Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

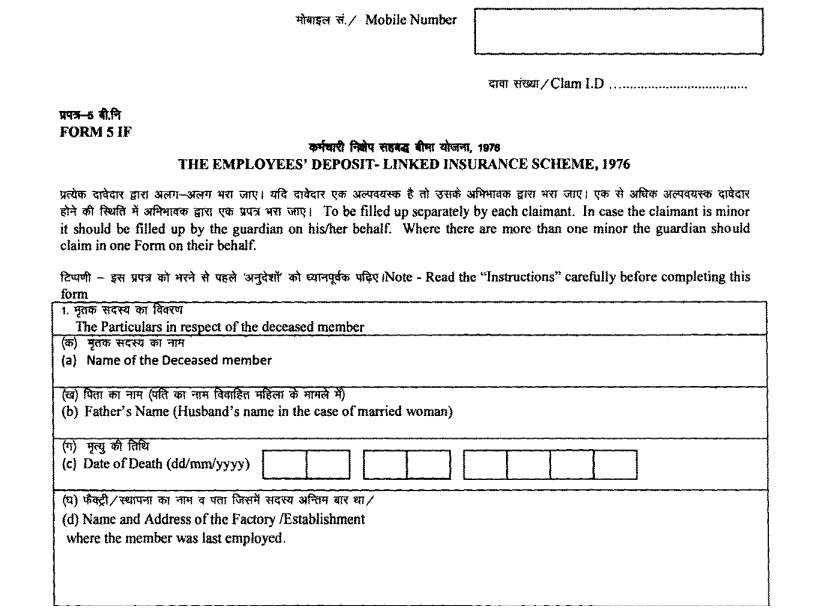

All members of EPFO covered under Employees’ Provident Fund (EPF) Scheme are automatically enrolled for EDLI. Family members/nominees/heirs get insurance benefits in case of death of an active contributing member of the EPFO. Each and every beneficiary has to fill EPF Form 5 IF to claim insurance benefits of up to Rs. 7 Lakhs.

Don’t Know your Credit Score? Now Get it for FREE Check Now

EPF Form 5 IF is filled by nominees/family members/legal heirs to claim insurance benefits after the death of an active EPFO member. It is worth mentioning that the service can be availed only when the member has died while in service. If he is no longer working at an EPF registered firm (one with 20 employees or more), his survivors will not be eligible for EDLI benefits.

| EPF Form | Form 5 IF |

| Purpose | EDLI Insurance Benefits of up to Rs. 7 Lakh |

| Link | https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form5IF.pdf |

| Eligibility | The employee should be an active EPF member at the time of his death |

| How to Fill | The form has to be filled offline and submitted to the EPF Commissioner’s Office |

| When is it Filled | After the death of the active EPF member |

| Employer Attestation | Mandatory |

| Document | Death Certificate of the member is mandatory |

EPF Form 5 IF has to be filled offline and submitted to the regional EPF Commissioner’s office after attestation (by the claimant) to claim insurance benefits after the death of the active member. The form has the following sections which have to be filled by each and every beneficiary separately:

EPF Form 5 IF has to be filled offline and submitted to the regional EPF Commissioner’s office after attestation (by the claimant) to claim insurance benefits after the death of the active member. The form has the following sections which have to be filled by each and every beneficiary separately:

Mobile Number – The mobile number should be filled by the beneficiary to get instant alerts about the status of the claim

Claimants, as well as the employer, have to sign the application form in the space provided.

The form has to be submitted to the EPF Commissioner’s office and the commissioner has to settle the claims within 30 days. If the claim is not settled within the stipulated time-frame, the commissioner has to pay an interest of 12% per annum from the 31st day to the date of actual disbursal.

Following documents have to be submitted by the claimants to avail the benefits of the EDLI scheme:

Don’t Know your Credit Score? Now Get it for FREE Check Now

Read More : How to Check Your EPF Balance and Status Online?

Following persons are eligible to fill the EPF Form 5 IF to claim insurance benefits in the event of the death of an active contributing member:

Read More: Employees’ Provident Fund (EPF): Schemes, Eligibility, Interest Rate, eKYC & Benefits

The claimant has to get the form attested by the employer under whom the member was working at the time of his death.

There may arise a situation where the establishment gets closed and no officer is authorized to attest the claim form. In such situations, the member has to get the form attested by any one of the following authorities:

A claimant has to keep the following points in mind at the time of filling the EPF form 5 IF:

The form has to be submitted to the EPF Commissioner along with the required proof