Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

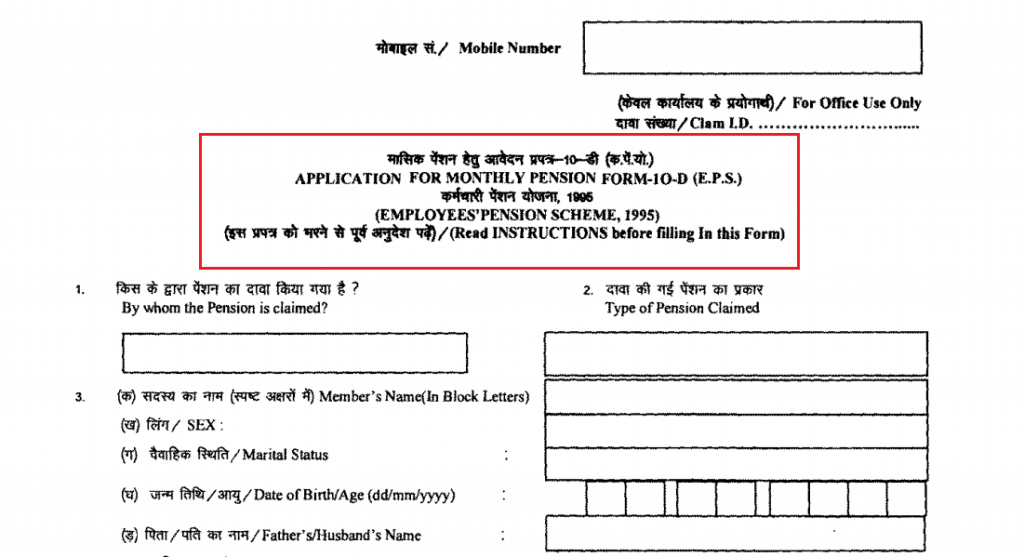

Want to withdraw your pension after retirement at the age of 58 years or a reduced pension after you turn 50 years old? Find out how and when to submit EPF Form 10D or Form 10D in EPFO, how to apply for EPF pension online, pre-requisites to submit the form and more below.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

All members of EPFO are automatically enrolled in the Employees’ Pension Scheme (EPS). Under this scheme, a member becomes eligible for a pension after retirement at the age of 58 years. However, a member can opt for a reduced pension after 50 years at a discounted rate of 4% each year. The member can apply for a monthly pension by filling EPF Form 10D. The pension amount that a member receives on retirement depends on the monthly pensionable salary and the total pensionable service.

| EPF Form | Form 10D |

| Purpose | Pension withdrawal after retirement |

| Link | https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form10D.pdf |

| Eligibility | Retirement (58 years) or after 50 years of age (reduced pension) |

| When to Fill | After retirement |

| Where to Submit | To be submitted to the EPFO through the establishment |

| How to Fill | Offline |

| Who has to Fill it | The employee or nominee (in case of death of the employee) |

Don’t Know your Credit Score? Now Get it for FREE Check Now

EPF Form 10D can be filled offline only and the member has to mention the following details in the form:

Mobile Number – To get status updates from time to time.

1) By whom is the pension claimed

The applicant has to mention any one of the following in this field:

2) Type of pension claimed

3) Member Details

4) EPF Account Details

Read More: Employees’ Provident Fund (EPF): Schemes, Eligibility, Interest Rate, eKYC & Benefits

5) Name & address of the Establishment in which the member was last employed

6) Date of leaving the service (dd/mm/yyyy)

7) Reason for leaving the service

8) Address for communication

9) Option for commutation of 1/3 of Pension

10) Option for Return of Capital. (Put a tick)

11) Mention nominee for Return of Capital

12) Particulars of Family

13) Date of the death of Member (if applicable)

14) Details of Bank Accounts Opened

15) Detail of Scheme Certificate already in possession of the member, if any

If the Scheme Certificate is received, indicate:

16) If the pension is being drawn under E.P.S, 1995, mention

17) Documents enclosed (Indicate as per the Instructions)

The applicant has to certify the details by signing the form and getting it signed by the employer as well.

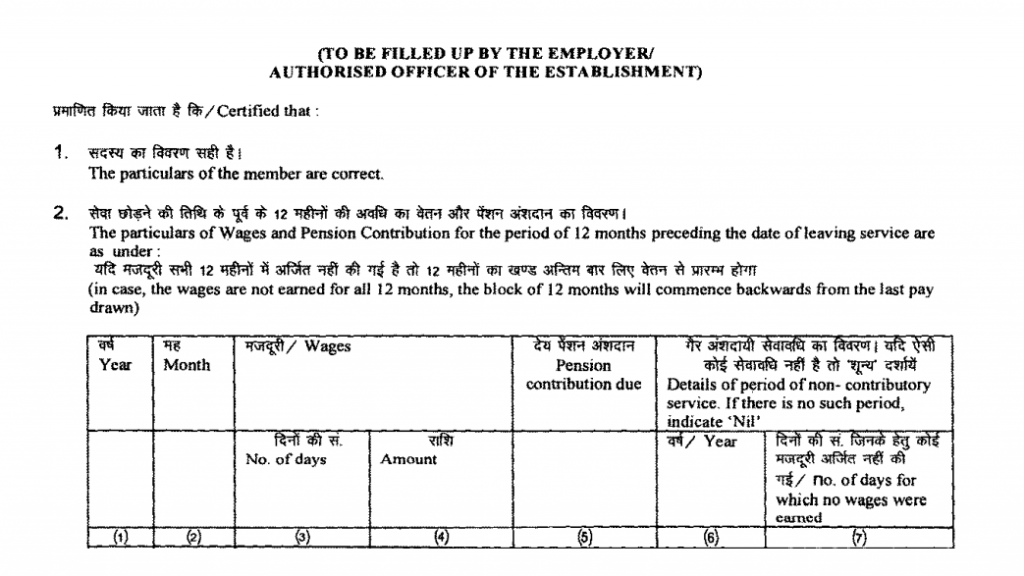

Employer Section of the EPF Form 10D

(to be filled up by the employer/authorised officer of the establishment)

The employer has to certify the details mentioned by the applicant.

The employer has to certify the details mentioned by the applicant.

Following details also have to be filled by the employer in the table of Section 2:

Don’t Know your Credit Score? Now Get it for FREE Check Now

The application form can be transmitted via any of the following ways:

Only EPF members, the widow or widower, orphan, guardian, nominee or dependent parents can make a claim using EPF Form 10D/Form 10D in EPFO.

Retired individuals have the option to receive their capital amount in lump sum, that is, up to 30% of the pension corpus and then draw a monthly pension from the remaining corpus.

Yes, your employer needs to verify your details by signing the form 10D for pension claim.

It generally takes up to 30 days for settling the pension to the beneficiary from the date of application submission.