Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

To get advance from your EPF, you need to submit EPF Form 31 which can be easily downloaded from the EPFO website. Here you will know how to download EPF Withdrawal Form 31, how to fill the claim form, check EPF Form 31 claim status and more.

Get your Free Credit Score with Monthly Updates

Let’s Get Started

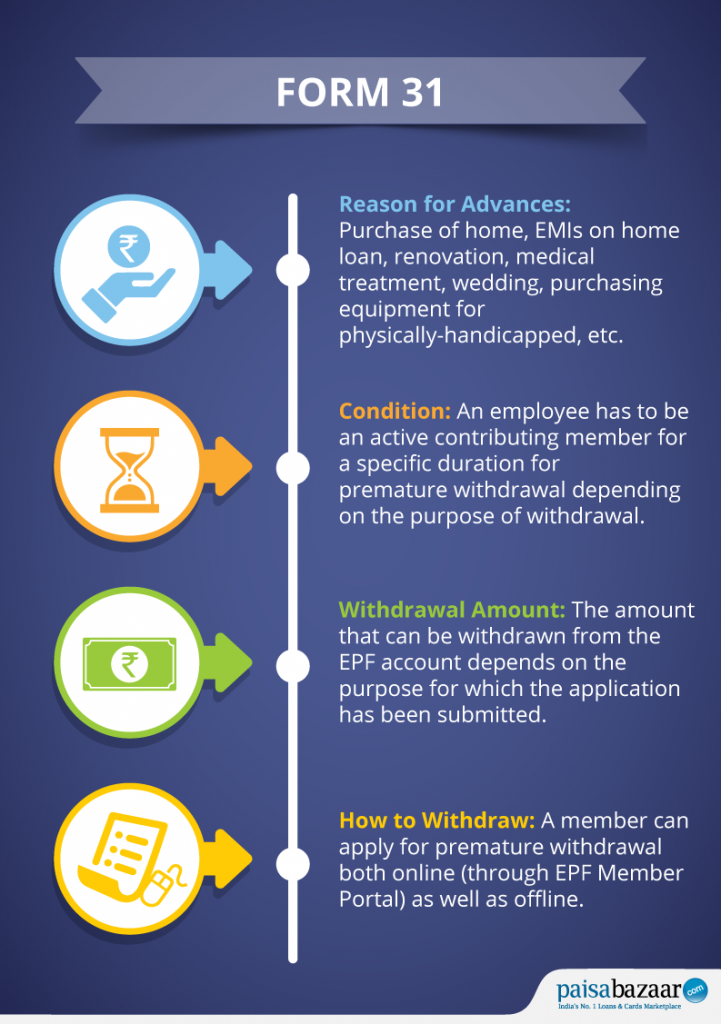

The entered number doesn't seem to be correct

Enabling savings amongst the working class in the country, the government of India came up with the Employee Provident Fund (EPF) wherein a fixed amount is transferred from the employee’s and the employer’s salary account to the employee’s PF account. Employees’ Provident Fund (EPF) helps employees build a corpus for their retirement. However, this corpus can also be utilized to meet various requirements during the employment period. Under certain conditions, members can even apply for partial withdrawals from their PF account by submitting EPFO Form 31 – Application for Advance from the Fund.

| Note: EPF Form 31 has been replaced with EPF Composite Claim Form. To know more about EPF Composite Claim Form, click here. |

Table of Contents:

| EPF Form No. | Form – 31 |

| Purpose | Application for Advances (partial withdrawal) from EPF |

| Link | https://epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form31.pdf |

| Mode of Filling | Both Online and Offline |

| Additional Requirements | Relevant documents have to be submitted |

| Reason for Advances | Home loan, medical requirement, wedding, etc. |

EPF Form 31 can be filled online as well as offline. The employee has to manually fill his details in the form while applying offline, whereas, if the employee fills the EPF withdrawal Form 31 online, most of his/her details will be auto-filled. However, the member has to register his UAN to avail the online service.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

EPF Form 31 is used to make declaration for partial withdrawal of your EPF corpus that has been otherwise reserved for the purpose of retirement. It must be noted that partial withdrawal from EPF is allowed only certain specific conditions such as purchase/construction of home, repayment of home loan, medical emergencies, wedding of self/sibling/child, or education of child/sibling. However, certain eligibility conditions must be met in order to be eligible for the application of such withdrawal.

The form serves as a proof of the fulfillment of the purpose of withdrawal and must be filled and signed duly by the employee. Certain sections of Form 31 need to be filled in by the employer and the EPF commissioner as well, apart from the details filled in by the employee himself. It is of utmost importance that the information provided in the form is up to date and stands true, and must be submitted along with the relevant documents required.

For EPFO Claim Online Form 31 download, you need to follow the steps given below-

For physical submission, you can download the EPF Form 31 from the EPFO website, fill up the necessary details and submit the form at your respective jurisdictional EPFO office after getting it attested by your employer.

As you download the EPF Form 31, you will be required to fill certain details yourself. The remaining details need to be filled in by your employer and the EPF Commissioner.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Also read : EPF Forms: Complete List of Employee PF Forms

Also Read: EPF Withdrawal: How to Fill PF Withdrawal Form and Get Claim Online

The following documents have to be produced along with Form 31 depending on the purpose of EPF withdrawal :

| Documents for EPF Withdrawal | |

| Purpose of EPF Withdrawal | Document Required |

| Buying a House | Declaration, Registration certificate of the property |

| Repayment of Loans | Outstanding principal and interest certificate by the lending agency |

| Grant of Advances in special cases | Certificate from the Employer |

| Medical Illness | Certificate by the employer and the doctor |

| Marriage | Declaration to be done in Form 31 itself |

| Physically handicapped | Certificate from the concerned doctor |

| Withdrawal before Retirement | Declaration by the Member |

Employees can withdraw the amount from PF account as an advance for the following purposes through Form 31:

Here’s how you can check EPF Form 31 claim status-

Get FREE Credit Report from Multiple Credit Bureaus Check Now

The EPF Claim Form 31 can get rejected due to any of the following reasons-

The online application of the withdrawal process may take around 5-30 days to get the PF amount in your registered bank account.

The amount you can withdraw from your PF corpus or Form 31 PF withdrawal limit depends upon your reason for withdrawal and the time period you have been in service.

Once you have applied for PF withdrawal and submitted Form 31, you are not allowed to cancel your application. You may contact the EPFO Regional Office in case of urgent situations.

‘Under process’ implies that your application is still in consideration and that it is being processed. In such cases, you must keep a check on your claim status till it gets approved and states that ‘your claim has been settled’.

You can withdraw your PF 2-3 times on a non-refundable basis, at a minimum gap of 6 months between the loans. However, you can only withdraw once for one specific reason.

It generally takes around a couple of weeks to process the application and transfer the funds.

No, EPF Form 31 can only be used for partial withdrawal. To withdraw your entire EPF corpus you need to fill up EPF Form 19. However, both these forms have now been replaced by a combined EPF Composite Claim Form.

EPF Form 31 can only be used for partial withdrawal from your EPF account. To withdraw your money from your EPS account, you need to submit Form 10C.

Yes, TDS will be deducted at a rate of 10% withdrawal is made within the initial 5 years of service and if the withdrawal amount is more than Rs. 50,000. However, in case you fail to provide your PAN details, TDS will be deducted at a rate of 30%.

Yes, partial withdrawal can be made while you are still employed, provided you meet the eligibility criteria.

You can send an email to employeefeedback@epfindia.gov.in. or call on the EPFO toll-free number 14470.