Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Exclusive Pre-Approved Cards waiting for you

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Error: Please enter a valid number

SBI Card allows customers to break up a big-ticket credit card purchase into smaller EMIs and pay off over a few months. For this facility, the issuer charges an interest rate and processing fee. However, no cost EMI facility is also available with some online shopping portals and merchants. Read on to find more details on SBI Credit Card EMI conversion.

Important Details on SBI Credit Card EMI

|

How to Opt | Interest Rates | Benefits | FAQs |

Suggested Read: Does It Make Sense To Convert Your Credit Card Dues Into EMIs?

You can opt for SBI credit card EMI conversion facility in the following ways:

Via merchant EMI conversion, one can convert their big-ticket purchase at the Point of Sale. The customer has to ask for EMI conversion at the time of billing, only for retail purchases. This facility can be availed only with select merchants. In case of online purchases, the customer simply has to select the Pay through EMI option at the time of payment. No-cost EMI conversion option can be availed at this time, if available.

For post purchase EMI conversion through Flexipay, follow the steps given below:

Alternatively, you may call SBI Card Helpline number to apply for Flexipay. The numbers are: (STD code) 39 02 02 02 | 1860 180 1290

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

| Category | Amount |

| Processing Fee | 2% (Min. Rs. 99 | Max. Rs. 1,000) |

| Interest: Post Purchase | 22% |

| Interest: Merchant | 14% (May vary across Merchants) |

| Cancellation Fee | 3% of the outstanding principal amount |

There are certain benefits and drawbacks associated with EMI conversions that customers should bear in mind. These are:

Deferred Payment: EMI conversion allows customers to pay off the amount over the period of a few months. Hence one can convert big-ticket purchases into EMI if they are unable to pay for it at the time.

Low Upfront Financial Strain: Customers’ savings do not suffer an immediate burden as they are paying off the amount over a course of a few months or even years. This can come in handy for cardholders who have a fixed income and want to purchase an item without severely impacting their budget.

No-cost EMI: This is the best option that one can choose when converting purchases into EMI. No-cost EMIs do not charge interest or processing fee. Even if charged these are adjusted via discounts or valueback, enabling the user to pay the EMI total equivalent to the product’s value and not beyond that. Thus, customers get all the benefits of EMI conversion without any of the setbacks.

Those who do not have credit cards can also make purchases on EMI via SBI Debit Card EMI facility.

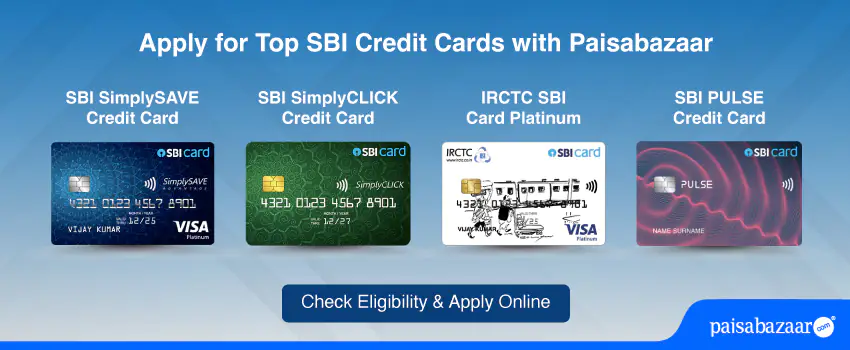

Meanwhile: Do not have an SBI Credit Card? Worry not and apply now with Paisabazaar to get best card offers.

Interest: Converting purchases into EMI incurs interest rate. The SBI credit card EMI interest rate is about 22% (post-purchase through Flexipay) or 14% (Merchant EMI). Thus, on big-ticket purchases with long tenures, the interest can be quite high which in turn drains the customer’s savings.

Blocked Credit Limit: The purchased amount is blocked against the credit limit. It is released every time the customer pays off the due EMI amount.

Increased Credit Utilization: The purchased amount is blocked against the credit limit and new purchases will use the remaining credit limit. In this scenario, the Credit Utilization Ratio will increase which, in turn, negatively impacts the credit score.

Alternatively, customers may apply for SBI Credit Card Loan. This facility allows users to get a loan amount against the credit limit of their SBI card. Additional details on SBI credit card loan can be found here.

Below, the customers will find certain points that must be kept in mind when applying for a credit card EMI conversion.

Longer Tenure is not always good : Generally customers are offered a low rate of interest on long tenures and vice-versa. One might be tempted to apply for the lower interest tenure but this is actually not a good idea. This is because customers will have to pay more interest amount. The following illustration will make it easier to understand.

Assumptions made:

|

Now, the interest amounts for different tenures are:

| Tenure | Payable Interest Amount |

| 3 Months | Rs. 986.30 |

| 12 Months | Rs. 3,600 |

Clearly choosing the shorter tenure is the right way to go. However, at times, the amount that needs to be paid in short tenure EMIs is quite high. If you are not careful you might have to expend a significant amount of your salary to pay the EMI. This might strain your monthly budget. To choose the best tenure, you must indeed access your ability to pay, keeping in view your monthly expenses, savings and what brings in the minimum liability to your funds each month.

Interest Rates may Vary: Different credit card providers charge different interest rates. Even cards from the same bank might charge different interest rate. Therefore, customers must compare the interest rates amongst all of their credit cards before applying.

Lost Benefits: Customers might lose out on the reward points or avail discounts if they apply for Merchant EMI conversion.

Timely Payment is Important: Customer must make all EMI payments in a timely manner. Before choosing the tenure, you must ensure whether payment of EMI and the outstanding amount is affordable for you or not. Failure in making timely payments will result in a high credit card bill. Here’s how:

What is Flexipay?

Flexipay is the name of the SBI Card facility which allows users to convert their purchases into EMI and pay it over a period of few months or years. It is offered to existing SBI credit cardholders and allows them to convert big purchases into easy monthly installments. Do note that the facility is not extended to delinquent or blocked cardholders.

Can I get no-cost EMI post-purchase?

No-cost EMIs aren’t usually given post-purchase by the credit card providers. Also, they are offered by online retailers like Amazon, Flipkart and so on.

Can I convert fuel spends into EMI?

No, you cannot convert fuel spends into EMI. Also, the following spends too cannot be converted into EMI; Interest, fees or any other charges levied on your card.

Can I book Flexipay on an add-on credit card?

No, you cannot book Flexipay on add-on credit cards. This facility is for primary cardholders only.

What is the tenure options provided on EMI conversions?

You can apply for any one of the following tenure options for Flexipay:

| No-cost EMI Tenures | Normal EMI Tenures |

| 3, 6 Months | 6, 9, 12, 24, 36* Months |

* Only available on amounts over Rs. 30,000