State Bank of India, the country’s largest bank, offers a range of services that can be availed by its customers both online and offline. Be it deposits or withdrawals, financial or non-financial transactions, SBI has made ample provisions for its customers. SBI NEFT service allows account holders to transfer funds from one account to another quite easily.

SBI Fund Transfer

SBI has made provision for account holders to transfer funds through various methods. An account holder can follow any of the following methods for transferring funds online:

NEFT full form is National Electronic Funds Transfer. It is an electronic fund transfer service through which an account holder can transfer funds from the bank account to another account in SBI or any other bank account, make credit card payments, pay bills, etc.

How does SBI NEFT Work

SBI NEFT works on the Deferred Net Settlement basis in which the payment is settled in half-hourly batches. Transactions made once are settled in the next batch automatically. NEFT is available 24x7x365 days.

Check FREE Credit Report from Multiple Credit Bureaus Check Now

Benefits of SBI NEFT Service

- No minimum or maximum limit for fund transfer under NEFT

- It is cost-effective

- Offers a safe and efficient NEFT experience for customers

- Can be done online through mobile banking or netbanking

Limitations of SBI NEFT Service

- One of the major limitations of doing fund transactions via NEFT is that payments are settled in batches and it may take up to 30 minutes to complete the transaction as opposed to UPI, RTGS or IMPS where funds are settled immediately.

- A payer has to add a beneficiary before making payment to a new account. It may take from 6 hours to 24 hours before you can make payment using NEFT to a new account.

- You have to pay a fee for making NEFT transaction which is not there in the case of UPI transactions.

NEFT Fund Transfer from SBI Account to another SBI Account

You have to follow the following steps for NEFT fund transfer funds from one SBI account to another SBI account:

- Login to your SBI Netbanking account

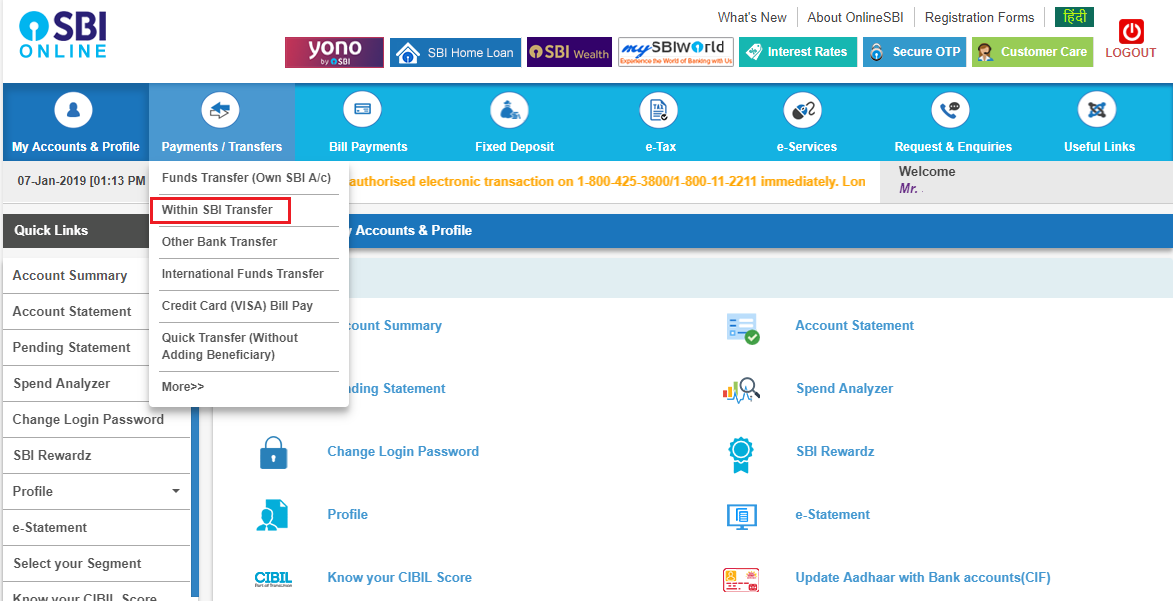

- Select “Within SBI Transfer” option from the “Payments/Transfers” drop-down menu

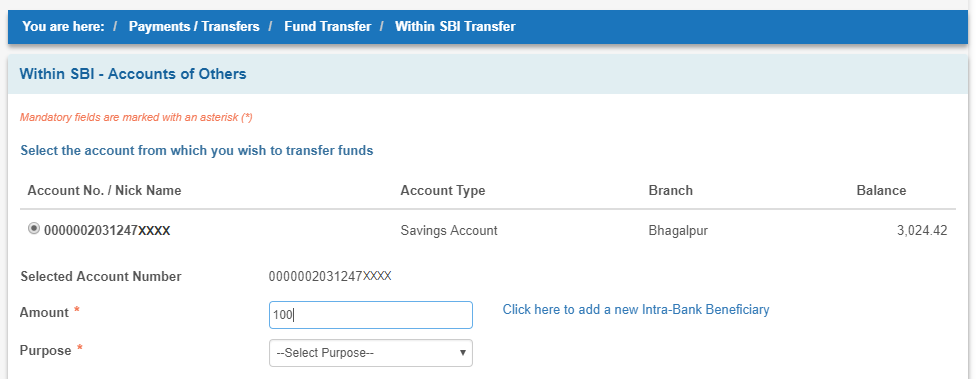

- Select your account number, enter the amount and purpose of fund transfer

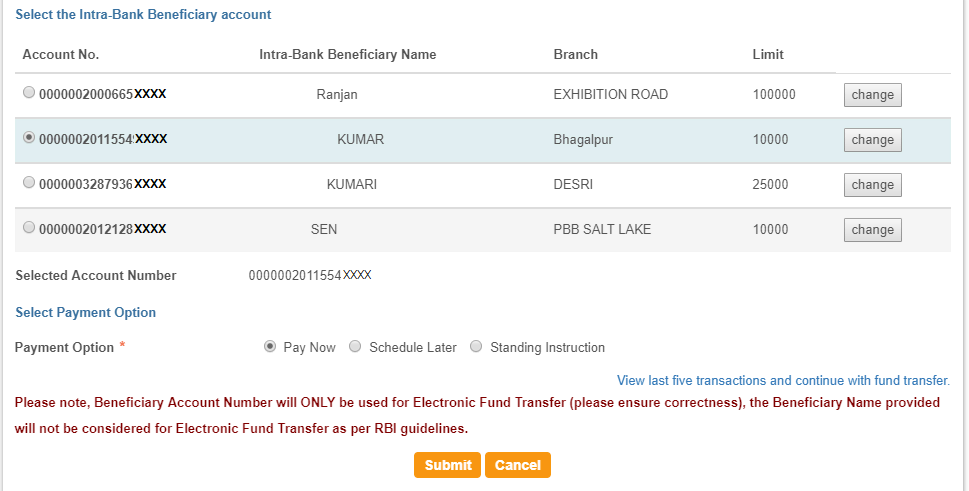

- Select the beneficiary account number, enter the payment schedule and click on the “Submit” button

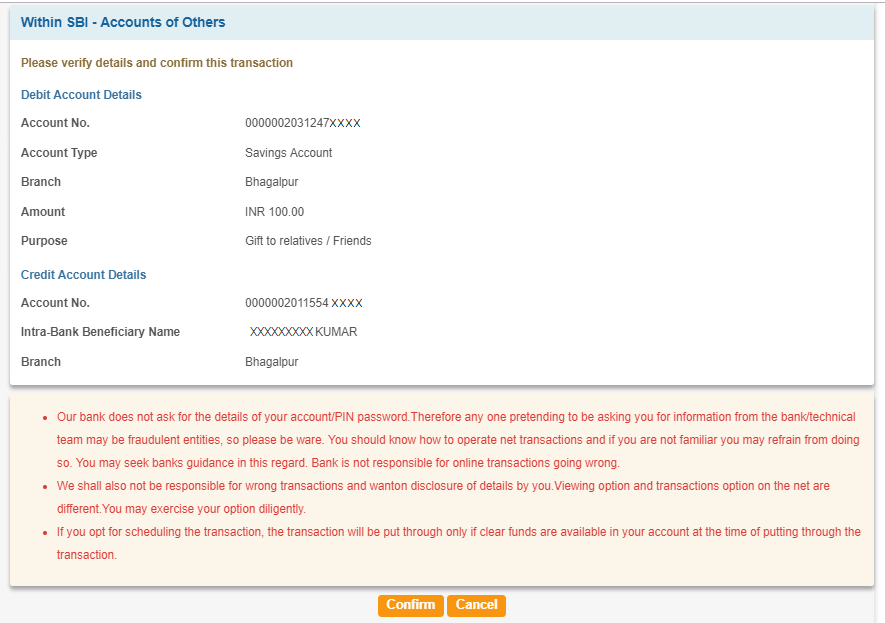

- Check the details and click on the “Confirm” button

Your fund will be transferred to the beneficiary’s account and a confirmation will be displayed on the screen.

Check FREE Credit Report from Multiple Credit Bureaus Check Now

How to transfer funds to another bank account through SBI NEFT

SBI allows its account holders to transfer funds through online banking to bank accounts other than SBI accounts as well. You can follow the steps mentioned below to transfer funds easily to other bank accounts through SBI NEFT:

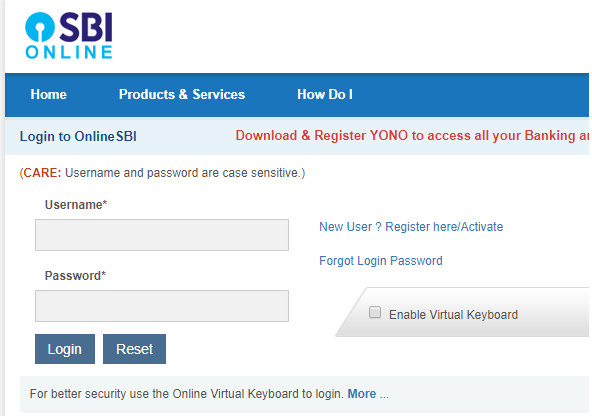

- Visit SBI internet banking login portal at https://retail.onlinesbi.com/retail/login.htm

- Enter your “Username” and “Password” and click on “Login”

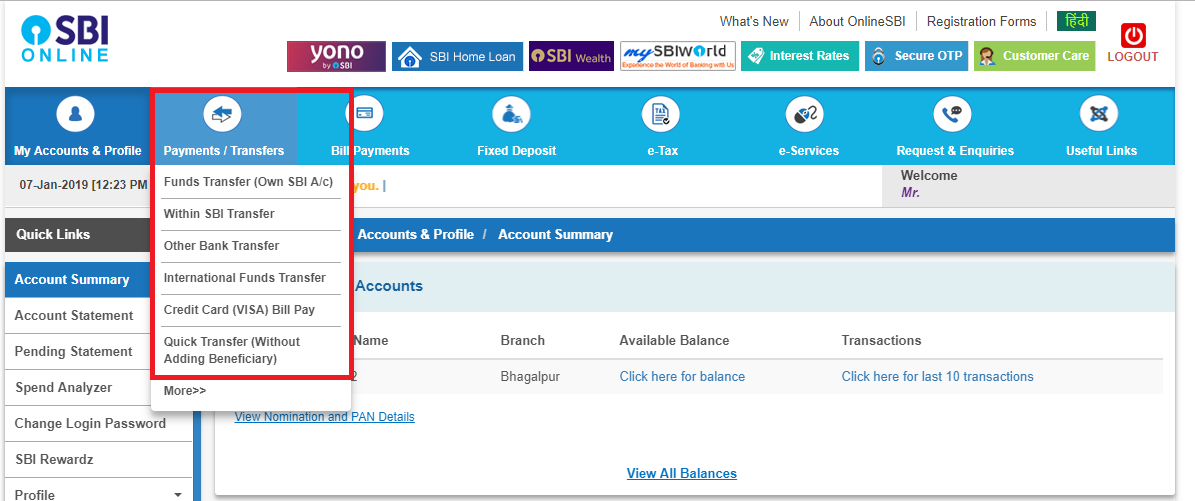

- Select “Other Bank Transfer” from “Payments/Transfers” drop-down menu

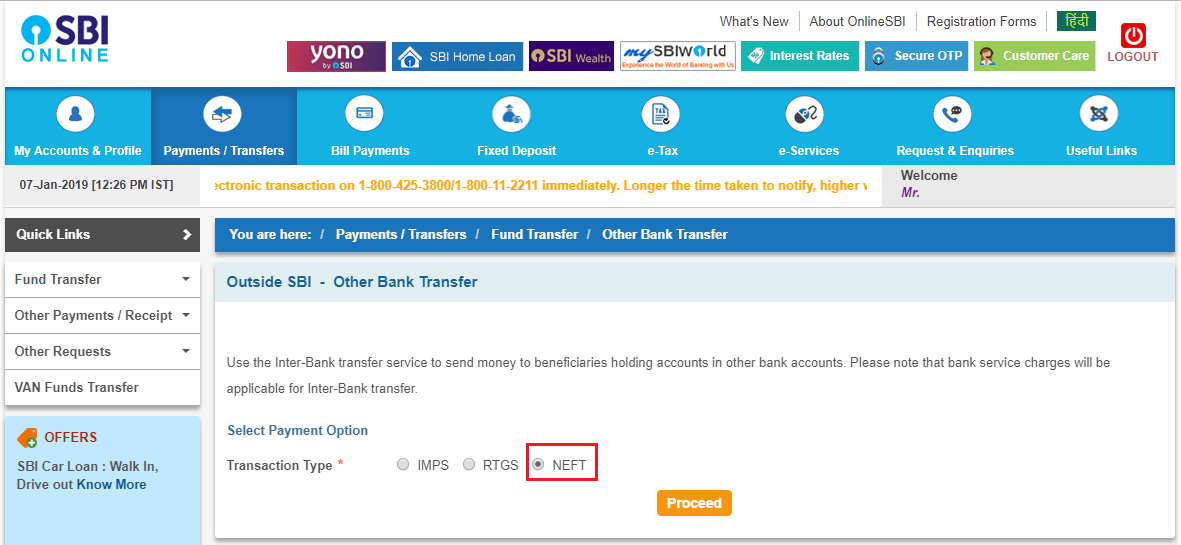

- Tick on NEFT and click on “Proceed”

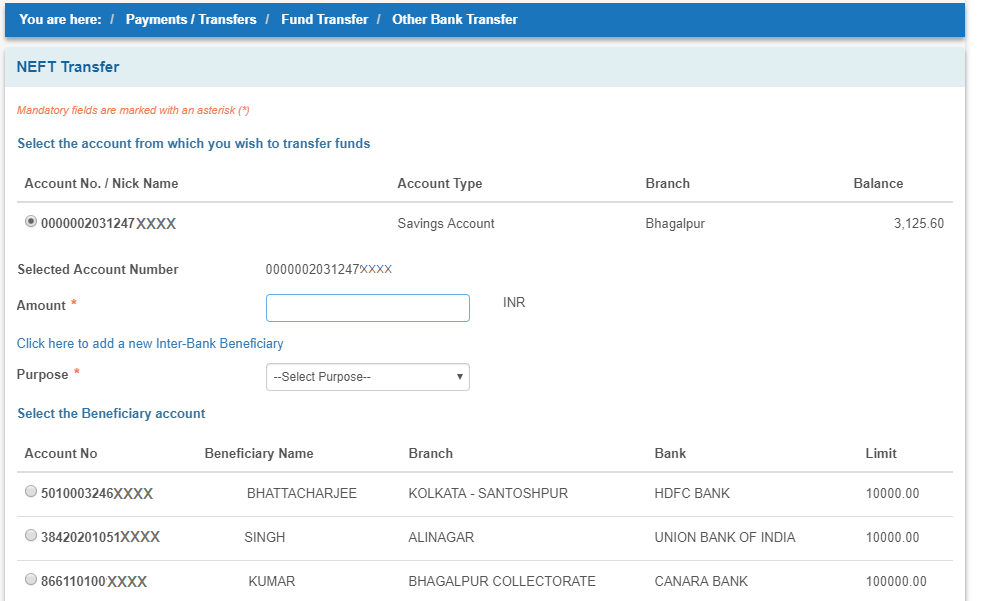

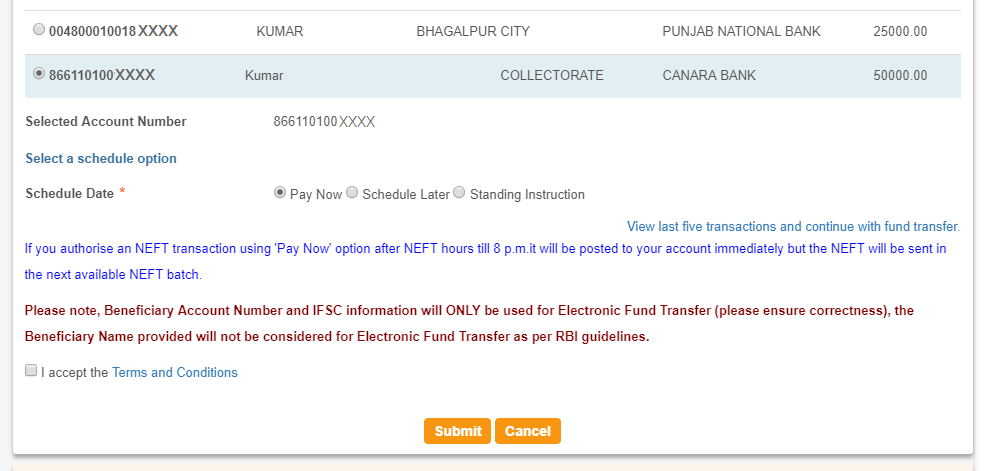

- Select the account number from which the fund has to be transferred. Enter the amount, purpose of the fund transfer and tick on the beneficiary account number

- Select the scheduled date of fund transfer, tick on “Terms and Conditions” and click on “Submit”

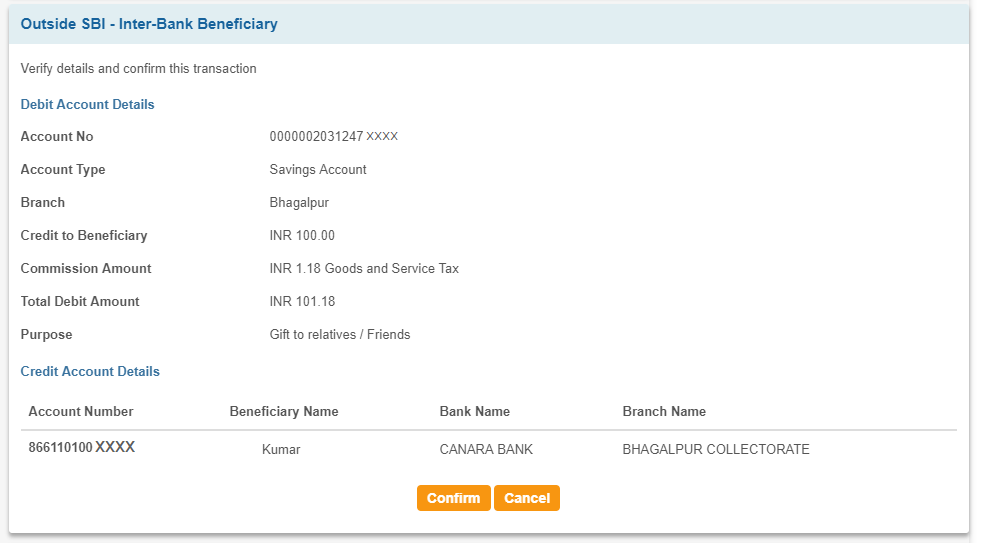

- Confirm the entries and if correct, click on the “Confirm” button

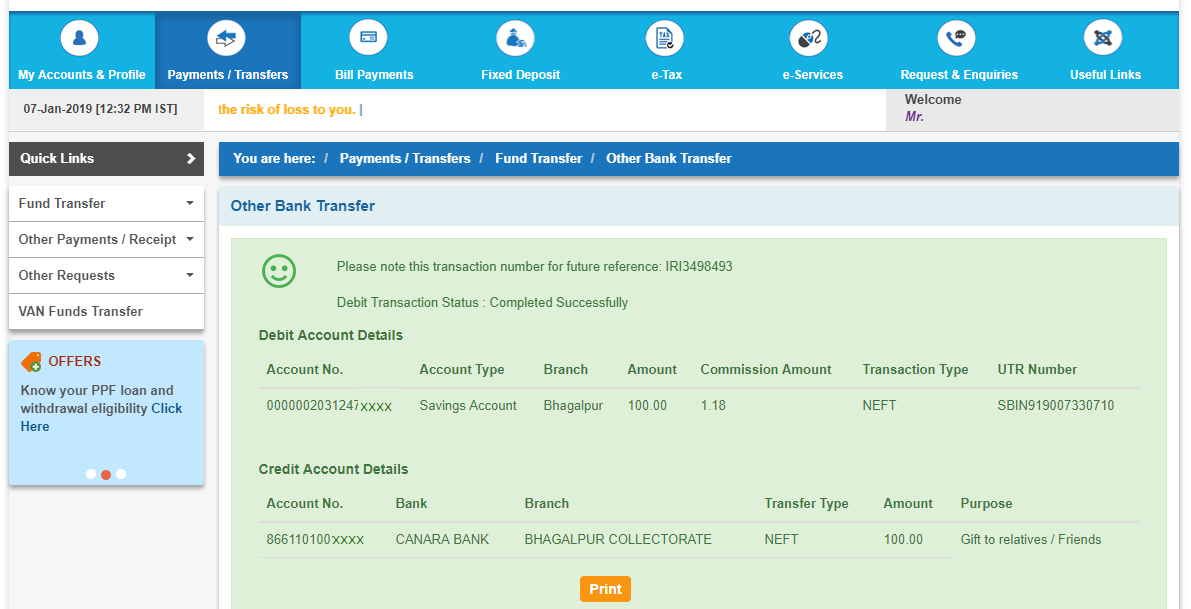

- Your SBI NEFT transfer will be complete and the amount will be transferred to the beneficiary account number

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Credit Card Bill Payment through SBI NEFT

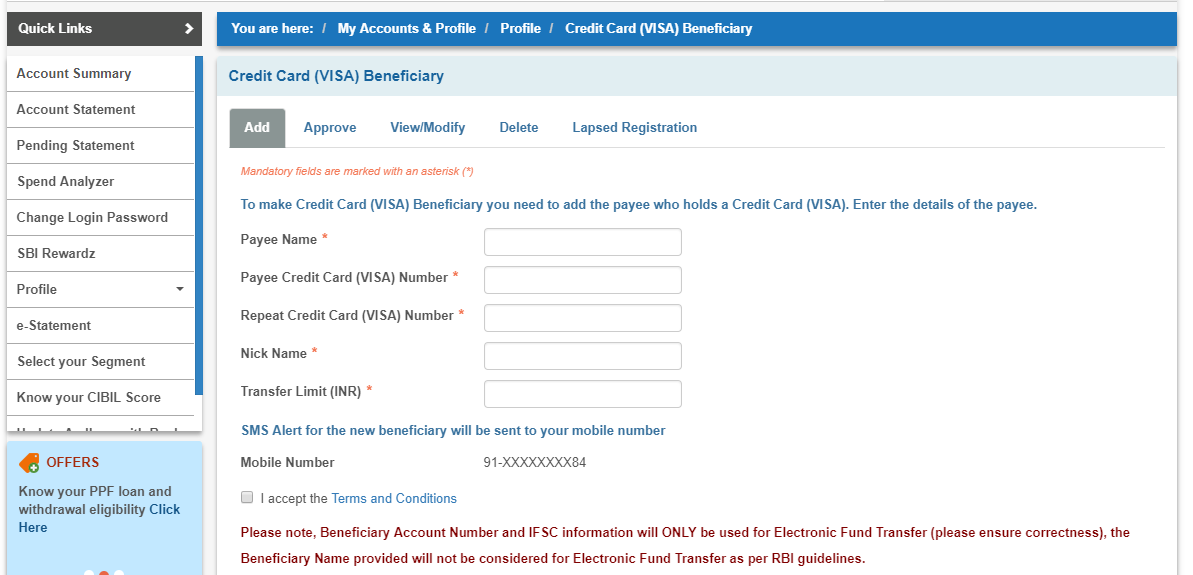

Follow the steps mentioned below to pay credit card bills through SBI NEFT:

- Login to your SBI net banking portal

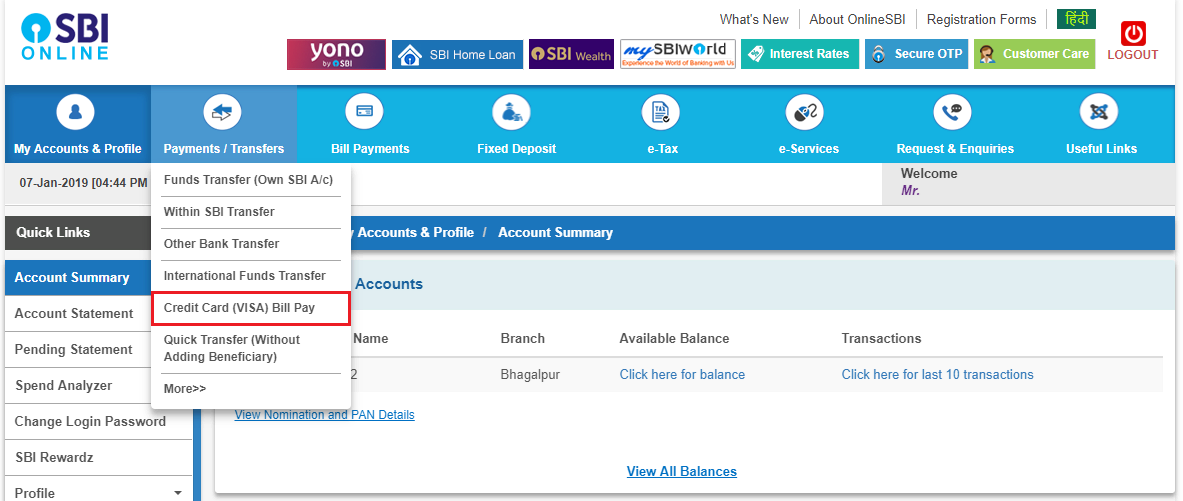

- Select the option “Credit Card (VISA) Bill Pay” from the “Payments/Transfers”

- Enter details in the space provided and submit the application

- You will now have to approve the request of adding the beneficiary

- Once added, you can make the payment directly as and when required.

SBI Credit Card Bill Payment through NEFT

An account holder can pay his SBI credit card bill online through NEFT as well. Here’s how to pay SBI NEFT credit card bill:

- Login to the netbanking account of your bank

- Add SBI card as the beneficiary under third-party transfer

- Enter the beneficiary IFSC code as SBIN00CARDS

- Enter the 16-digit card number in place of the account number

- Mention bank name as SBI CREDIT CARD – NEFT

- Fill the bank address as PAYMENT SYSTEMS GROUP, STATE BANK GITC, CBD BELAPUR, NAVI MUMBAI.

- Submit your application to complete the addition of the beneficiary

- Now you can directly make the payment of the credit card online through SBI

SBI NEFT Charges

As directed by RBI, no service charges are levied on NEFT transfers initiated online via internet/mobile banking channels. However, transactions initiated at the bank are charged with a nominal amount:

| Transaction Amount | NEFT Charges for Branch | NEFT Charges for Net Banking |

| Up to Rs. 10,000 | Rs. 2.00+ GST | NIL |

| Up to Rs. 10,001 to Rs. 1 lakh | Rs. 4.00+ GST | NIL |

| Above Rs. 1 lakh up to Rs. 2 lakh | Rs. 12.00+ GST | NIL |

| Above Rs. 2 lakh | Rs. 20.00+ GST | NIL |

SBI NEFT Facts

There are certain facts about SBI NEFT charges, transactions, and service model which should be understood and remembered for a hassle-free fund transfer experience. Below mentioned are some of the SBI NEFT facts:

- Transactions via NEFT are processed on half-hourly basis, and it takes a maximum of 2 hours.

- NEFT service is regarded as a safe, simple, secure, and quick way of transferring money.

- An accountholder of SBI savings account can easily transfer & receive funds using NEFT. Furthermore, the non-customers are also allowed to deposit cash through NEFT up to Rs. 50, 000/- per transaction

- The remitter needs to keep the necessary details like account number, beneficiary name, account type, IFSC code, etc. while processing an NEFT transaction.

- The minimum amount which can be transferred through NEFT is Rs. 1.

SBI NEFT Timings

Account-holders can make NEFT fund transfers online or through the bank. NEFT timings are decided by the RBI. Currently, NEFT transfers are available on a round-the-clock basis, i.e., 24x7x365 basis. NEFT is not available on banking holidays for the customers wanting to process NEFT by visiting the bank. In such a case, the customer should call their bank’s branch and enquire about the days when NEFT cannot be processed. One can also check the SBI holidays list 2022 before visiting the bank for NEFT transactions.

SBI NEFT Limit

The amount to transfer funds is decided by the Reserve Bank of India. As per the present scenario, the SBI NEFT Limit is mentioned below:

| Transaction | Minimum Limit | Maximum Limit |

| SBI NEFT | Rs. 1 | No limit |

SBI NEFT Form

A person has to fill SBI NEFT form in order to transfer funds by visiting the bank. He has to mention details such as account number, beneficiary account number, transfer amount, cash details, the signature of the remitter, mobile number, date of the transaction, etc. The form is free of cost and is available at the bank. The remitter has to submit this form along with the cash amount. The cashier returns the customer copy as the receipt to the remitter mentioning the transaction details. Mentioned below is the form for reference.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

SBI NEFT Transaction Requirements

The following details have to be provided for making SBI NEFT transactions:

- Name of the beneficiary

- Amount to be transferred

- Customer’s account number

- Name of the beneficiary’s bank

- IFSC code of the bank’s branch

- Remitter’s account number from which the amount has to be transferred

FAQs

Q. What happens if the amount is not credited to the beneficiary’s account?

Ans. In case the amount is not credited to the beneficiary’s account, the amount is transferred to the remitter’s bank within 2 hours of the clearing batch. The bank then credits the amount to the remitter’s account.

Q. How can I know if the amount is transferred from my bank account?

Ans. You can check SBI balance through netbanking, mobile banking, missed call, SMS or by getting your passbook updated.

Q. Who should one contact in case of non-credit of funds in case of SBI NEFT transfer?

Ans. The remitter should immediately get in touch with the home branch in case funds are not transferred to the beneficiary or delay in fund transfer. Alternately, the remitter can connect with the SBI customer care team for speedy resolution.

Q. Is NEFT available on Saturdays?

Ans. Yes, NEFT is available on Saturdays if you process NEFT via online. However, if you want to process NEFT by visiting the bank, it cannot be processed on the 2nd and 4th Saturday as banks remain closed on these days.

Q. How much time does it take for the amount to reflect in the beneficiary’s account?

Ans. NEFT works in half-hourly batches. Thus funds transferred reflect into the beneficiary’s account within 30 minutes. However, it may take about 2 hours for the NEFT amount to be reflected in the beneficiary’s account in some cases.

Q. Is the IFSC code required for NEFT?

Ans. IFSC code is mandatory for NEFT transactions. In case of incorrect IFSC, the fund is not transferred to the beneficiary’s account.