Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

The Pradhan Mantri Jeevan Jyoti Bima Yojana was started by the then Finance Minister, Mr. Arun Jaitley in the annual financial budget of 2015. The scheme was actually launched by the Prime Minister, Mr. Narendra Modi in Kolkata considering the fact that as of the mentioned year (May 2015), only 20% of the country’s population had an insurance policy in their name.

The main idea behind the scheme was to increase the number of health insured citizens in the country. Additionally, the bank accounts that were initially opened under the Pradhan Mantri Jan Dhan Yojana will be used for this scheme as well. This was done to reduce the number of accounts under the scheme with zero balance. The scheme offers a life cover of Rs.2 Lakh to the insured member for the time period of one year, stretching from June 1 to May 31; this time period will be renewed every year.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

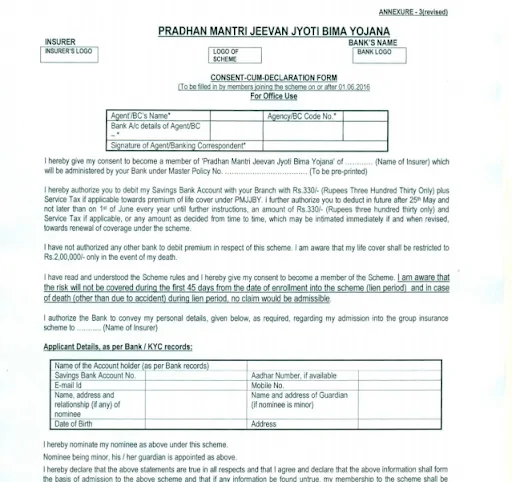

To avail the benefits of Pradhan Mantri Jeevan Jyoti Bima Yojana, the eligible candidates must either fill a form at the bank branch at any time of the year or apply for the scheme online through netbanking service. However, before applying for the scheme, it is mandatory for the members to get their KYC done by submitting their Aadhaar along with the application form.

It must be noted that the premium amount will be deducted automatically from the insured member’s bank account on an annual basis.

Here’s the application form that you must submit while applying for the scheme-

It must be noted that the PMJJBY application form is available in several languages such as English, Hindi, Gujarati, Bangla, Kannada, Odia, Marathi, Telugu and Tamil.

Additionally, individuals who exit the scheme at any given point in time may also re-enter the scheme in the future by paying the annual premium and submitting a self declaration form of good health.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

With effect from 1 September 2018, the Ministry of Finance revised the premium payment structure on a quarterly basis depending upon the request date of joining the scheme. The revised premium amount that must paid under the scheme is as follows-

| Month of Enrolment | Premium to be Paid |

| June, July, August | Rs.330 |

| September, October, November | Rs. 258 |

| December, January, February | Rs. 172 |

| March, April, May | Rs. 86 |

The life insurance policy will be considered terminated upon the occurrence of any of the following and no benefits would be payable-

In case of death of the policy holder, the nominee or the family members can claim the insured amount of Rs.2 Lakh by contacting the respective banks branch where the insured person was having a bank account.

The nominee or the family of the insured person must submit the following document at the bank; post which the claim amount will be transferred to the nominee’s account.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Given below is a list of few of the banks that offer the life insurance policy under the Pradhan Mantri Jeevan Jyoti Bima Yojana-