-

Personal Loan

-

Credit Score

-

Credit Cards

-

Business Loan

-

Home Loan

-

Bonds

-

Fixed Deposit

-

Mutual Funds

-

Calculators

-

Other Loans

-

Learn & Resources

Get the app — instant card and loan offers!

Talk to Expert

Sales Enquiry

Call Us: 1800 570 3888

Service Helpline

Call Us: 1800 258 5616

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Offers on Paisabazaar are only from Credit Institutions regulated by the RBI

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

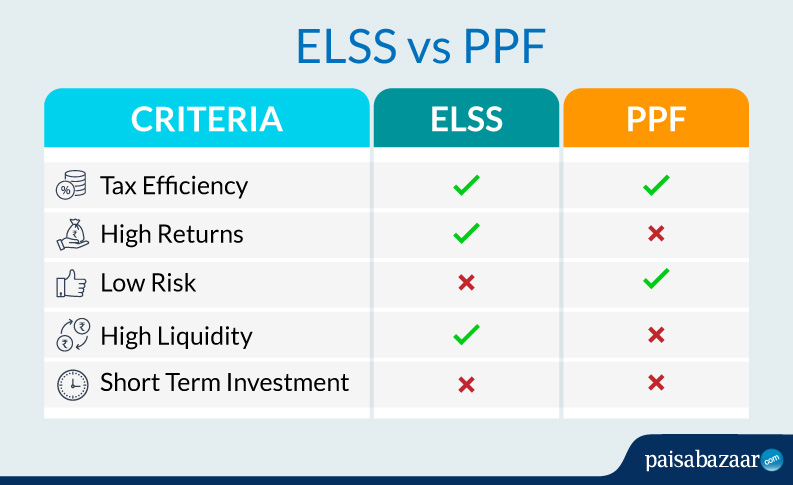

Since both the Equity Linked Savings Scheme (ELSS) and Public Provident Fund (PPF) are saving schemes eligible for tax benefits, there is always an element of confusion among the investors in picking out one of the schemes.

While PPF has been a traditionally popular investment option, ELSS is slowly catching up in the modern era due to higher returns. Further, the investors must know that apart from tax benefits there is nothing similar between the two schemes.

The article aims to present a comparative analysis of the two schemes to help investors in selecting the right one for them.

Don’t Know your Credit Score? Now Get it for FREE Check Now

| Characteristic | PPF | ELSS |

| Safety | Very High (Govt Guaranteed) | Low-Moderate (Invests in Equity) |

| Returns | Moderate – Fixed by Govt every quarter. | High – Equity compounds over the long term |

| Lock-in | 15 years | 3 years |

| Liquidity | Low (Partial withdrawals after the expiry of 5 years from account opening year) | High ( Withdrawal at any time after the lock-in period) |

| Tax on Returns | Exempt | 10% on long term capital gains. Gains up to 1 lakh exempted. |

| Tax on Maturity | Exempt | Only gains are taxed as shown above |

What is ELSS?

Equity Linked Saving Scheme (ELSS) is a type of mutual fund that is eligible for tax deduction benefits under the section of 80C of the Income Tax Act, 1961. Due to higher returns and lowest lock-in period in the tax-saving category, ELSS has become hugely popular in recent times.

Also Read: Best ELSS Funds to Invest in 2020

What is PPF?

Public Provident Fund (PPF) is a government-backed saving scheme which provides guaranteed returns and added tax benefits u/s 80C. The interest rates on PPF are fixed by the government every quarter. The interest rates for the current quarter Q2 (July-September) FY-25-26 has been fixed at 7.1%.

ELSS Features:

- High Returns: ELSS has delivered one of the highest returns in the category of tax-saving products. If you look at past data, ELSS schemes have generated about 11-14% returns in 3-years and 5-years time frame. However, ELSS returns are market-linked and therefore, not guaranteed.

- Tax Benefits u/s 80C: Investments up to Rs.1.5 lakh a year in ELSS are eligible for tax deduction benefits under section 80C of the Income Tax Act, 1961. One can potentially avail tax benefits up to Rs. 46,800 by investing in ELSS. However, unlike PPF which is tax-free at every stage, ELSS returns are taxable at 10% if the gain exceeds Rs. 1 lakh in the year.

- Lowest Lock-in: ELSS investment comes with a lock-in of only 3 years in the tax-saving category, making ELSS investments a relatively more liquid option. You can actually redeem your ELSS fund investment in just 3 years.

- SIP Option: You can start investing in ELSS with an amount as low as Rs. 500 per month through the Systematic Investment Plan (SIP). You can start and stop the SIP when convenient. It provides enormous flexibility as well as convenience while making small but regular investments.

Also Read: Calculate Your Target Corpus using SIP Calculator

PPF Features:

- Low-Risk Instrument: As PPF deposits and returns are government-guaranteed, it is one of the safest investment options available in the country. Despite being low on returns, PPF has been an immensely popular investment option due to the safety of capital and returns.

- Tax Benefits: PPF investments come under exempt-exempt-exempt (EEE) category i.e at no stage are PPF deposits or returns taxed. While making PPF deposits upto Rs. 1.5 lakh, the investor can avail tax benefits under section 80C of the Income Tax Act. Further, interest credited every month is also tax-free. Lastly, the maturity amount is also tax-exempt.

- Lock-in Period: PPF deposits come with the mandatory lock-in period of 15 years. However, you can take a loan on the PPF deposits from 3rd to 6th financial year from the year of account opening. Further, you can make a partial withdrawal from 6th year onwards but only on some pre-specified grounds.

- Fixed Returns: PPF deposits fixed returns in form of interest rate every year. The interest rate on PPF is fixed by the government on a quarterly basis. The average returns on PPF for the last 5 years have been around 7%.

- Investment and Withdrawal: PPF has a minimum investment of Rs 500 and a maximum investment of Rs 1.5 lakh. You can make deposits in the PPF account up to 12 times in a year. Premature closure is only allowed on limited grounds such as serious ailments. Partial withdrawals are allowed after the expiry of 5 years since the end of the year in which the account is opened.

Also Read: All You Need to Know About PPF

Don’t Know your Credit Score? Now Get it for FREE Check Now

ELSS or PPF: Which One Should You Invest in?

While both the schemes are tax saving, it is important to pick a scheme based on return expectations, risk appetite and investment time horizon. PPF is suited for individuals who are absolutely risk-averse and can afford a 15-year lock-in period.

Whereas those investors who are willing to take a moderate risk to earn higher returns can opt for ELSS. The best way to reduce risk in ELSS to its minimum is by staying invested for the long term.