Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

1st Year Fee: ₹12,500* Plus Applicable Taxes

Travel Benefits

Up to 33.33% savings on travel spends

Reward Points

3.33% value-back on regular spends

Lounge Access

16 free lounge visits worldwide yearly

Author: Shruti Sharma

Find Best Credit Card Offers

It hardly takes 2 minutes

Don't worry, this will not affect your credit score

The entered number doesn't seem to be correct

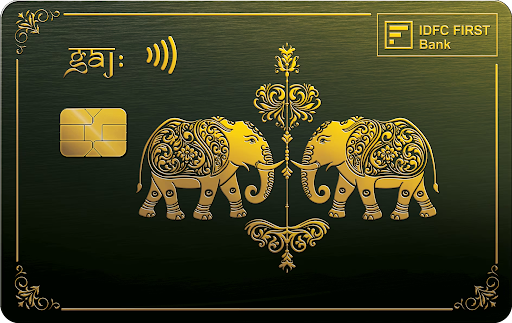

IDFC FIRST Gaj is an invite-only premium credit card that offers benefits across travel and lifestyle categories. With 33.33% value-back on travel spends and 3.33% value-back on regular spends, this card competes well with other premium cards like HDFC Infinia and ICICI Emeralde Private. Like these cards, it also offers a 1:1 reward redemption ratio for travel spends.

A notable benefit is the inclusion of often-excluded categories such as utilities, rent, and insurance spends in the rewards program. The card also comes with a complimentary Digital RuPay card, allowing cardholders to earn reward points on UPI transactions. Additionally, it offers exclusive benefits at ITC Hotels & Elivaas, along with extra benefits at other luxury hotels.

Note: This Card is not available on Paisabazaar. The content on this page is for information only. To express interest in this card, please visit IDFC FIRST Bank’s website.

Rewards Program

Travel Benefits

Trip Cancellation Cover

Lifestyle Benefits

Welcome/Renewal Benefits

Fee Waiver

Fuel Benefit

Insurance Benefits

| Fee Type | Amount |

|---|---|

| Joining Fee | Rs. 12,500 + Applicable Taxes |

| Annual Fee | Rs. 12,500 + Applicable Taxes |

| Finance Charges | 0.71% to 3.85% p.m. (8.5% - 46.2%) |

| Late Payment Fee | 15% of the total amount due (Min. Rs. 100 and Max. Rs. 1,300) |

You are a high spender with a long-standing relationship with the bank

You are a frequent traveller looking to save significantly on your domestic & international travel spends

You are comfortable in redeeming the accumulated reward points against travel spends through the IDFC FIRST mobile app

You can reach the annual spending milestone of Rs. 10 Lakh to avail annual fee waiver

Travel3.5/5

Rewards4.0/5

Lounge Access3.0/5

Lifestyle Benefits3.5/5

IDFC FIRST Gaj Credit Card is one of the best premium credit cards with its excellent reward rate, exclusive hotel & dining benefits, complimentary airport services, free golf rounds, zero forex markup fee, and more. Cardholders can earn up to 33.33% value-back and redeem accumulated reward points against travel bookings via IDFC FIRST app at a 1:1 ratio. While the card competes well with other premium cards in the market, most cards in this fee range offer unlimited airport lounge access and golf benefits. However, with its strong travel and lifestyle privileges, IDFC FIRST Gaj Credit Card turns out to be a suitable option for HNIs seeking an all-rounder premium card.

Everything you need to know about this credit card

To apply for IDFC FIRST Gaj Credit Card, you need to meet the bank’s income and age requirements. Typically, applicants should be at least 25 years old with a stable source of income. Since it’s an invite-only premium card, eligibility may also depend on your banking relationship and credit history.

Yes, you can earn reward points on UPI transactions made using IDFC FIRST Gaj Credit Card. This card comes with a complimentary Digital FIRST RuPay Credit Card, allowing you to earn 1 reward point for every Rs. 150 spent on UPI.

The credit limit on IDFC FIRST Gaj Credit Card is personalized and varies based on your income, credit score, and banking relationship with IDFC FIRST Bank. Premium cardholders usually receive a higher limit compared to standard credit cards.

Upon renewal, IDFC FIRST Gaj Credit Card offers either 12,500 reward points worth Rs. 12,500 on payment of the annual fee, or an annual fee waiver on spending Rs. 10 Lakh in a year.

IDFC FIRST Gaj Credit Card comes with zero forex markup fee, making it a suitable option for international spends.

Yes, you can use IDFC FIRST Gaj Credit Card to withdraw cash at ATMs, but it’s considered a cash advance. Cash withdrawals attract interest from the day of the transaction and may also incur additional fees, so it’s advisable to use this feature only in emergencies.

Click here to know More Terms and Conditions

Shruti Sharma is a skilled content writer with a passion for simplifying personal finance for consumers. Specializing in credit cards and financial planning, she offers valuable insights that empower individuals to make informed financial choices. Through her writing, she shares practical tips and guides readers through the nuances of credit card usage.