Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

If you've left your job or have retired, you can claim full settlement from your PF account. However, there are certain rules and regulations to it. Know the terms and conditions of EPF withdrawal, how to submit claim form/Form 19 in EPFO and more.

Check your Credit Score for FREE

Let’s Get Started

The entered number doesn't seem to be correct

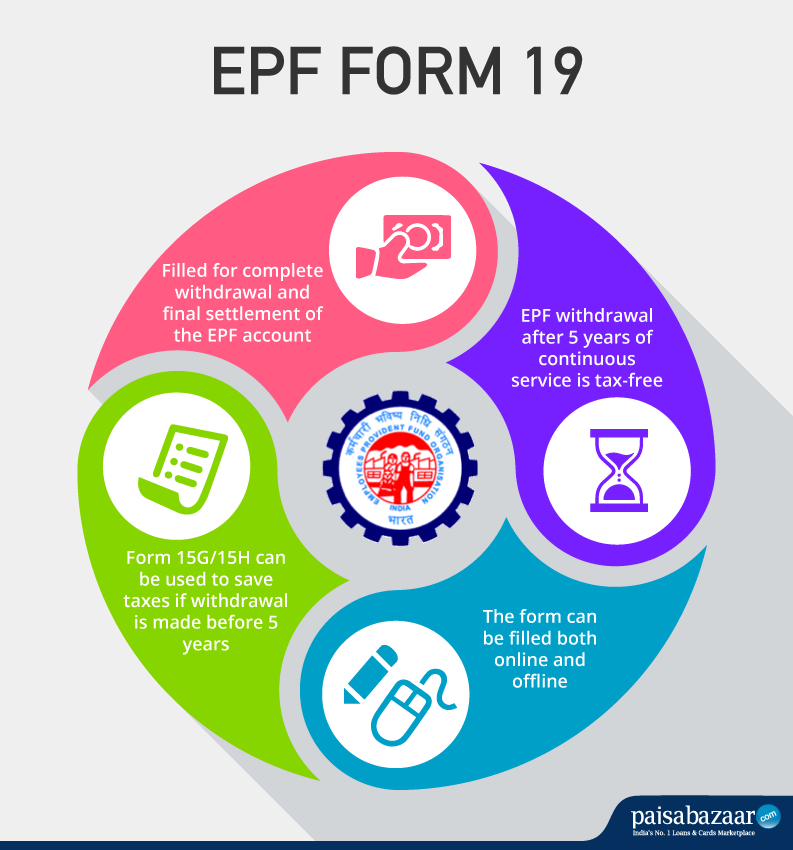

Employees’ Provident Fund (EPF) is a retirement scheme where an employee and his employer contribute a part of the salary during the service period and the member withdraws the lump-sum amount on retirement. An employee can also request for the final settlement of the EPF account once he leaves the job. He has to fill EPF Form 19 to withdraw funds from the EPF account for final settlement.

| Note: EPF Form 19 has been replaced with EPF Composite Claim Form. To know more about EPF Composite Claim Form, click here. |

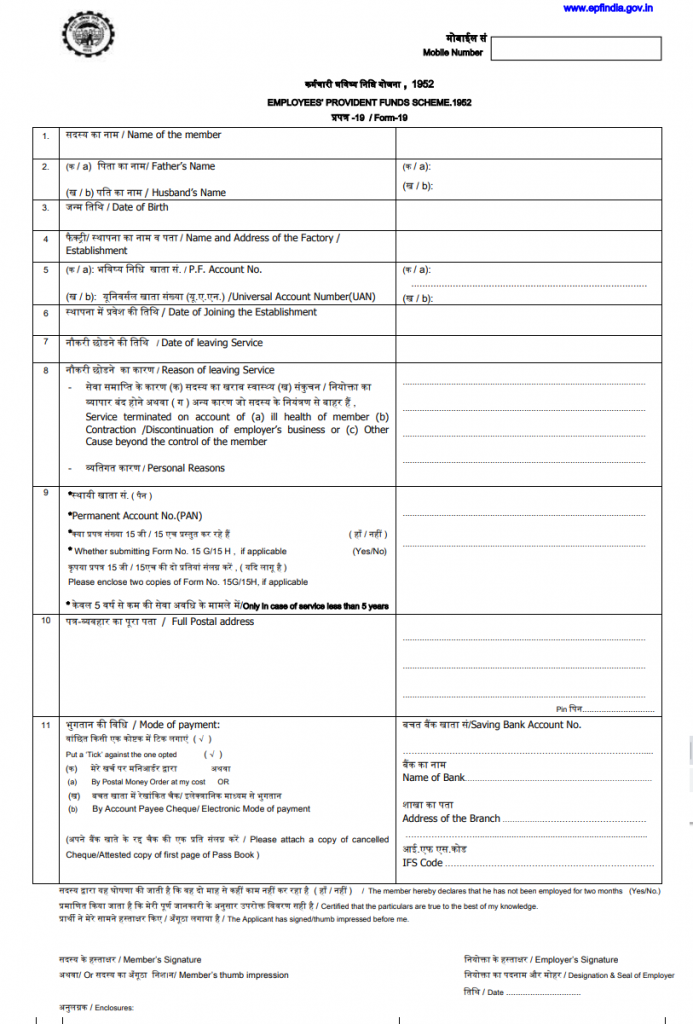

EPF Form 19 or PF Form 19 is used for final settlement of an employee’s Provident Fund account. This claim form can be used by individuals after they leave their job or retire from their company to initiate the withdrawal process of the employee’s accumulated PF savings, which also include the employer’s contribution and interest.

| EPFO Form 19 Highlights | |

| Purpose/When Can you Use Form 19 |

Final settlement |

| EPF Form 19 Download Link | https://epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form19.pdf |

| Eligibility | All existing employees who want to close their existing EPF account |

| Mandatory | Yes (for final settlement) |

| How to Fill the Form | Both online and offline |

| When is it Filled | At least 2 months after leaving the company |

Don’t Know your Credit Score? Now Get it for FREE Check Now

Form 19 EPF has the following sections:

The member’s signature, as well as the employer’s signature, is required.

The advance stamp receipt has to be filled when you need the payment by cheque. An advance stamp means that you have to affix a revenue stamp of Rs. 1 to the form and sign across the stamp. If you choose the ECS option (electronic credit), you do not need an advance stamp.

The employee has to provide his mobile number at the beginning of the form.

Once you leave a job, you can either settle your PF account or transfer it to the new EPF account in the new organisation. In case you want to make a final settlement, you can fill EPF Form 19 both online as well as offline. You have to follow the steps mentioned below to fill up the EPFO online claim form:

Get Your Latest Credit Score in Just 2 minutes Check Now

Here are a few pre-requisites that you must consider before filling up the EPFO online claim form:

Composite Claim Form is a combination of EPF Form 19, Form 10C, and Form 31. Form 19 is filled for PF final settlement, Form 10C is filled for pension withdrawal and Form 31 is filled for partial EPF withdrawal. However, only the Composite Claim Form has to be filled for withdrawing funds offline.

Also Read: EPF Withdrawal: How to Fill PF Withdrawal Form and Get Claim Online

A. Following reasons are considered valid if the employee makes a claim for final settlement. These reasons have to be given for offline withdrawals. For online withdrawals, these reasons/points are not present in the form :

A. If you want to save tax on EPF withdrawal (in case the withdrawal amount is more than Rs. 50,000 and the service period is less than 5 years), you have to submit Form 15G. Attach 2 copies of the form at the time of submitting the form offline.

A. Total service in the present, as well as previous employment, is considered at the time of EPF withdrawal.

A. No, you do not have to submit a revenue stamp for online applications. However, for offline applications, you have to affix a revenue stamp of Rs. 1 and cross-sign it at the time of submitting the application in case you want the payment through cheque.

Note: The revenue stamp is no longer required since the Composite Claim Form is a cumulative form that has now replaced EPF Form 19, 31C and 31.

A. Yes, you can claim the EPF settlement amount through cheque. You have to mention the following details in the form itself :

EPF Form 19 can either be submitted online via the UAN member portal or offline by visiting the nearest EPFO office in person.

Unless you fill and submit the EPF Form 19 you will not be able to withdraw your EPF corpus.

You can only withdraw the EPF amount from your PF account using EPFO Form 19. To withdraw the EPS corpus, you need to fill and submit Form 10C.

In case there are discrepancies or errors in EPF Form 19 or its submission, you will not be able to withdraw your EPF corpus.

Yes, you can track the status of your EPFO Form 19 online via the UAN Member portal, EPF website or UMANG app.

Read more about How to Track EPF Claim Status

No, earlier Form 31 had to be used to make partial withdrawal from your EPF account. However, the new EPF Composite Claim Form has now replaced Form 31, 19 & 10C.