Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Exclusive Pre-Approved Cards waiting for you

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Error: Please enter a valid number

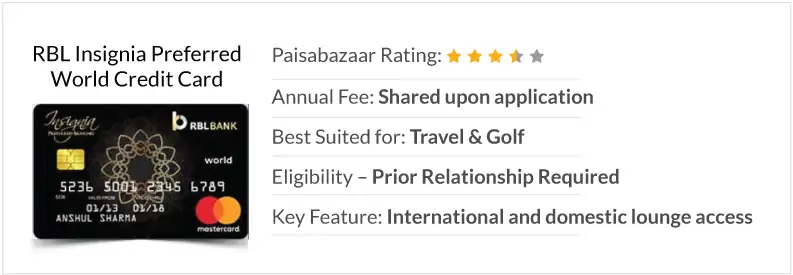

Lifetime free credit cards do not charge an annual fee or joining fee. They are a great option for customers who just want to build credit score and make minimal purchases on it. RBL Bank provides only one lifetime free credit card called RBL Bank Insignia Preferred Banking World credit card. In order to apply for this card customer must have an invitation from the bank. Please see below for more details on RBL Lifetime Free credit card.

The top benefits that the card provides are:

Reward Scheme – 5 reward points for every Rs 100 spent domestically. 2x points on international spends.

Lounge Access – Priority Pass Membership along with 6 free lounge visits per year. 2 free domestic airport lounge visits.

Fuel Surcharge Waiver – Up to Rs. 250 p.m. on spends between Rs. 500 & Rs. 4,000.

Golf Benefits – 4 free green fee rounds & 12 free games per year. 50% off on green fees post after the sessions are over.

Hotel Offer – Discounts, late check-outs, breakfast for 2, complimentary Wi-Fi, room upgrade and more benefits are provided to customers.

Concierge Service – Helps make travel arrangements, gift delivery and much more.

Special Invite Offers – Access to exclusive events and concerts.

Dining Offers – Avail hospitality & experiences designed especially for you at select restaurants.

Accor Plus Membership – Accor Plus membership and its privileges (free stays, discount on dining, etc.) can be availed upon spending Rs. 8 lakh in a year.

RBL Insignia Preferred Banking World Credit Card is an invite-only credit card. You may apply for the card if you already are an Insignia Preferred Banking client at RBL Bank. Apply for the card if:

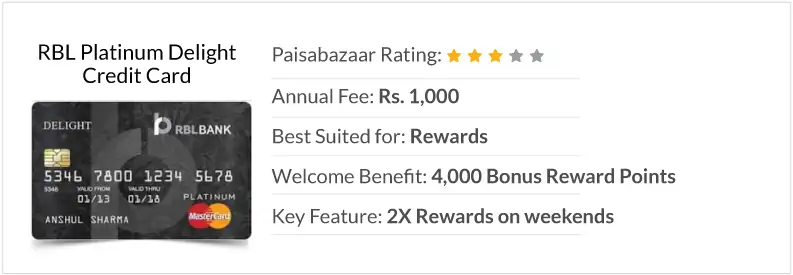

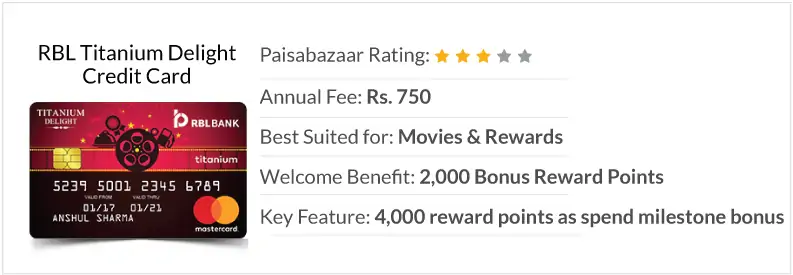

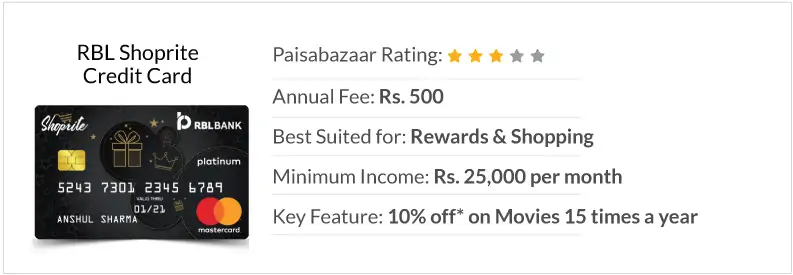

RBL Bank makes up for the lack of lifetime free credit cards by providing many cards that give waiver on the annual fee. The details of best RBL cards are given below:

| Credit Card | Annual Fee | Waiver Condition | Minimum Income Requirement* |

| Platinum Delight Card | Rs. 1,000 | Spend Rs. 1.5 lakh in an anniversary year | Check with bank** |

| Titanium delight Card | Rs. 750 | Spend Rs. 1 lakh in an anniversary year | Check with bank** |

| RBL Shoprite Card | Rs. 500 | Spend Rs. 1 lakh in an anniversary year | Rs.25,000 p.m. |

| Edition Credit Card | Rs. 3,000 | Spend Rs. 2.5 lakh in an anniversary year | Check with bank** |

* The minimum income mentioned is for salaried applicants. The requirement may vary for self-employed individuals.

** Income eligibility for these cards is shared by the bank at the time of application. Please contact bank officials for the same.

Key Highlights

Reward Points – 4,000 reward points upon payment of joining fee and using the card within the first 30 days.

Reward Points – 2 Reward Points for every Rs. 100 spent on any purchase.

Accelerated Reward Points – 4 Reward Points for every Rs.100 spent during the weekends.

Bonus Reward Points – Make 5 transactions of at least Rs. 1,000 each to earn 1,000 Bonus Points every month.

Key Highlights

Welcome Benefits – 2,000 reward points, additional, 1,000 points on spending Rs. 10,000 within first 60 days.

Reward Points – 1 reward point per Rs. 100 spent on travel, groceries, dining and electricity bill payment.

Annual Spend Benefit – Spend Rs. 1.2 lakh or more in a year to get 4,000 bonus points.

Movie Benefit – Buy 1 Get 1 free ticket on Wednesday’s of each month. Maximum discount is Rs. 200, the ticket must be booked through BookMyShow.

Accelerated Reward Points – 40 Reward Points per Rs. 100 spent on pizzas ordered on Wednesdays from Dominos/Pizza Hut. 20 Reward points for every Rs. 100 spent on groceries on Wednesdays. Maximum Reward points that can be earned in a month per category are 1,000.

Convenience Fee Waiver – Fuel surcharge waiver of up to Rs. 100 p.m. on spends between Rs. 500 & Rs. 4,000.

Welcome Benefit – 2,000 reward points.

Reward Points – 1 reward point per Rs.100 spent excluding fuel expenses.

Accelerated Reward Points – 20x Points on grocery spends. 10s Points on fuel spends. Max. 1,000 points per month on each category

Movie Discount – 10% off, up to Rs.100, on movie tickets booked via BookMyShow.

Key Highlights

Cashback – Cashback is provided in the form of Edition cash which can be used on Zomato App only. 1 Edition Cash is = Re. 1. Earn rate is:

Annual Spend Benefits – The benefits are:

| Spent Amount in a year | Benefit |

| Rs. 5 lakh | 2,000 Edition Cash |

| Rs. 2.5 lakh | Annual Fee (Rs. 3,000) waiver |

Zomato Benefit – Free Zomato Gold Membership in India and overseas.

Movie Offer – Buy 1 Get 1 Free movie tickets bought from BMS every month. Maximum discount offered is Rs. 200.

Lounge Access – 2 free domestic airport lounge visits every calendar quarter. Free Priority Pass membership with 2 free accesses per year.

Foreign currency mark-up Fee – Only 1.50%.

No, RBL bank will automatically waive of the annual fee once you spend the required amount.

It is at the discretion of RBL Bank whether they will refund you the money for the previous credit card. However, you may contact them and ask for a refund. You can call on the RBL credit card customer care number +91 22 6232 7777 or send an email at cardservices@rblbank.com.