PAN 2.0 is a new initiative by the Income Tax Department to modernise taxpayer registration. The project aims to streamline the process of issuing and managing taxpayers’ PAN and TAN by integrating multiple platforms into a single unified portal and making it more user-friendly and efficient.

Under the new PAN 2.0 system, a single digital platform will be offered for PAN generation as well as management and PAN allotment/update/correction will be done free of cost. Moreover, the new PAN will also possess a dynamic QR code containing the latest data in the PAN database.

What is PAN 2.0

PAN 2.0 Project is the Income Tax Department’s (ITD) e-Governance project for re-engineering the business processes of taxpayer registration services. The primary aim of this project is to improve the quality of PAN services through the adoption of the latest technology. Under this project, ITD is consolidating all processes related to PAN allotment /corrections and updates.

TAN-related services are also merged with this project. Moreover, PAN validation/authentication using online PAN validation service shall also be provided to user agencies such as banks, financial institutions, government agencies, state and central government departments, etc.

Features of PAN 2.0

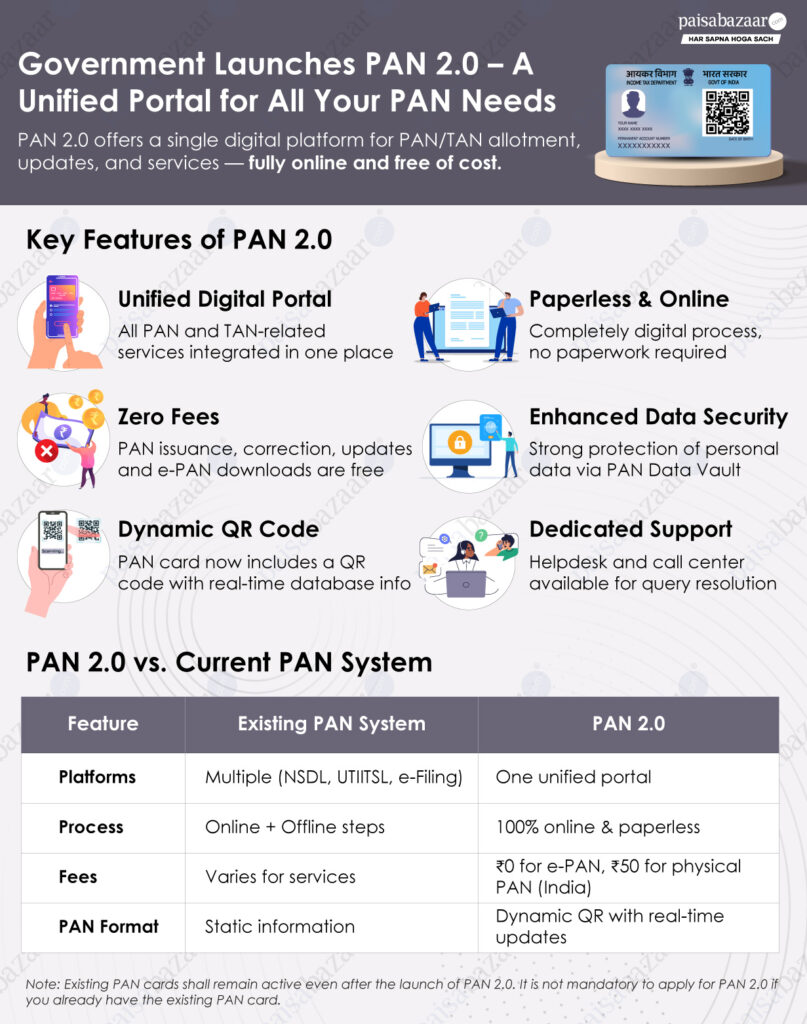

The following are the key features of PAN 2.0:

- One single portal for all PAN/TAN-related services to simplify access for users

- Eco-friendly paperless processes to minimize paperwork

- PAN shall be issued free of cost, with faster processing times

- Protection of personal and demographic data using enhanced security measures, including a PAN Data Vault.

- A dedicated call centre and helpdesk to address user issues and queries

How is PAN 2.0 Different from Existing PAN

Here are the key differences between the existing PAN and PAN 2.0:

| Basis | Existing PAN | PAN 2.0 |

| Integration of platforms | Currently, the PAN related services are hosted on three different portals- e-Filing portal, Protean e-Gov portal and UTIITSL portal. |

|

| Comprehensive use of technology for paperless processes | Different online as well as offline processes | Complete online

paperless process as opposed to the prevailing mode |

| Taxpayer facilitation | Different fees and charges need to be paid for allotment and updates/correction depending on whether you want a physical PAN or e-PAN card. |

|

Is PAN 2.0 Mandatory for Everyone

- No, existing PAN cardholders are not required to apply for a new PAN under the upgraded system (PAN 2.0). The existing PAN cards will continue to be valid under PAN 2.0.

- Moreover, your PAN card will not be changed unless you wish to make any updates or corrections

- PAN cardholders who wish to make any updates or corrections to their PAN details can do so free of cost once the PAN 2.0 project commences. Until then, they can make updates/corrections to their PAN using the existing online processes on the NSDL (Protean) or UTIITSL portal or by visiting the nearest physical PAN centre

How to Apply for PAN 2.0

Once the PAN 2.0 project commences, you can apply for a PAN card as well as avail all PAN card-related services using a single unified portal of ITD. However, until its commencement, applicants can make PAN card applications online via the NSDL (now Protean) or UTIITSL website.

| How to Apply for PAN Card via NSDL | How to Apply for PAN Card via UTIITSL |

How to Download PAN 2.0

Just like the PAN card application, PAN card download can also be carried out via the unified portal of the Income Tax Department once the PAN 2.0 project commences. Until then, applicants can download the e-PAN card online via the NSDL (now Protean) or UTIITSL website.

| How to Download e-PAN Card via NSDL | How to Download e-PAN Card via UTIITSL |

Fee for PAN 2.0

- Under the PAN 2.0 project, allotment/correction/updation of PAN will be carried out free of cost and e-PAN will be sent to your registered email address.

- In case you wish to avail a physical PAN card, you need to make a request for the same and pay a prescribed fee of Rs. 50 for delivery of PAN card at an address within India. In case the PAN card needs to be delivered outside India, you will be required to pay a fee of Rs.15 along with India post charges at actuals.

FAQs on PAN 2.0

Q. Will existing PAN cardholders be required to apply for new PAN under the upgraded system?

Ans. No, existing PAN cardholders are not required to apply for a new PAN under the upgraded system (PAN 2.0).

Q. Do I need to change my PAN number under the new project?

No, you need not change your active PAN to avail facilities of PAN 2.0. All existing PAN accounts will be eligible for this service.

Q. Can people get corrections done on PAN like name, spelling mistakes, address change, etc.?

Ans. Yes, in case existing PAN cardholders wish to make updates/corrections to their existing PAN details such as their email, mobile number, address or demographic details such as name, date of birth, etc., they can do so free of cost once the PAN 2.0 project commences.

Until then, they can make use of the Aadhaar-based online facility available on the NSDL and UTIITSL website for updation/correction of email, mobile number and address free of cost. For any other update/correction in their PAN details, they can use the existing process by either visiting the nearest physical PAN centre or apply online on payment basis.

Q. Do I need to change my PAN card under the PAN 2.0?

Ans. No, unless you wish to make any update/correction to your PAN card, your PAN card will not be changed. The existing PAN cards will continue to be valid under PAN 2.0.

Q. What does the Unified Portal mean?

Ans. At present, all PAN-related services are hosted on three different portals. Under the PAN 2.0 project, all PAN/TAN-related services will be hosted on a single unified portal of the Income Tax Department.

This portal will host all end-to-end services related to PAN and TAN like allotment, correction, updation, Online PAN Validation (OPV), Aadhaar-PAN linking, Know your AO, verify your PAN, request for e-PAN, request for re-print of PAN card etc., thereby further simplifying the processes and avoiding delay in PAN services delivery, delay in redressal of grievances etc. caused due to the presence of various modes of receipt of applications (online eKYC/online paper mode/offline).

Q. Do I need an Aadhaar card for generating PAN 2.0?

Ans. Yes, you need your Aadhaar card to generate or apply for PAN 2.0.

Q. My existing PAN card has a QR code. Will the QR code be valid after PAN 2.0 launch?

Ans. Yes, the existing QR code on your PAN card shall remain valid even after PAN 2.0 is launched. In case you have a PAN card without QR code, you have the option to apply for a new card with QR code in the existing PAN 1.0 ecosystem or using the PAN 2.0 project.

Q. I have ePAN card. Should I get a new ePAN for PAN 2.0?

Ans. Your existing e-PAN will remain valid even after PAN 2.0 project commences.

10 Comments

I want to get PAN 2.0 card. When is the PAN 2.0 apply date starting?

The government has not notified the start date for PAN 2.0. Please visit the page again after a few days to stay updated with the latest information regarding this service.

Will I have to do any PAN 2.0 update to get this new card?

You can request for a copy of PAN 2.0 once the facility starts. As of now, the project has been launched but the government is yet to provide the facility for PAN 2.0.

How to do PAN 2.0 download?

As of now, you can download existing PAN with an updated QR code. Once the facility starts, you will be able to download from a single unified portal.

Pan 2.0 apply how to do?

A single platform will be provided to apply and download PAN 2.0 once the project starts.

Old pan card to new pan 2.0

You can request for an updated PAN with QR code by paying a fee as of now. Once PAN 2.0 facility starts, you can get it online for free.