Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

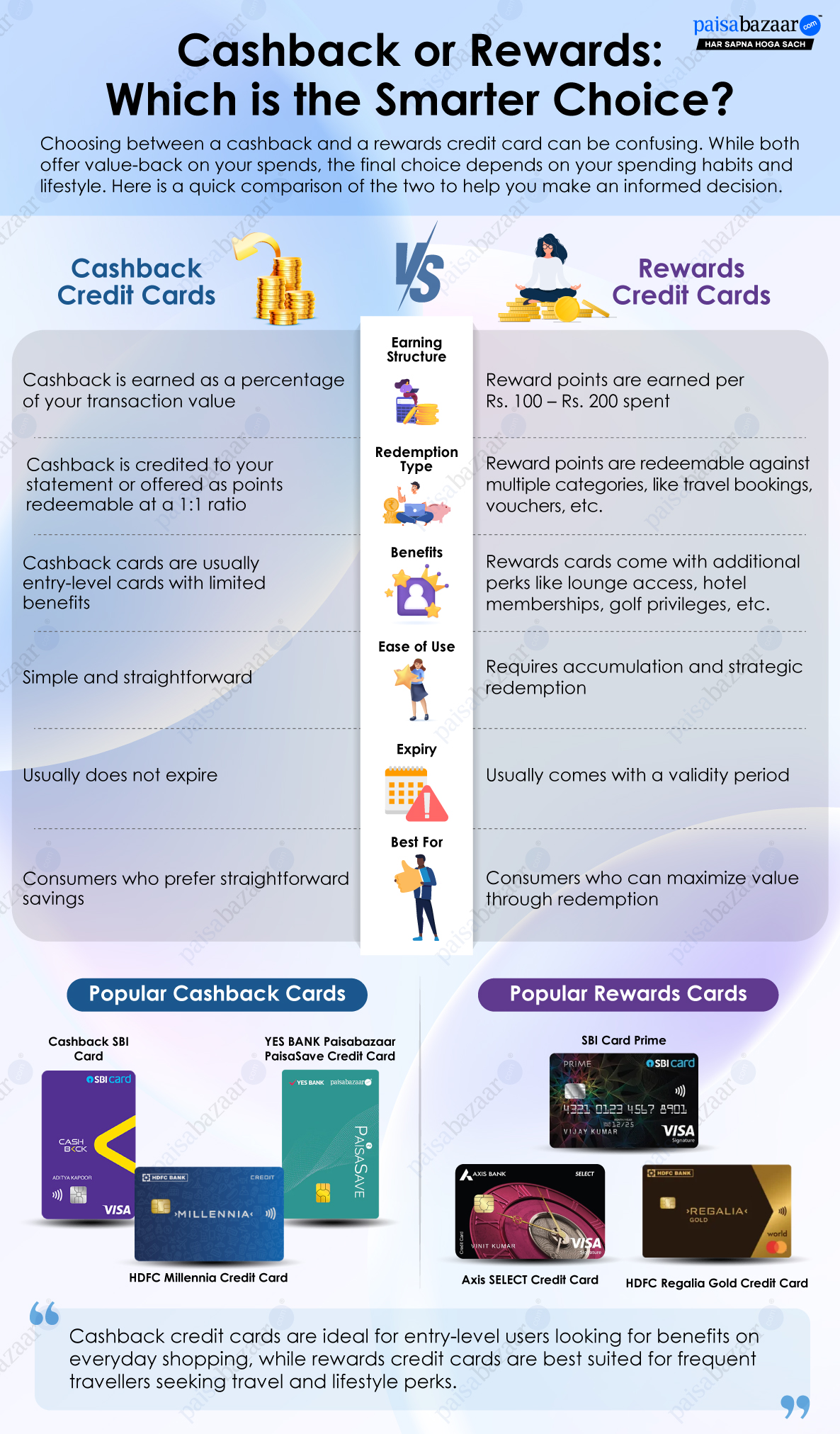

Credit Cards have emerged as a popular alternative to make purchases, owing to a variety of benefits they offer, among which reward points and cashback are two of the most common ones. While cashback credit cards are attractive due to their straightforward benefit structure, rewards credit cards can enable you to accumulate points that can be redeemed against free flights, hotel stays, products, or vouchers.

Both cashback and reward points offer value-back on your spends. Cashback is a straightforward benefit, offering direct value-back either as a statement credit or, in some cases, through reward points that can be redeemed against cashback at a 1:1 ratio.

For instance, with Cashback SBI Card, you can earn 5% cashback on online spends, which is credited directly to your account as a statement credit. Similarly, cards like HDFC Millennia and YES BANK Paisabazaar PaisaSave allow you to accumulate reward points and redeem them against your card statement at a value of 1 Point = Rs. 1.

On the other hand, rewards credit cards offer reward points that are redeemable across a variety of categories, such as travel bookings, vouchers, products & items, and more. Although reward credit cards also allow you to redeem accumulated points against cashback, the value is usually lower compared to other redemption options.

For example, with HDFC Regalia Gold, you can accumulate reward points and redeem them against a variety of categories as per your preference:

Another point to note is that most cashback credit cards are entry-level and cater to everyday shopping needs. Whereas, rewards credit cards, particularly premium ones, not only offer decent value-back but also come with additional benefits such as lounge access, complimentary hotel memberships, golf privileges, and more, enhancing the overall value of the card.

For example, cards like Cashback SBI Card, HDFC Millennia, and Amazon Pay ICICI are some of the best options for cashback, but their benefits are generally limited to online shopping. On the other hand, rewards credit cards like HDFC Regalia Gold and Axis SELECT offer a wider range of benefits along with higher reward rates.

Cashback credit cards offer a portion of the transaction amount of your purchases back to you. The percentage of cashback may differ from card to card and depend on the spending category as well. Some of the cashback cards are co-branded and offer cashback into the partner merchant’s wallet, for example the cashback offered by Amazon Pay ICICI Credit Card is credited as Amazon Pay balance. While in case of some other credit cards, the cashback is added directly to the credit card account. Here are some of the pros & cons of cashback credit cards:

| Pros | Cons |

| Cashback is easy to track as the value is fixed and doesn’t vary based on redemption options | Some cards have a maximum cashback limit per month or category |

| Cashback usually comes with lifetime validity, so you’re not time-bound to redeem it | With certain co-branded cards, cashback is offered into the partner merchant’s wallet |

| Cashback offers direct savings as it is automatically credited to card account | Unlike reward points, cashback cannot be redeemed against multiple categories, such as travel, merchandise, or gift vouchers. |

Rewards credit cards come with an extensive rewards program under which you can earn substantial reward points on your credit card purchases. Some rewards credit cards also offer accelerated reward points on certain spending categories. These reward points can later be redeemed against travel bookings, Air Mile conversion, vouchers, products & items and more via the rewards catalogue. Given below are pros & cons of rewards credit cards:

| Pros | Cons |

| Rewards cards offer more value if points are redeemed strategically | Reward points value vary depending on how and where they are redeemed |

| You can convert or transfer reward points to the loyalty points programs of your issuer’s partner brands | You need to monitor reward points and expiry dates to avoid losing value |

| Rewards cards are more valuable for frequent travellers as they offer higher value-back against travel bookings or Air Miles conversion | Some reward points cannot be redeemed for certain purchases or may require a minimum threshold |

The choice between cashback and rewards credit cards depends on your spending habits. Typically, rewards credit cards are ideal for frequent travellers as they offer reward points or miles, which can be redeemed for Air Miles or hotel/flight bookings, often allowing consumers to avail free flights or hotel stays.

On the other hand, cashback credit cards offer direct savings by offering a percentage of your spending back as direct cash. This makes cashback cards ideal for those who prefer simplicity over strategic reward earning, tracking and redemption.

Ultimately, the best strategy could be to own one of each, using your cashback card for daily spends and your rewards card for travel or big-ticket purchases to maximize overall savings.

Choose Cashback Credit Cards if:

Choose Rewards Credit Cards if: