Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

1st Year Fee: ₹1,499* Plus Applicable Taxes

Rewards

5X rewards on canteen stores

Dining

5X rewards on dining spends

Lounge Access

4 domestic lounge visits yearly

Author: Shruti Sharma

Find Best Credit Card Offers

It hardly takes 2 minutes

Don't worry, this will not affect your credit score

The entered number doesn't seem to be correct

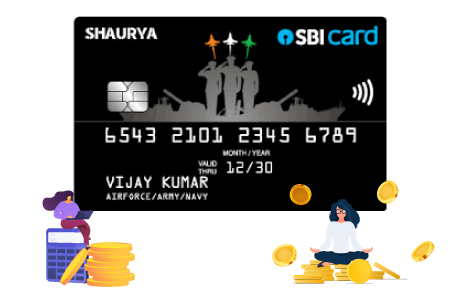

Shaurya Select SBI Card is the premium variant of Shaurya SBI Card. This card comes with an annual fee of Rs. 1,499 and offers 2.5% value-back on everyday categories such as dining, movies, departmental stores, and groceries. Additionally, it also offers 2.5% rewards on CSD canteen store spends, making it a strong choice for defence personnel. For all other spends, the card offers a base reward rate of 0.5%.

Unlike its base variant, Shaurya Select SBI Card offers complimentary domestic lounge access along with 24×7 concierge services, enhancing the value for frequent travellers. Cardholders can also earn complimentary vouchers worth up to Rs. 9,000 from Pizza Hut, Yatra, or Pantaloons through milestone benefits.

Overall, at a higher annual fee, Shaurya Select SBI Card turns out to be a decent option for defence personnel seeking accelerated savings on everyday spends along with other travel and lifestyle benefits.

Note: This Card is not available on Paisabazaar. The content on this page is for information only. To express interest in this card, please visit SBI Card’s website.

Suggested Read: Best SBI Credit Cards in India

Rewards Program

Milestone Benefits

Travel Benefits

Annual Benefit

Fuel Benefit

Insurance Benefits

Other Benefits

Suggested Read: Best Credit Cards for Defence Personnel

| Particulars | Amount | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Joining Fee | Rs. 1,499 + Applicable Taxes | ||||||||||||||

| Annual Fee | Rs. 1,499 + Applicable Taxes | ||||||||||||||

| Finance Charges | 2.75% p.m. (33% p.a.) | ||||||||||||||

| Late Payment Charges |

|

You are a serving or retired defence personnel

You want to earn accelerated rewards on daily spends like CSD, groceries, and dining

You are a domestic traveller seeking a card with complimentary domestic lounge access

You can spend Rs. 5 Lakh in a year to maximize value-back through milestone benefits

Travel3.0/5

Rewards4.0/5

Dining Benefits3.0/5

Shaurya Select SBI Card offers 2.5% value-back on canteen spends, along with other categories including dining, movies, departmental stores, and groceries, making it a suitable option for everyday spends. Besides this, the card also offers milestone benefits through complimentary vouchers from brands like Pizza Hut and Yatra/Pantaloons worth up to Rs. 9,000 every year, which significantly enhances the overall value. Unlike the base variant, this variant offers domestic lounge access along with 24×7 concierge services. However, the reward redemption value remains low at Rs. 0.25 per point. Overall, this credit card is a suitable option for defence personnel looking to save on everyday spends while availing additional benefits.

Everything you need to know about this credit card

Shaurya Select SBI Credit Card is a credit card designed specifically for military personnel. It allows you to emboss the card with the insignia of the Army, Navy, Air Force, or Paramilitary forces. The card offers benefits such as domestic lounge access, accelerated reward points, and several lifestyle privileges.

SBI Card will inform you via email or physical mail once your application is approved or rejected. You can also track your application status on the SBI Card website by entering your application number.

No, the card currently supports embossing only for the Army, Navy, Air Force, and Paramilitary insignias.

You can redeem your reward points through the SBI Card website or mobile app. Simply log in, go to the ‘Rewards’ section, and choose from options such as merchandise, gift vouchers, or statement credit. You may also redeem points by contacting the SBI Card helpline.

You can contact SBI Credit Card customer care by calling 1860 180 1290 or 3902 0202 (with your local STD code). You can also reach out through the ‘Contact Us’ section on the official SBI Card website or mobile app.

Defence personnel can check their application status by visiting the SBI Card website and selecting the ‘Track Application’ option. The status can be viewed by entering the application reference number or the mobile number used during the application process.

Click here to know More Terms and Conditions

Shruti Sharma is a skilled content writer with a passion for simplifying personal finance for consumers. Specializing in credit cards and financial planning, she offers valuable insights that empower individuals to make informed financial choices. Through her writing, she shares practical tips and guides readers through the nuances of credit card usage.