With the advent of technology, the internet has gained much importance in every segment. In this regard, the banking sector has shown a way forward to maintain pace with the new era of technology. This has impacted the financial safety in forms of different benefits which are transferred to the customers to ease their banking experience. Most companies have adopted internet services for their customers to get their transactions to flow in the safest way. Keeping aside the fraudulent activities, identity theft, online fraud, the Government has announced that banks should acknowledge the PAN KYC Status of their customers while making financial transactions.

About PAN KYC

Know Your Customer commonly called as KYC, is the process of verifying the identity of the customers. The Reserve Bank of India introduced KYC guidelines for all banks in 2002. In 2004, RBI directed all banks to ensure that they are fully compliant with the KYC provisions before December 31, 2005. Banks and companies are now turning out to be the biggest supporter of KYC. The process has come up as a powerful tool to combat issues like money laundering, tax evasion, corruption, terrorist financing, etc. KYC’s rules and regulations are directed by the Reserve Bank of India to all the banks for the legal and regulatory requirements of the customers.

Important Situations When KYC is Required

- Opening of bank accounts

- Applying for loans or credit cards

- Opening a locker

- Investing in mutual funds

- New mobile connection

- Changes in beneficiaries or signatories

Role of PAN Card in KYC

Possessing a PAN card is made mandatory for all income-earning individuals and non-individuals by the Government of India. Its primary objective is to identify and verify the identity of individuals and other entities before they get into financial transactions. Using PAN for updating KYC is of utmost importance to verify the holder’s identity and avoid any mishaps. PAN is one of the important documents that individuals must provide during the KYC process. As a PAN card reflects the necessary financial transactions like salary receivable bank accounts, purchase of assets above a specific amount or others, it is required to get the KYC done as early as possible.

Documents Required for PAN KYC

Customers need to submit the following documents along with the KYC form for proof of identity and proof of address:

- Proof Of Identity: PAN Card, Driving License, Passport Copy, Voter ID, Aadhaar Card or Bank Photo Passbook.

- Proof Of Address: Latest Landline or Mobile Bill, Electricity Bill, Ration Card, Rental Agreement, Driving License or Aadhaar Card

Get Free Credit Report with monthly updates. Check Now

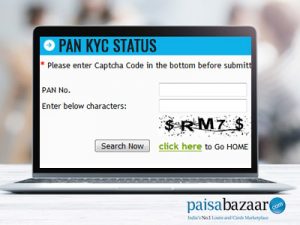

Steps to Check PAN KYC Status

Any customer who has submitted the KYC forms online can check the PAN card KYC status. All you need is to follow the steps mentioned below to track PAN KYC update status:

- Visit the CDSL (Central Depository Services Limited) KYC enquiry page at https://www.cvlkra.com/default.aspx

- Afterwards, enter your PAN number or name, date of birth/incorporation, exempt category and click on “Submit”

- If your KYC has been verified then, the updated status will be displayed as ‘MF- Verified by CVLMF’.

- If your KYC has not been verified then, the status ‘Pending’ will be shown.

- You can take a print of the page if needed.

Also Know: How to Check PAN Card Status Online

FAQs

Q. Are there any charges to check my PAN KYC status?

No, you are not required to pay any fees/charges to check your PAN card KYC status.

Q. In case there is a change in my details such as address, will I have to submit the KYC form again?

Yes, in case there is a change in address or other important details about your identity, you will have to fill and submit the KYC form again.

Q. What does “customer” mean in context of KYC?

As per KYC regulations, a customer is defined as an entity or individual that has an account or business relationship with a bank.

Q. Where can I get the KYC form?

You can get the KYC form from your financial advisor or broker. You can also get it from a mutual fund firm website.

| Find PAN Card Office in India 2024 |

| PAN Card Centers in Delhi |

| PAN Card Centers in Gurgaon |

| PAN Card Centers in Mumbai |

| PAN Card Centers in Noida |

| PAN Card Centers in Bangalore |

| PAN Card Centers in Chennai |

| PAN Card Centers in Kolkata |

| PAN Card Centers in Pune |

| PAN Card Centers in Hyderabad |

| PAN Card Centers in Vadodara |

| Other PAN Card Forms |

| Form 60 |

| Form 61 |

| Form 49A |

| Form 49AA |