Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

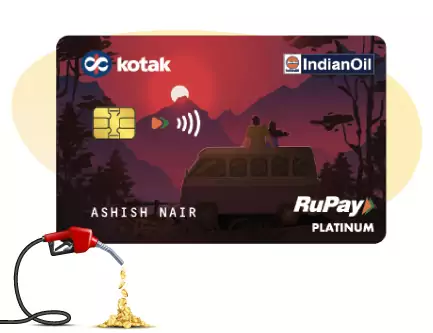

1st Year Fee: ₹449* Plus Applicable Taxes

Co-branded

Up to 5% savings at IndianOil

Shopping

2% value back on grocery & dining

Lifestyle

24x7 personal concierge services

Author: Shruti Sharma

Find Best Credit Card Offers

It hardly takes 2 minutes

Don't worry, this will not affect your credit score

The entered number doesn't seem to be correct

IndianOil Kotak Credit Card is a co-branded fuel credit card offering diverse benefits from accelerated value back on fuel, dining, and grocery spends, along with base value back on UPI transactions (with the RuPay variant). The card offers up to 5% value-back on IndianOil fuel purchases — 4% via reward points and 1% through the fuel surcharge waiver. Additionally, it offers 2% value-back on grocery and dining spends, covering two major everyday spending categories. The accumulated reward points can be redeemed against cashback and products or vouchers through the rewards catalogue. Cardholders can also convert these points into XTRAREWARDS Points (XRP), which can then be used for fuel purchases at IndianOil fuel stations.

While the card offers accelerated value back on fuel, dining and grocery spends, the maximum capping on these categories and a low reward redemption value of 1 RP = Rs. 0.25 limit the overall value back of this card. Also, as the benefits are primarily inclined towards IndianOil, the card functions more as a co-branded fuel card, offering limited benefits apart from IOCL fuel purchases.

Overall, if you’re specifically looking for a fuel credit card and prefer IndianOil fuel outlets over others, this card can help you save significantly on your fuel and daily expenses.

Fuel Benefits

Reward Earning

Reward Redemption

Welcome Benefit

Annual Fee Waiver

Concierge Services

| Fee Type | Amount | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Joining Fee | Rs. 449 + Applicable Taxes | ||||||||||||||||

| Annual Fee | Rs. 449 + Applicable Taxes | ||||||||||||||||

| Finance Charges | 3.75% p.m. (45% p.a.) | ||||||||||||||||

| Late Payment Charges |

|

Given below is a comparison of IndiaOil Kotak Credit Card with similar co-branded cards from Axis Bank and HDFC Bank.

| Particulars | IndianOil Kotak Credit Card | IndianOil HDFC Bank Credit Card | IndianOil Axis Bank Credit Card |

|---|---|---|---|

| Joining Fee | Rs. 449 | Rs. 500 | Rs. 500 |

| Annual/Renewal Fee | Rs. 449 | Rs. 500 | Rs. 500 |

| Renewal Fee Waiver | On spending Rs. 50,000 in the previous year | On spending Rs. 50,000 in the previous year | On spending Rs. 50,000 in the previous year |

| Welcome Benefit | 1,000 bonus reward points as welcome benefit on spending Rs. 500 within 30 days of card issuance | – | 100% cashback of up to Rs. 250 on fuel transactions done in the first 30 days of card issuance |

| Reward Benefit across IndianOil fuel pumps | 24 reward points on every Rs. 150 spent (Up to 1×200 reward points in a month) | 5% of spends as Fuel Points (Up to 250 Fuel Points per month in first 6 months, max. 150 Fuel Points post 6 months from card issuance) | 20 reward points per Rs. 100 spent (On fuel transactions between Rs. 100 and Rs. 5,000 per month) |

| Fuel Surcharge Waiver | 1% fuel surcharge waiver on transactions between Rs. 100 & Rs. 5,059 (Maximum surcharge waiver of Rs. 100 per statement cycle only at IndianOil outlets) | 1% fuel surcharge waiver (Max. of Rs. 250 per statement cycle), applicable on a minimum transaction value of Rs. 400) | 1% fuel surcharge waiver on transactions between Rs. 200 and Rs. 5,000 per month (Maximum waiver of Rs. 50 in a statement cycle) |

| Reward on other categories | 12 reward points on every Rs. 150 spent on grocery and dining (Up to 800 reward points per statement cycle) 3 reward points on every Rs. 150 spent on other categories |

5% as fuel points on grocery and bill payments (Max. 100 Fuel Points per month on each category) 1 Fuel Point for every Rs. 150 spent on all other purchases |

5 reward points per Rs. 100 spent on online shopping (Applicable on online transactions between Rs. 100 and Rs. 5,000) 1 eDGE reward point on every Rs. 100 spent |

| Other Benefits | Personal accident insurance cover of Rs. 2 Lakh Personal concierge assistance |

Complimentary IndianOil XTRAREWARDSTM Program (IXRP) Membership Zero lost card liability Interest free credit period up to 50 days |

10% discount on booking movie tickets through BookMyShow’s app or website Up to 20% discount on dining bills at partner restaurants in India under the Dining Delights program |

You commute daily with your vehicle, and fuel expenses are a significant part of your monthly budget

You prefer fueling at IndianOil fuel stations over other outlets

You are looking for a credit card that offers basic benefits on UPI spends

You can spend Rs. 50,000 in a year to avail the annual fee waiver

Rewards3.0/5

Fuel Benefits3.0/5

Co-branded Benefits4.0/5

With this card, IndianOil loyalists can save up to 5% on their fuel spends, along with an accelerated value back of 2% on everyday categories like dining and groceries. Another significant benefit is that the card is available on the RuPay variant, allowing cardholders to earn rewards even on UPI spends. While the overall value back is capped, this card is still a reasonable choice for daily commuters who prefer IndianOil over other fuel stations.

IndianOil Kotak Credit Card is a suitable choice if you commute daily using your personal vehicle and prefer IndianOil petrol pumps over other fuel stations. While the card claims to offer accelerated benefits on fuel, grocery, and dining, the total value back will still be limited due to the monthly capping, regardless of how much you spend on these categories. This card is a suitable option if your monthly fuel spends are high and you can make most of the available redemption options. However, if you’re looking for rewards on all fuel transactions without brand restrictions, you should consider other popular fuel credit cards.

Everything you need to know about this credit card

Click here to know More Terms and Conditions

Shruti Sharma is a skilled content writer with a passion for simplifying personal finance for consumers. Specializing in credit cards and financial planning, she offers valuable insights that empower individuals to make informed financial choices. Through her writing, she shares practical tips and guides readers through the nuances of credit card usage.