Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

UPI (Unified Payments Interface) is an instant money transfer facility which allows individuals to make payments just by using their mobile device. UPI facility is safe, secure and convenient to use. The facility is provided free of cost. Read on to know more about UPI and its features.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

India’s digital push through various mediums and reforms has taken the country in the direction of a cashless economy. One such digital advancement that has facilitated digital transactions the most is the UPI. The UPI full form is Unified Payments Interface. This is a mode of payment where one can actually send money from the smartphone at any point in time from any place. In a way, you can say that your smartphone also acts as a virtual mode of payment like a debit card. Another important fact is that you can use this app to send and receive funds in an instant.

The UPI app was launched in January 2016 and was adopted by only a handful of national banks initially. As of now, all banks operating in India have adopted UPI and most of them even provide their own version of the UPI app.

UPI is a payment platform that allows bank accountholders to carry out low-value transactions up to Rs. 2 lakh. One can use UPI to transfer funds, make instant payments or request money from any person. It is accessible through a smartphone or a feature phone.

The structure of UPI address is just like your email id and can be taken as your financial address. Similar to your bank account, this remains unique to every individual and will help you to transfer and receive funds instantly.

You do not need to transfer funds using old methods like NEFT, RTGS, and cheque. You can now send or receive money instantly throughout the day and even on holidays.

Don’t know your Credit Score? Check it here for FREE Check Now

The UPI was launched by the National Payments Corporation of India also known as the NPCI. In conjunction with the Reserve Bank of India and Indian Banks Association, NPCI has framed this network. It is similar in mechanisms like the RuPay system through which debit and credit cards function.

UPI has enabled us to replace fund transfer up to Rs. 2 lakh through this platform. Following transactions and services can be performed through the UPI:

NPCI does not levy any fees or charges to avail UPI services. This service is free of cost. The purpose to launch UPI was to promote digital transactions making it available for all individuals.

Important: According to a circular released by the NPCI in March 2020, the transaction limit for payments through Unified Payments Interface (UPI) at stores run by ‘verified merchants’ has been increased to Rs. 2 Lakh from April 2020. This move is to boost digital payments through UPI. However, this change will not be applicable to peer-to-peer fund transfers.

To use UPI as a payment mode, one has to sign-up for the service through a UPI app. This can be done on the mobile banking of your particular bank or a third-party UPI app. After that, here are steps to be followed to generate a UPI PIN:

Step 1: Go to the UPI app of your choice – iMobile, SBI YONO, BHIM, Google Pay, etc

Step 2: Scroll to the ‘Bank Account’ section on the app. This section shows all the bank accounts linked with this particular app

Step 3: Select the bank account for which you want to set a UPI PIN. You will see a ‘SET’ option in case you have never set a UPI PIN for the bank account

Step 4: Enter the ‘Last six digits’ and ‘Expiry date’ of your Debit/ATM card

Step 5: Now, you will receive an OTP from your bank on the registered mobile number. In the next screen, enter the OTP and the UPI PIN you want to set for the account and click ‘submit’

You will receive a congratulatory message on the successful generation of UPI PIN. After this, you can send money, make payments from your bank account directly by authenticating using your UPI PIN.

Don’t know your Credit Score? Check it here for FREE Check Now

As the name suggests, UPI AutoPay is an automatic bill payment service that schedules a predetermined date to pay a recurring bill. UPI AutoPay allows users to enable recurring e-mandate for multiple financial purposes such as payments of mobile bills, electricity bills, EMI payments, entertainment/OTT subscriptions, insurance payments, mutual fund SIP payments, and more.

Don’t know your Credit Score? Check it here for FREE Check Now

To find your UPI ID, you need to follow the steps mentioned below:

In case you forgot the UPI PIN, follow the steps mentioned below to reset UPI PIN:

Below-mentioned steps explain how to link your RuPay Credit Card with UPI:

Step 1: Download any UPI app from the app store

Step 2: Enter the code and select your bank account

Step 3: Add details of your bank account and select the credit card option

Step 4: Select the credit card issuer bank and select your credit card

Step 5: Confirm and click on to view the accounts from the available options

Step 6: Set the UPI PIN and start doing the transactions

Step 1: Scan merchant UPI or code

Step 2: Add the amount that you need to pay and select the credit card account

Step 3: Select your RuPay credit card account and enter the UPI PIN

Step 4: The transaction is now completed

Don’t know your Credit Score? Check it here for FREE Check Now

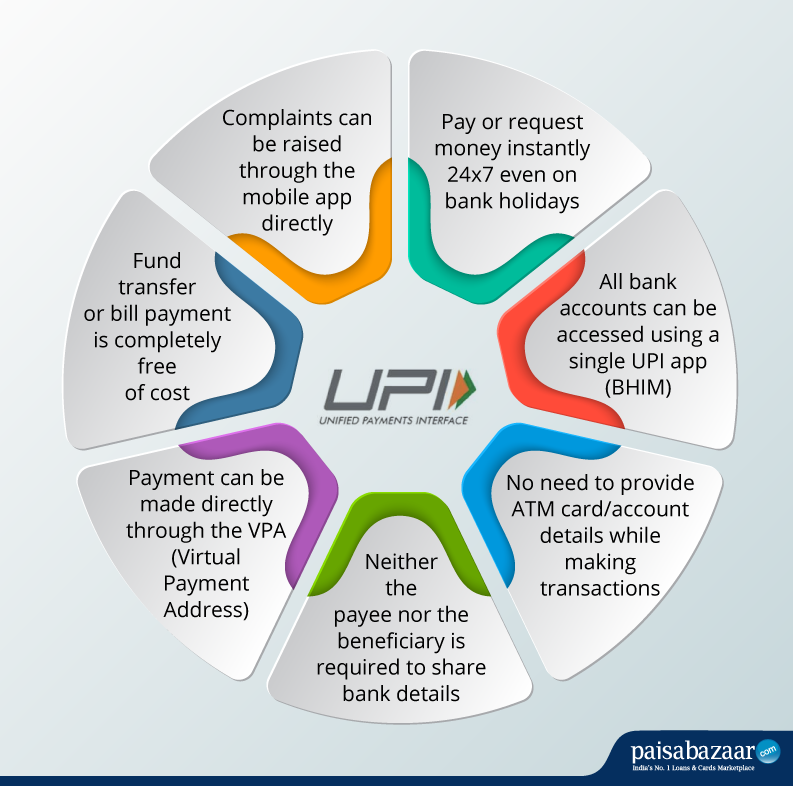

Below mentioned are the benefits of the UPI service:

UPI is a digital platform that helps you transfer funds from one bank account to another without using any account number, bank name, account type or IFSC.

To use UPI to transfer funds, you need to have the following things in place:

Once these things are with you, the next thing you need is UPI registration and UPI mPIN generation. On successful registration and generation on mPIN, you are all set to use UPI.

To send or receive funds using UPI, you need to have a UPI-based mobile app, e.g. iMobile Pay, YONO SBI, BHIM UPI, Google Pay, PhonePe, etc.

UPI transfers funds from the sender’s bank account to the receiver’s bank account without revealing bank account details to any of the parties involved in the transaction. Transfers can be done 24 x 7, irrespective of the general bank hours.

UPI can be used in three ways, viz.:

The USP of this payment mode is complete privacy and instant transfer. Also, you can link multiple bank accounts to your UPI app.

Don’t know your Credit Score? Check it here for FREE Check Now

The UPI service is not limited to smartphones, it has now been introduced on feature phones as well. This service is known as UPI 123Pay. Features of UPI 123Pay are mentioned below:

Click to know more about UPI 123Pay

Here is a list of all the banks that provide customers with the option of UPI-based fund transfers:

| Bank Name | UPI App Name | Transaction Limit |

| State Bank of India | BHIM SBI Pay | Rs. 1,00,000 |

| ICICI Bank | iMobile Pay | Rs. 1,00,000 |

| HDFC Bank | HDFC Bank MobileBanking | Rs. 1,00,000 |

| Axis Bank | BHIM Axis Pay | Rs. 1,00,000 |

| Bank of Baroda | BHIM Baroda Pay | Rs. 1,00,000 |

| Canara Bank | BHIM Canara-eMPower | Rs. 1,00,000 |

| Central Bank of India | BHIM Cent UPI | Rs. 1,00,000 |

| Punjab National Bank | BHIM PNB | Rs. 50,000 |

| HSBC | HSBC SimplyPay | Rs. 1,00,000 |

| IDBI Bank | BHIM PayWiz by IDBI Bank | Rs. 1,00,000 |

| Kotak Mahindra Bank | BHIM Kotak Pay | Rs. 1,00,000 |

| YES Bank | BHIM YES Pay | Rs. 1,00,000 |

| Karur Vysya Bank | BHIM KVB Pay | Rs. 1,00,000 |

| Jammu and Kashmir Bank | BHIM JK Bank UPI | Rs. 25,000 |

| Equitas Small Finance Bank | Equitas UPI | Rs. 1,00,000 |

| Indian Overseas Bank | BHIM IOB UPI | Rs. 1,00,000 |

| Union Bank | VYOM | Rs. 1,00,000 |

| DCB Bank | DCB UPI | Rs. 1,00,000 |

| Dhanlaxmi Bank | BHIM DLB UPI | Rs. 1,00,000 |

| Federal Bank | FedMobile | Rs. 1,00,000 |

| IndusInd Bank | BHIM IndusPay | Rs. 1,00,000 |

| IDFC First Bank | BHIM IDFC First Bank | Rs. 1,00,000 |

| Karnataka Bank | BHIM KBL UPI | Rs. 1,00,000 |

| RBL Bank | BHIM RBL Pay/MoBank | Rs. 1,00,000 |

| CSB Bank | CSB BHIM | Rs. 1,00,000 |

These are some of the major banks in India that offers customers with UPI-based transfer options. Along with these, small finance banks such as Jana, Equitas and ESAF are on the list too. The list mentioned above is not exhaustive and many new banks have been added to this program by NPCI. To check if your bank offers UPI, please connect to your bank for further details.

Users can do low-value transactions through UPI Lite. This service allows customers to make transactions below Rs. 200. You can simply activate UPI Lite wallet in your UPI app namely BHIM, Paytm, PhonePe, etc. Customers can easily make payments from this wallet and it requires just one click. Users do not require to authenticate their transaction with UPI PIN in this facility. The service will reduce the load from the core banking system, thereby, making UPI transactions faster.

Read More: UPI Lite

NPCI has enabled UPI users to create their own UPI Circle and add secondary users who would be able to carry out UPI transactions using the paimary user’s UPI account. It is aimed at enabling such individuals use UPI who either don’t have a savings account or are not using their bank account to carry out UPI transactions.

An individual can add up to 5 secondary users who can be family, friends, spouse, children, dependents, etc. Total amount allowed under UPI Circle is Rs. 15,000 per month and Rs. 5,000 per transaction.

Read More in Detail: UPI Circle

The NPCI has issued new guidelines which will allow NRIs from certain countries to access UPI services using their international phone numbers for bank accounts which are known as NRE (Non-Resident External) and NRO (Non-Resident Oridnary) accounts. NRIs of these countries can now access UPI services even on their international numbers having the country code of the below-mentioned countries.

| Country Name | Country Code |

| Australia | +61 |

| Canada | +1 |

| Hong Kong | +852 |

| Oman | +968 |

| Qatar | +974 |

| Saudi Arabia | +966 |

| Singapore | +65 |

| United Arab Emirates | +971 |

| United Kingdom | +44 |

| USA | +1 |

| Bhutan | +975 |

| Nepal | +977 |

| Malaysia | +60 |

| Thailand | +66 |

| Vietnam | +84 |

| Cambodia | +855 |

| Indonesia | +62 |

| Sri Lanka | +94 |

| Mauritius | +230 |

| Bahrain | +973 |

| Maldives | +960 |

| Taiwan | +886 |

| South Korea | +82 |

| Japan | +81 |

| France | +33 |

| Switzerland | +41 |

| Netherlands | +31 |

| Russia | +7 |

| European Union | NA |

It is worth mentioning that NRIs will not be able to avail this facility on domestic accounts opened in India. Also, accounts opened by these NRIs in foreign countries will not be eligible for providing the facilities of UPI.

Don’t know your Credit Score? Check it here for FREE Check Now

UPI-enabled banks can be categorized under three broad heads depending upon the platform they chose to adopt in order to provide UPI-enabled services to their customers. They are as follows:

Below mentioned are some important things to know about UPI:

UPI users can register their complaints by dialling the UPI customer care number. A toll-free number has been launched by the government for queries and issues regarding digital payments. Here is the toll-free UPI customer care helpline no:

| Toll-Free UPI Customer Care Helpline No.:

1800-1201-740 |

To raise a dispute related to UPI transactions, users can follow the below-mentioned steps:

Example: If the customer is using BHIM app to make UPI transactions, the complaint must be first raised with BHIM app only. IF TPAP fails to resolve the complaint, the customer can then raise the complaint with his/her bank.

It is to be noted that if customers are using their bank’s application to make UPI payments, the complaint, in that case, shall be raised with the bank in the first place.

| Particulars | NEFT | IMPS | UPI |

| Regulated By | Regulated by RBI | Regulated by NPCI | Regulated by NPCI |

| Type of Settlement | Settled in half-hourly batches | Immediate settlement | Immediate settlement |

| Minimum Transfer Limit | Rs. 1 | Rs. 1 | Rs. 1 |

| Maximum Transfer Limit | No limit on maximum fund transfer | Maximum fund transfer is Rs. 2 lakh | Maximum fund transfer is Rs. 1 lakh |

| Availability | The service is available online and offline | The service is available only online | The service is available online and offline |

| Charges | No charges on transacting online whereas charges may vary while transacting offline | May vary from bank to bank | No charges |

Don’t know your Credit Score? Check it here for FREE Check Now

Ans. UPI full form is Unified Payments Interface.

Ans. A UPI ID is your address through which one can transfer funds to you or request the same. It is just like your email ID and is accompanied by an mPIN (like a password).

Ans. A Virtual Payment Address (VPA) refers to a unique identifier to help UPI in tracking a person’s account. It basically acts as an ID independent of your bank account number and other details.

Ans. mPIN is a password containing 4-6 digits that is required to send money via UPI. It works the same way an ATM PIN works.

Ans. UPI is developed and regulated by NPCI (National Payments Corporation of India) which in turn is regulated by the Reserve Bank of India.

Ans. No. UPI is a platform that facilitates the transfer of funds from one bank account to another whereas BHIM is a mobile app developed by NPCI. The common link between these two terms is that both are developed by the same entity of NPCI (National Payments Corporation of India).

Ans. Currently, UPI is a free mode of bank to bank fund transfers. However, as per certain media reports, in the coming times, transactions may become chargeable. But it is expected to fall within 50 paisa per transaction which is quite reasonable.

Ans. The UPI transaction limit is Rs. 2 lakh every day. An individual can perform up to 20 fund transfer transactions in a day. This limit does not contain merchant transactions, bill payment and collect requests.

Ans. Yes. You can add multiple bank accounts to your UPI app provided the bank/provider approves of it.

Ans. Yes. To do so, you will need to enter the receiver bank account number, IFSC Code, and account holder’s name.

Ans. There can be various reasons why your UPI might not be working such as poor internet connection, entering the wrong PIN, or 20 completed transactions in a day, etc.

Ans. It is important to know that, even though a lot of flexible features are available under the UPI system, but a customer cannot connect a wallet to UPI. Only savings accounts can be linked for successful fund transfers.

1st May 2025: With effect from 16th June, 2025, banks participating in the UPI ecosystem will have to process transactions quicker. There will be a significant reduction in response time of UPI transactions. As per the NPCI, this is with respect to streamlining the performance of UPI. Hence, there has been a revision in the response time of UPI transactions.

| UPI API | Entities | Existing Response Time | Revised Response Time |

| Request Pay, Response Pay (Debit and Credit) | Remitter Bank Beneficiary Bank |

30 seconds | 15 seconds |

| Check Transaction Status | Remitter Bank Beneficiary Bank |

30 seconds | 10 seconds |

| Transaction Reversal (Debit and Credit) | Remitter Bank Beneficiary Bank |

30 seconds | 10 seconds |

| Validate Address (Pay, Collect) |

Payer PSP

Payee PSP |

15 seconds | 10 seconds |

20th March 2025: The National Payments Corporation of India (NPCI) has partnered with HitPay, Fintech from Singapore, to facilitate UPI payment services in the country. This collaboration shall help Indians carry out UPI-based transactions at over 12,000 merchants there. This move will boost digital payment accessibility for Indian travellers and NRIs.

The move will help NPCI simplify cross-border transactions and come closer to its vision of promoting UPI as a global payment solution.

26th August 2024: The National Payments Corporation of India (NPCI) has launched a new feature termed as ‘UPI Circle’ on its Unified Payments Interface (UPI) platform. UPI Circle permits primary UPI account holders to securely delegate payment accountabilities to trusted secondary users. With this feature primary users can link their UPI accounts with secondary users, allowing them the access to make payments on their behalf.

8th August 2024: As directed by The Reserve Bank of India (RBI) in the recent MPC meeting, the UPI transaction limit for direct and indirect tax payments has been increased from Rs. 1 lakh to Rs. 5 lakh. This increase shall help the taxpayer to pay higher tax liability instantly. No additional fee will be charged for the transactions of the payments.

11th December 2023: The Reserve Bank of India has raised the UPI limit for certain transactions. Individuals can now make UPI payments of up to Rs. 5 lakh per transaction to hospitals and educational institutions. Earlier the transaction limit was capped at Rs. 1 lakh. However, for other transactions, existing UPI limits shall prevail.

12th September 2023: NPCI has leveraged the UPI ecosystem by launching UPI ATMs which will enable bank accountholders to withdraw cash from the UPI ATM. Just go to any UPI ATM machine and follow the instructions. One has to generate a fresh UPI QR code, scan the UPI QR code in a UPI app and enter the UPI PIN to withdraw cash using this facility. Once you enter the PIN, your cash will be dispensed. The facility also allows a user to switch between registered accounts at the time of withdrawing cash from the UPI ATM.

10th July 2023: Customers of YES Bank can link their YES Bank RuPay credit card on BHIM UPI and make UPI transactions just by scanning the UPI QR code of the merchant. It is to be noted that P2P payments cannot be done through UPI from YES Bank RuPay credit card. Click here to know more.

9th June 2023: As the popularity of using UPI continues to grow, NPCI has made amends to making daily transactions. NPCI allows making transactions up to Rs. 1,00,000 in a day through UPI. However, this limit may vary from bank to bank. As per new regulations, an individual is allowed to carry only 20 transactions through the bank’s UPI app. As per updated regulations, third-party UPI apps such as Google Pay, Paytm, Amazon Pay, etc. per will let users do only 10 transactions a day. Thus, it is recommended to make note of transactions allowed on your account beforehand to avoid any inconvenience.

12th May 2023: Foreign nationals/NRIs coming from G20 countries are now able to use UPI services. This service can be used to make payments at all UPI-enabled merchant locations. Foreign nationals can avail UPI One World on KYC completion. This will help them in eliminating the hassle of carrying cash and multiple foreign exchange transactions. This service is available with the mentioned partners across India namely: EbixCash, ICICI Bank, IDFC First Bank, Pine Labs, Thomas Cook and Transcorp.

21st February 2023: Through a tie-up between Singapore’s PayNow facility and India’s UPI facility, citizens will now be able to transfer funds from their savings account or current account in Singapore to India and vice-versa. This will provide users with a safe, simple, and cost-effective way to transfer funds between these two nations. Residents of India can use any UPI app to transfer money to Singapore just by adding the receiver’s mobile number and citizens of Singapore can transfer money via PayNow app to Indian citizens.

This move will help Indian citizens residing in Singapore to make a cost-effective fund transfer to their friends and relatives in India. It will also benefit students studying in Singapore to receive money from India instantly.

16th February 2023: As per NPCI, HDFC customers can now use their HDFC RuPay credit card on UPI. HDFC Bank is the first public sector bank in India to enable this service on UPI making hassle-free payments through this credit card. The card can now be directly linked to UPI and the customers can carry payments and transactions through their HDFC RuPay credit card using any UPI app.

11th January 2023: NRIs of these countries having NRE and NRO accounts in India will now be able to access UPI services on their international number. As of now, this facility will be available in ten countries namely: Australia, Canada, Hong Kong, Oman, Qatar, Saudi Arabia, Singapore, United Arab Emirates, United Kingdom and USA. Click here to know more.