Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Post Office Savings Account (POSA) is a deposit scheme under the Government of India, operational at all post offices in the country. It yields returns on your investment at a fixed interest rate of 4.00% p.a. (Oct-Dec 2025) for Post Office Savings Account, which is decided by the Reserve Bank of India (RBI).

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

The Post Office Savings Account (POSA) is similar to a regular savings account you find in banks but managed by the post office network across the country. Opening a savings account under the Post Office Savings Scheme is beneficial for individuals who want to start savings and earn fixed returns on their investment with minimum risk.

Further, let’s know more about Post Office Savings Account (POSA), including interest rates, eligibility, documentation, etc.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Latest Post Office Savings Scheme Interest Rates: October-December 2025 is 4% p.a.

The interest is decided by the Reserve Bank of India which is calculated on a monthly basis and credited annually into your bank account. Specifically, it’s calculated on the minimum balance between the 10th of each month and the end of that month.

Currently, an individual earns interest at the rate of up to 2.25% p.a. (Quarterly) on their account balance for Regular and Basic Savings Account.

| Account Type | Annual Interest Rate | Frequency of Pay-out |

| Regular Savings Account | Balance up to Rs. 1 Lakh – 2.00% per annum Balances above Rs. 1 Lakh & up to Rs. 2 Lakh – 2.25% per annum |

Quarterly* |

| Basic Savings Account | Quarterly* | |

| Premium Savings Account | Quarterly* | |

| DigiSmart Savings Account | 2% per annum | Quarterly* |

*Interest shall be paid in the subsequent month of each quarter and are updated as of Dec 2025.

Interest earned up to Rs. 10,000 in a financial year is exempt from taxable income (no TDS). This provision is as per section 80TTA of the Income Tax Act, 1961.

– The balance at any given time in the account exceeds Rs. 50,000

– The aggregate of all credits in the account in any financial year is more than Rs. 1 lakh

– The aggregate of all withdrawals and transfers in a month from the account is more than Rs. 10,000

Note: We have taken this information from The Gazette of India. To read more, click on https://egazette.nic.in/WriteReadData/2023/244822.pdf

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Follow the steps given below to open a Post Office Savings Account:

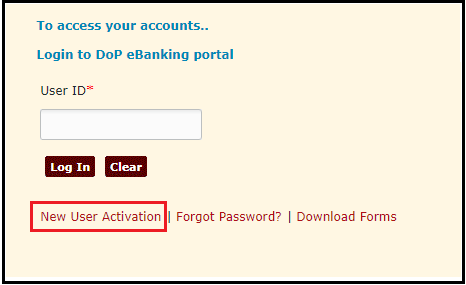

How to Activate Indian Post Internet Banking for New Users

2. Click on “New User Activation”

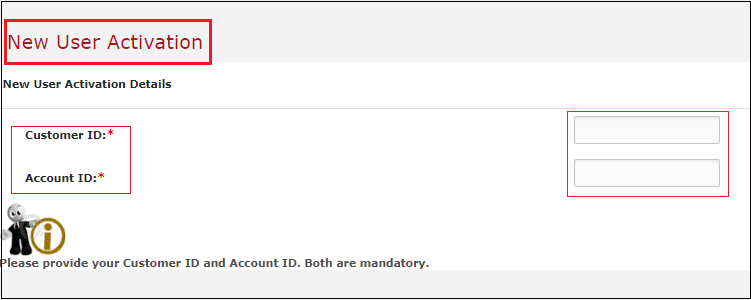

3. Enter the required details- Customer ID (printed on the first page of your passbook) and Account ID

4. You will receive a ‘User ID’ within 48 hours, once your activation process is completed

You can check your account balance in the following ways:

1. Missed Call

| Purpose | Number |

| Registration for missed call service | 8424054994 |

| Balance Enquiry | 8424046556 |

| Mini Statement | 8424026886 |

2. Post Office SMS Banking

| Purpose | Code | Send To |

| SMS Banking Registration | REGISTER | 7738062873 |

| For Balance Enquiry | BAL | |

| For Mini Statement | MINI |

Important points to consider:

Get FREE Credit Report from Multiple Credit Bureaus Check Now

A savings account is considered a Silent Account if there is no record of transactions for 3 continuous financial years. To revive a silent account, the account holder is required to submit a fresh application with a duly filled KYC form.

You need to maintain a minimum balance of Rs. 500 throughout the financial year. Failure of this may lead to a fine of Rs. 50 as Account Maintenance Fee. Also, you will not be able to withdraw from your account if the balance is Rs. 500 or below.

One can withdraw a maximum of Rs. 20,000 from a GDS. Earlier this limit was set at Rs. 5,000

After the death of the depositor, the amount in the respective bank account is given to the nominee. If the amount in the account is less than Rs.60000 and there is no nominee for the same, the Department of Post Office pays the amount to a person appearing before the deceased person, who is entitled to receive it or to administer the estate.

India Post Department has launched its online banking website and mobile application for the users to record their account activities easily. However, you will have to generate a unique User ID and apply for e-Banking to start the same service.

Yes, it is possible to change the post office branch. You will have to submit the required form or application, as and what is asked for.

Debit card and ATM card options are not offered by all the post offices. However, there are some core banking post offices that provide such services. So, you can ask the concerned administrator of your post office branch to check for these facilities.

The rate of interest for basic and regular POSA is 4.00% per annum.

The account holder can make a premature withdrawal whenever he/she wants. But, the POS account requires a minimum balance of Rs. 500 to be maintained by all the account holders.

An individual (single adult) can open only one single account at one post office.

To obtain a cheque book facility, you need to have a savings account with the post office with a minimum deposit of Rs. 500. Additionally, you need to download and submit the respective form at the concerned post office.

It all depends on your requirements and liking, as both the financial entities perform different roles. The terms and conditions defined by banks shall vary from post office.