Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Known to be one of the most useful savings schemes for employees, the EPF or Employees’ Provident Fund is a type of savings account introduced by the Ministry of Labour for the welfare of employees. EPF payments or PF online payments are made every month by both the employer and the employee into the employee’s PF account on which interest is offered by the government and which eventually builds up to a corpus for the employee’s retirement.

EPF is an ideal retirement fund in which both the employer and the employee contribute an amount equal to 12% each of the employee’s salary (basic and dearness allowance) to the EPF, at fixed equal intervals. However, only the employers that are registered and their employees can contribute to this fund. The interest received on the total accumulated amount (deposit and the interest received) is tax-free. Employer registration can be done voluntarily or through the statute mandate.

To ensure the safety of the fund and timely payments by employers and employees, provisions with respect to the fund are governed by The Employers’ Provident Funds and Miscellaneous Provisions Act, 1952 (PF Act). As per the act, all the companies that have employed more than 20 individuals including the ones on contractual basis must register under the PF Act. It must be noted that after the activation of PF Act, even if the number of employees in the organization gets lower than 20, the employer organization will still be governed by the PF Act.

Even though both employer and the employee are bound to contribute to the PF account, the employer who is registered with the PF Act has to make the EPF payment/PF payment. Starting September 2015, it has been made mandatory for all the registered employers to make the payment online. The EPF online payment/PF online payment can be made either through the EPF’s official website or through the bank’s website, if the bank facilitates direct payment through its website. EPFO has currently tied up with the following banks for the collection of EPF dues-

| SBI | PNB | Corporation Bank |

| Indian Bank | Union Bank of India | IDBI Bank |

| Kotak Mahindra Bank | Bank of Baroda | Canara Bank |

| HDFC Bank | ICICI Bank | Indian Overseas Bank |

| Axis Bank | Bank of India | Central Bank of India |

| Bank of Maharashtra | ||

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Follow the given steps in order to make the EPF payment online-

However, there are certain banks that have a specific procedure of payment of their own. You can visit the bank’s website in order to check the same and make the payment accordingly.

EPF payment due date is the date by which PF from the employees’ salary should be deducted. This should be done on or before the 15th of every next month. However, the due date of PF return and the PF payment due date are both the same, i.e. on or before the 15th of every month.

Upon the late EPF Challan payment, the following two penalties are applied-

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Employee Provident Fund, launched by the Ministry of Labour has the following objectives-

The following eligibility conditions must be met in order to avail the benefits of EPF-

It must be noted that the scheme does not cater to the employees of Jammu and Kashmir (an erstwhile state).

The following documents are required to register for an employee PF account-

For organizations-

Along with the above-mentioned documents, all the entities (Proprietor/ Company/ Society/Trust) must have the following documents while applying for registration of PF-

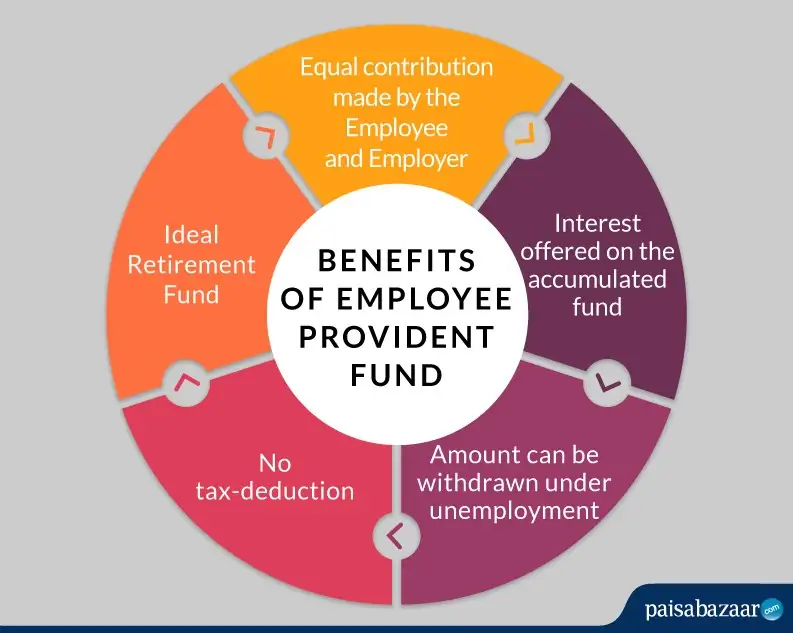

Given below are a few key benefits of making EPF payment or contributing to EPF:

Given below are the different ways through which an employees can check their EPF payment status:

You can check your PF balance by sending an SMS “EPFOHO UAN” to 7738299899. You can also check your PF balance by giving a missed call on 9966044425 from your registered mobile number. Do remember that you need to register your mobile number and complete the KYC on the EPFO portal to avail this service. Alternatively, you can also check your PF balance online via the Umang App or EPFO website. To know more details about the same, click here.

The wages paid out in a calendar month are taken into account to determine the due contribution.

Yes, an employee can continue as a PF member even after retirement if he continues to work even after attaining the superannuation age.

The contribution made to your EPF account by your employer is tax-free and the contribution that you make yourself is tax-deductible under Section 80C of the Income Tax Act. Moreover, EPF has the Exempt, Exempt, Exempt (EEE) status in terms of taxes.

No, an employee cannot join EPF on their own. He or she must work for an organization that is governed by the EPF and MF Act of 1952.

Yes, your EPF account is transferred and carried over to a new account under the same UAN each time you switch your job.