Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Adding a nominee to your PF account ensures that the designated person is able to withdraw the money in case any mishap happens to the member. Read the complete article to know more about PF nomination form/e-nomination including how to fill EPF Form 2 (Revised), how to avail EPF Form 2 online, nomination, how to submit and more.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Employees’ Provident Fund (EPF) is a form of a social security scheme in which members must contribute a portion of their salary and the employer also contributes into this fund on behalf of workers. Each and every employee has to submit a declaration and nomination under the Employees’ Provident Fund Scheme, 1952 and Employees’ Pension Scheme, 1995. The employee has to file a nomination through the EPF Form 2 so that the nominated person gets the fund accumulated in the account in case of unfortunate death of the employee.

Note: EPF members can now add/update/change their nominations online on their own using the e-nomination form via the EPF member portal. Earlier nominations were made using EPF Form 2, which the employer would submit offline to EPFO.

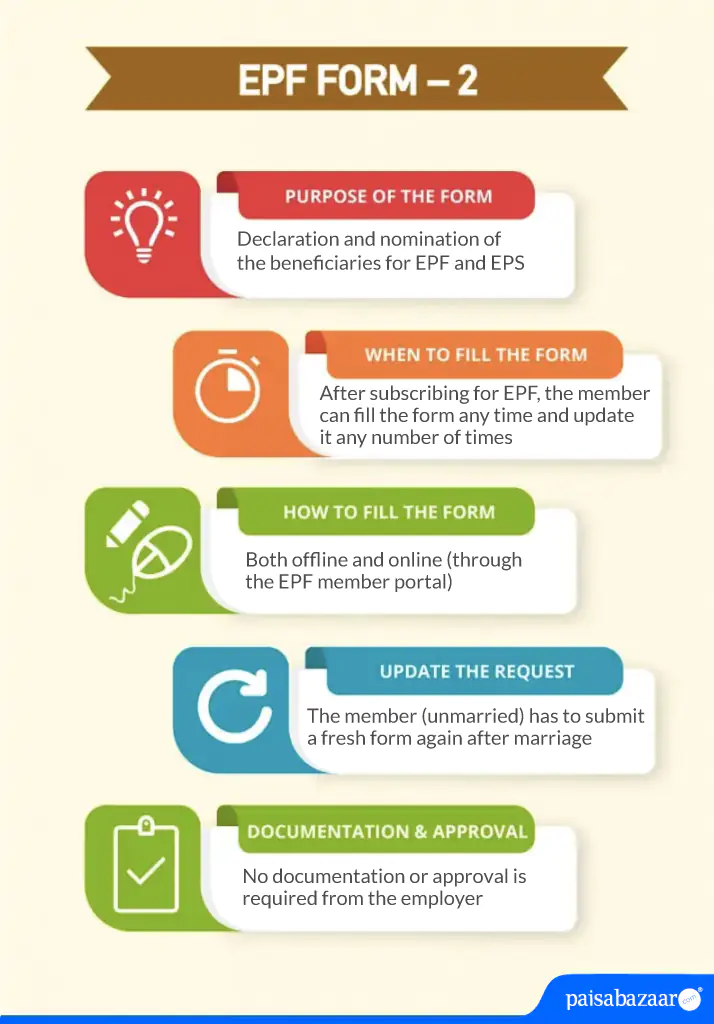

| EPF Form No. | Form – 2 |

| Purpose | Declaration and Nomination of the beneficiary |

| Download Link | https://goo.gl/Vvg4JT |

| When to Fill | Any time after getting enrolled in the scheme |

| How to Fill | Both online and offline facilities are available |

| Update Required | After marriage, the form has to be filled again |

| Submission Limit | There is no limit and the member can change his nominations as many times as he wants. |

| Documents | No additional documents required |

| Approval | No approval required from the employer or the PF Commissioner |

Don’t Know your Credit Score? Now Get it for FREE Check Now

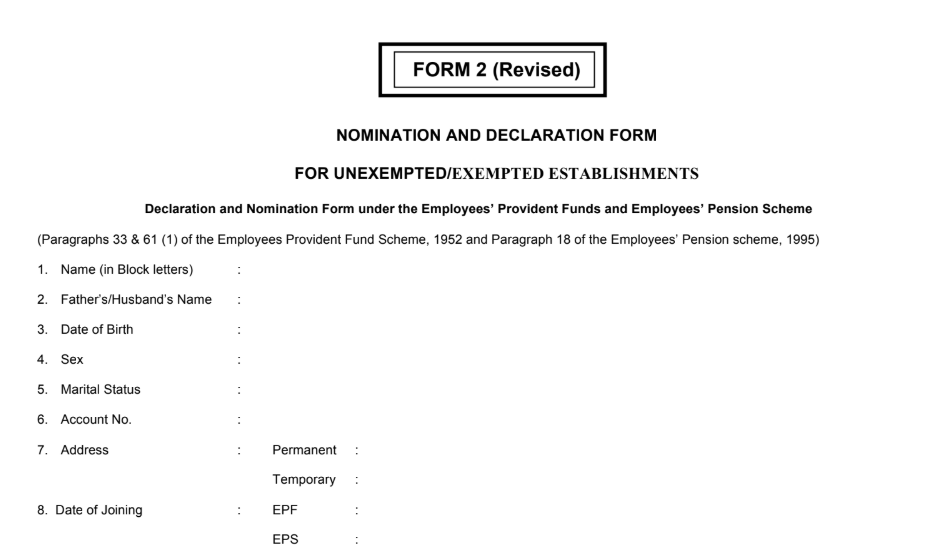

EPF Form 2/PF nomination form has four sections, namely – General Information, Part – A (EPF), Part– B (EPS) (Para–18) and Certificate by the Employer.

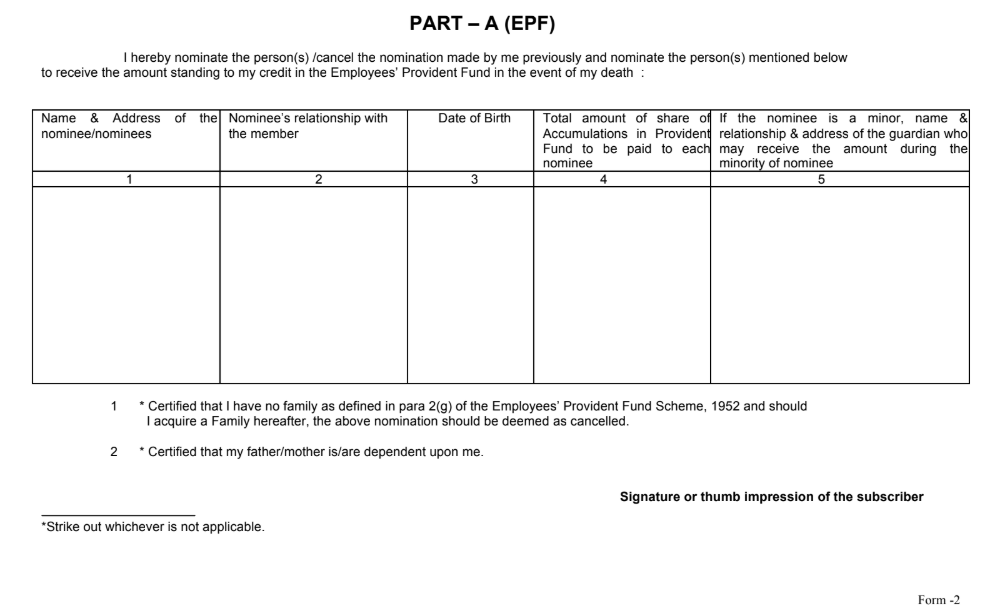

In this section, EPF account holder is to give information about the nominee whom he or she would like to nominate to receive EPF account balance in case of his or her death. Following details have to be provided in this section:

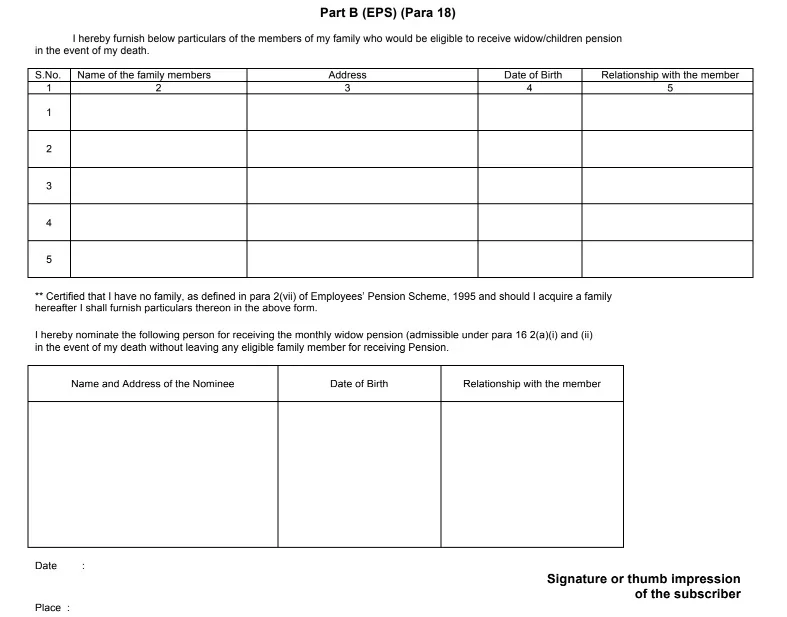

EPS is the abbreviation for Employees’ Pension Scheme. 8.33% out of 12% of employer’s contribution in EPF is deposited in the EPS account of the member. The EPS proceeds of a member’s PF account is also disbursed to eligible nominees. This section requires you to furnish details of the family member(s) eligible to receive the pension. The member has to mention following details in this section:

In case of nomination for monthly widow pension (admissible under Para 16 2(a) (i) and (ii)), the member has to give detail such as:

The employer has to certify the details mentioned in the form and has to mention following details in the form:

Also Read: EPS

Don’t Know your Credit Score? Now Get it for FREE Check Now

A member who has already registered his UAN at the unified EPF Member Portal can fill his e-Nomination online. In case you have not registered at the EPF member portal, you will have to first activate your UAN and then follow these simple steps for e-Nomination:

A married employee with his or her parents and those who are dependent on the employee or without parents can nominate one or more family members. A member has to keep following points in mind while nominating the family member(s) through Form – 2:

In Employees’ Provident Fund Scheme

A family is defined in the Employee’s Provident Fund Scheme as:

In Employee’s Pension Scheme

A family is defined as:

Making PF nominations helps the nominated person get the fund accumulated in the PF account in case of the unfortunate demise of the EPFO member.

EFP Form 2 is the nomination and declaration form that an employee can fill any time after getting enrolled into the EPF scheme.

EPF Form 2 has four sections which require the employee to provide his general information, EPF and EPS related details along with a certificate by the employer.

In case EPF Form 2 is not submitted, the member would not have a clear nominee. Moreover, in case of the employee’s unfortunate demise, the entire accumulated corpus would be paid to the family members in equal shares or to the people who are legally entitled to it if there are no eligible family members.

The main purpose of EPF Form 2 is to have a clear declaration and nomination of the beneficiary who would receive the entire corpus in case the EPF member passes away before collecting the pension.

No, additional documents are required to fill EPF Form 2/PF Form 2.

No, EPF Form 2 needs to have a certificate by the employer and can be only be submitted to EPFO by the employer. However, you can now also file your e-nomination online by logging into the EPF member portal.