can be invested in up to 4 asset classes – equities, corporate bonds, government bonds and alternative assets through various pension fund managers.

The National Pension System is a defined, voluntary contribution pension where contributions made by the subscribers to NPS accumulate till retirement and the entire corpus experiences growth through market-linked returns. It is an EEE instrument where the entire amount accumulated at maturity as well as the whole pension withdrawal amount is tax-free.

Read more about NPS Returns for Tier 1 & Tier 2

| Tier I Account | Tier II Account |

Out of the 60% withdrawn as lump sum, only 40% was tax exempted earlier. The remaining 20% was taxable as per the income tax slab of the subscriber. However, the government has extended tax benefits on the entire 60% withdrawn as lump sum at the time of maturity from FY 2020-21 as announced in the Union Budget 2019. This makes NPS a completely tax-free investment product.

Know more about NPS Tax Benefits

You can open an NPS account online.

In this online account opening process, you need your valid PAN, mobile number, Email ID, valid bank account and online payment option (either by net-banking or UPI) at your end.

If in case, your KYC is not available in CKYC registry, you will require your Aadhaar.

| To invest in NPS through Paisabazaar, Click Here |

| Already have an NPS account through us? For Subsequent Contribution, Click Here To Set up SIP, Click Here |

To login to your NPS Account, you are required to have an active NPS account i.e. PRAN (Permanent Retirement Account Number).

PRAN is a unique 12-digit number that identifies those individuals who have registered themselves under the National Pension System (NPS).

Once you have generated your NPS Account, you can visit CAMS NPS Portal – https://www.camsnps.in/ and login to your account.

In NPS Tier 1, the minimum initial contribution is Rs. 500. However, the minimum annual contribution to your NPS Tier 1 account is Rs. 1,000. There is no limit to the maximum annual contribution. The minimum amount per contribution is Rs. 500.

In NPS Tier 2, the minimum initial contribution is Rs. 1,000. There is no minimum or maximum annual contribution. The minimum amount per contribution is Rs. 250.

National Pension System is one of the cheapest investment products available with low charges. The Pension Fund Manager fee is capped at 0.01% compared to 2-2.5% for mutual funds. Other charges in the NPS are also very low as can be seen from the tables below:

| Charge Head | Service Charges* | ||||

| Private / Govt. | Lite/APY | ||||

| PRAN Opening charges | CRA charges for account opening if the subscriber opts for Physical PRAN card (in Rs.) | CRA charges for account opening if the subscriber opts for ePRAN card (in Rs.) | Rs. 15.00 | ||

| Welcome kit sent in physical | Welcome kit sent vide email only | ||||

| NCRA | 40 | 35 | 18 | ||

| CCRA | 40 | – | 18 | ||

| KCRA | 39.36 | 39.36 | 4 | ||

| Note: The reduction in charges will be on the current charge structure and excludes applicable taxes. Charges will be applicable post release of the functionalities by CRAs to capture the choice of NPS subscribers to have physical or ePRAN card. |

|||||

| Annual PRA Maintenance cost per account | NCRA: Rs. 69 CCRA: Rs. 65 KCRA: Rs. 57.63 |

NCRA: Rs. 20 CCRA: Rs 16.25 KCRA: Rs. 14.40 |

|||

| Charge per transaction | NCRA: Rs. 3.75 CCRA: Rs 3.50 KCRA: Rs. 3.36 |

Free | |||

| Intermediary | Charge Head | Service Charges* |

| POP (Point-of-Presence) | Initial subscriber registration | Rs. 400 |

| Initial/Subsequent contribution upload | 0.50% of the contribution amount from subscribers subject to a minimum of Rs. 30 and a maximum of Rs. 25,000 |

| Transaction Type | PG Charges (in Rs.) |

GST 18% (in Rs.) |

Total PG Charges (in Rs. including GST) |

| UPI | 2.50 | 0.45 | 2.95 |

| Internet Banking | 3.00 | 0.54 | 3.5 |

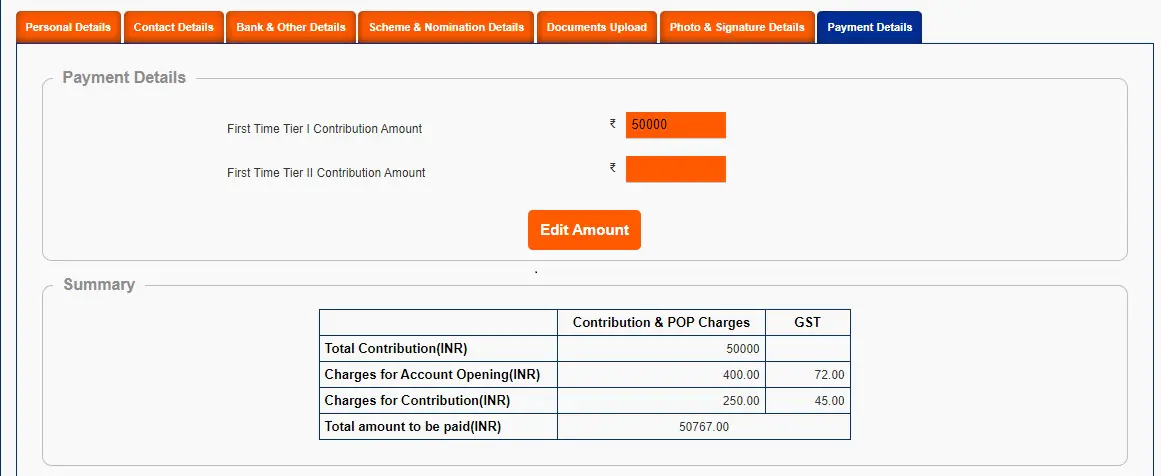

Here is a sample of charges when you make your NPS contribution:

| Service Standards for PoP-NPS and PoP-NPS-Online | NPS Fees & Charges | NPS Circular |

NPS Withdrawals

In case of an NPS Tier 2 account, there is no lock-in and hence there is no restriction on withdrawals. However, withdrawals from the NPS Tier II account are fully taxable at the slab rate.

You can also go for a premature exit after completing 5 years in the NPS. If you choose this option, you can withdraw only 20% of your accumulated corpus which will be exempt from tax. The balance 80% must be used to buy an annuity (regular pension).

The annuity will be fully taxable as per the tax slab. If the total corpus is less than Rs. 2.5 Lakh then 100% can be withdrawn as lump sum and this withdrawal will be exempt from tax.

If the subscriber wants to exit from the scheme, he/she will have to submit an online withdrawal request to the POP. The POP will process the withdrawal request by logging into the CRA portal.

Read more on NPS Withdrawal

NPS Calculator is a unique tool that you can utilise to estimate your future monthly pension and potential investment corpus created through deposits into the NPS account till retirement. NPS calculator typically features the following fields:

Under existing rules, a minimum 40% of NPS corpus is to be mandatorily used for the purchase of annuities. Higher the portion of NPS future corpus used for annuity purchase, greater will be the monthly pension that you will get.

This depends on the performance of your NPS funds. Your contributions invested in the National Pension System are invested in assets like equity or debt and earn returns. Your corpus is thus expected to steadily grow over time.

When you hit the age of 60, you can use the accumulated corpus to buy an annuity (monthly pension). The actual pension you get thus depends on the corpus size and the prevailing annuity rates.

For example, if your corpus is Rs. 1 Crore and the prevailing annuity rate for a simple annuity is 8%, you will get an annual payment of Rs. 8 Lakh. This translates to a monthly pension of Rs. 66,666.

Read more about NPS Calculator

You have to analyse the previous performance of the different pension fund managers. You can get data on this at http://www.npstrust.org.in/return-of-nps-scheme.

You can also change your NPS fund manager once in a financial year.

At present there are 11 fund managers who are managing the deposits of NPS subscribers to maximize returns:

National Pension System Benefits

National Pension System v/s Atal Pension Yojana (APY)

Atal Pension Yojana (APY) is also a pension scheme regularised by the Government of India primarily for the unorganised sector. Here is a tabular representation of the difference between NPS and APY:

| Parameters | NPS | APY |

| Type | Choice between Tier I and Tier II account | One account |

| Eligibility | Citizens of India & NRIs / OCIs | Residents of India |

| Age | Minimum – 18 years

Maximum – 70 years |

Minimum – 18 years

Maximum – 40 years |

| Investment Particulars | No maximum limit of investing | Predetermined monthly contributions |

| Minimum Investment | Rs. 500 per month | Rs. 42 (Monthly) or Rs. 125 (Quarterly) |

| Returns | Subject to contributions made and market movements | Pre-defined returns ranging from Rs. 1,000 to Rs. 5,000 |

| Withdrawal | Only Tier 2 subscribers are eligible for premature withdrawals as per designated rules | Premature Withdrawal can be executed in case of death of contributor or medical illness |

| Taxation Policy | Tax rebate of up to Rs. 2 Lakh | No benefits |

| Government Contribution | No Government contribution | Monetary contribution by the Govt. |

National Pension System v/s LIC Pension Yojana (LPY)

LIC Pension Plan is a unit-linked deferred pension plan which provides the subscribers a minimum guarantee on the gross premium paid. Let us have a look at the major differences between NPS and LPY:

| Parameters | NPS | LPY |

| Age | Minimum – 18 years

Maximum – 70 years |

Minimum – 30 years Maximum – 85 years |

| Eligibility | Indian Citizens and NRIs / OCIs | Indian Citizens |

| Returns | Not Guaranteed | Assured Returns |

| Taxation | Tax benefits under Section 80 CCD and 80 C | Tax Benefit under 80 C only |

| Contributions | No upper limit Minimum – Rs. 500 per month (Tier I) and Rs. 250 (Tier II) |

No maximum limit Minimum – Rs.1.5 Lakh |

| Premature Withdrawal | 60% withdrawal after retirement only. At least 40% corpus must be kept invested for regular pension | Withdrawal can be initiated after completion of 3 months of insurance of policy or expiry of the ‘Free-look’ period |

| Loan | Not possible | Can be availed after 1 year |

National Pension System v/s Voluntary Provident Fund (VPF)

Voluntary Provident Fund is a saving scheme listed under Provident Funds. Under this, the employee decides on a fixed contribution made monthly towards the Fund. Here is a comparison table for NPS and VPF:

| Parameters | NPS | VPF |

| Eligibility | Indian Citizens and NRIs | Salaried Individuals |

| Contribution | No upper limit Minimum – Rs. 500 per month (Tier I) and Rs. 250 (Tier II) |

Voluntary (Up to 100%) |

| Interest Rate | Return in not interest-based | 8.75% per annum |

| Withdrawals | 60% withdrawal after retirement only. At least 40% corpus must be kept invested for regular pension | Partial withdrawals available |

| Taxation Policy | Tax benefits under Section 80 CCD and 80 C | Exempted from tax payments |

| Asset Allocation | Different asset classes – Equity, Corporate Bond, Government Securities and Alternate Investment Fund | Debt Securities |

Old Pension Scheme (OPS) was introduced by the Government of India to provide pension benefits to government employees. The scheme was later replaced by the National Pension System in 2004 which works for all Indian citizens and NRIs:

Retirement gratuity providedRetirement, death and service gratuity are provided

| Parameters | NPS | OPS |

| Returns | Depends on contributions made and Market Movements as it is a market-linked scheme | Pre-defined regarding the number of years of service and salary |

| Contributions | No upper limit Minimum – Rs.500 per month (Tier I) and Rs. 250 (Tier II) |

No contribution is made as this scheme works under a pre-defined module of pension provision after retirement |

| Tax Benefits | Tax benefits under Section 80 CCD and 80 C | Lump sum amount received on commutation of pension is exempted from tax |

| Gratuity | Retirement gratuity provided | Retirement, death and service gratuity are provided |

The amount deposited by the customer will be displayed in his/her NPS account within T+3 working days, where T is payment clearance date.

The contact details of NPS grievance redressal officer are as follows:

Name– Ms. Jyotsna Popli

Email– npsgrievanceofficer@paisabazaar.com

Phone– 1800-258-5615

Calling time: 9:30 AM-6:30 PM

To know more about NPS Grievance Redressal Mechanism, click here

Ans:In case the PRAN of the subscriber is frozen or inactive at the time of withdrawal, the request will be processed like a regular withdrawal.

Ans: Subscribers have to make at least one contribution per year to keep their account in running or active mode. The account may be frozen if certain contribution requirements are not met. To unfreeze the account, the subscriber has to make the required contribution. The contribution requirements for each type of account are mentioned here.

| For all Citizens | Tier I Accounts | Tier II Accounts |

| Min. Contribution for Account Opening | Rs. 500 | Rs. 1,000 |

| Min. Amount per Contribution | Rs. 500 | Rs. 250 |

| Min. Total Contribution Annually | Rs. 1,000 | None |

| Min. Frequency of Contributions | 1 per year | None |

Ans: Yes, both NRI and OCI can open NPS accounts.

Ans: Yes, you can invest in both NPS and APY. There is no bar to this.

Ans: Absolutely. There is no rule against investing in multiple retirement programmes.

Ans: Subscribers are required to declare the nominations at the time of the PRAN registration process. However, they can also file a subsequent nomination update request for subsequent nomination.

Ans: In the event of the death of the subscriber, the nominee will receive the entire accumulated pension wealth. If the subscriber has not declared a nominee then it will go to the legal heir of the subscriber. In both the cases, there would not be any requirement for purchasing an annuity or a monthly pension plan.

Ans: No. You can only make partial withdrawals from the NPS account up to 25% of your contributions. This can only be for specific reasons like children’s marriage or education. Unemployment is not a valid ground for withdrawal.

Ans: Yes, you can do this three years after account opening. You can make partial withdrawals for specified purposes up to 25% of your contributions. Such partial withdrawals can only be made up to three times in your entire tenure in the NPS. The withdrawals can be for:

Ans: The National Pension System has a lock-in for a period of five years from account opening. Thereafter you can go for ‘premature exit’ from the National Pension System even before the age of 60. However you have to mandatorily use 80% of their corpus to buy an annuity and can only withdraw 20%. This 20% withdrawal will be exempt from Tax. An annuity is a fixed payment you get for the rest of your life. It can be taken monthly and becomes a monthly pension.

Ans: You can contact CAMS CRA customer care through toll free no. 1800-572-6557 or raise your grievance by login in to your NPS account and you can reach out to your POP.

Ans: The scheme does not offer a fixed interest rate. However, the rate of interest is apparently higher than the ROI offered by many other saving schemes.

Ans: It depends on your risk appetite. If you are not sure of it, simply select an NPS lifecycle fund. These funds will automatically set your asset allocation according to your age and rebalance it every year.

The early policy of General Provident Fund (GPF) has been replaced by NPS (National Pension System). The GPF was made available only for Government employees before January 2004. However, NPS is now available for all the Indian citizens. This makes the government employees not eligible for EPF (Employee Provident Fund)

NPS is a benefit given to individuals after retirement wherein the individual subscribing to the same gets an option to choose from various asset classes. Government Subscribers can invest up to 50% of the total investments in equity under Scheme E of NPS. There are two investment options available for the Government subscribers- Active and Auto. NPS gives inflation adjusted returns against the investments made by them in equity.

July 08, 2019

The Union Finance Minister, Nirmala Sitharaman, in her maiden budget speech 2019 has given Exempt-Exempt-Exempt (EEE) status in terms of tax treatment to the National Pension System (NPS) scheme. It means that 60% of the NPS corpus which can be withdrawn at the time of retirement would be entirely tax-free.

Earlier, only 40% of the lump sum withdrawn was exempted from tax, rest 20% was taxed as per the Income Tax Slabs. The move was much-awaited and makes NPS scheme at par with other long term small saving schemes such as Public Provident Fund (PPF)

Therefore, as per the latest rules, an NPS subscriber can avail to tax benefits on NPS contributions upto Rs. 1.5 lakh u/s 80C of the Income Tax Act, 1961. Further, the interest credited to your NPS account is also tax exempt and the 60% of the corpus withdrawn in lump sum at the age of 60 would also be tax-free.