Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

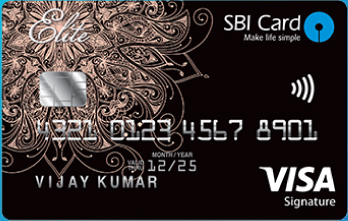

1st Year Fee: ₹4,999* Plus Applicable Taxes

Movie Benefits

Movie tickets worth Rs. 6,000 every year

Milestone Benefits

Up to 50,000 bonus reward points annually

Welcome Benefit

Vouchers worth Rs. 5,000 on card activation

Author: Rupanshi Thapa

Find Best Credit Card Offers

It hardly takes 2 minutes

Don't worry, this will not affect your credit score

The entered number doesn't seem to be correct

SBI Card ELITE is an all-rounder card offering benefits across multiple categories including movies, dining, rewards and more. Cardholders can earn decent rewards on their everyday spends along with substantial milestone benefits, making it a good choice for high-spenders. The card also offers movie tickets worth Rs. 6,000 in a year along with travel benefits like complimentary domestic and international lounge access and low foreign exchange mark-up fee.

Consumers who can maximize the movie benefit and spend a good amount through the card would be able to compensate for the fee charged. However, those who specifically seek travel benefits should look for other cards that offer benefits more inclined towards travel, such as Axis Atlas, or an airline co-branded credit card of their preference. High-spenders can also consider premium cards that comes with a high reward rate along with substantial benefits on travel and lifestyle spends, such as HDFC Diners Club Black or YES Marquee Credit Card.

Rewards Program

Milestone Benefits

Cardholders can get up to 50,000 Bonus Reward Points worth Rs. 12,500 in a year in the following manner:

Also Read: Best credit cards in India 2026

Despite charging a significantly high annual fee of Rs. 4,999, SBI Card ELITE’s reward rate of 2.5% (on the accelerated category) is lower than many entry-level and mid-range cards. SBI Card’s own Cashback Credit Card offers 5% value-back across all online spends, at an annual fee of Rs. 999. Earlier the card offered complimentary Trident Red Tier and Club Vistara Silver Tier memberships, which added significant value for travellers. However, now both memberships have been discontinued, leaving travellers with only lounge access feature to avail.

Also Read: International Lounge Access credit cards

This is mandatory field

If you spend upto ₹0/yr

Spend Rewards₹0

Milestone Benefits₹0

You save₹0

₹4,999 Plus Applicable Taxes

NA₹4,999 Plus Applicable Taxes

Waived off on annual spends of Rs. 10 lakhNeed Help understanding?

| Fee Type | Amount | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Joining Fee | Rs. 4,999 + Taxes | ||||||||||||||

| Annual Fee | Rs. 4,999 + Taxes | ||||||||||||||

| Finance Charges | 3.50% p.m. | 42% p.a. | ||||||||||||||

| Late Payment Charges |

|

You put most of the expenses on your credit card every month

You go out for movies and dining many times in a month

Complimentary domestic and international lounge access is a valuable feature for you

You would like to earn accelerated rewards on grocery and departmental store spends

Age: 21 to 70 years

Occupation: Salaried or Self-employed

Documents Required: PAN, Aadhaar or any other government approved photo ID and address proof, along with last 3-month’s salary slip or bank statement as proof of income

Travel3.5/5

Rewards3.5/5

Welcome Benefits4.0/5

Rewards Flexibility3.0/5

SBI Card ELITE offers a decent reward rate across quite practical categories like grocery and dining. Moreover, movie benefit on the card is excellent wherein cardholders can get free movie tickets worth Rs. 6,000 in a year. This benefit alone can compensate for the card’s annual fee of Rs. 4,999, if maximized. Overall, the card stands a good option for people who regularly spend a considerable amount across the bonus categories and seek movie benefits from the card.

Though SBI Card ELITE charges a high annual fee, the value-back (2.5%) offered through its rewards program is not impressive, especially in a market where many mid-range cards offer up to 5% value-back. Club Vistara and Trident Hotel membership has also been discontinued, which again reduces the card’s overall proposition an an all-rounder option. While the first-year fee is completely compensated for in the form of vouchers, second year onwards consumers would have to spend at least Rs. 10 Lakh in a year to get the fee waived off. Spending such a substantial amount through a card that features an average reward rate of 2.5% is perhaps not a good idea. Before getting the card, consumers should explore other entry-level and mid-range card options with good reward rate.

Everything you need to know about this credit card

Click here to know More Terms and Conditions

Rupanshi is a personal finance writer, specializing in credit cards and consumer finance. Her work is committed to helping readers navigate the complex world of credit with confidence– whether they are selecting the right credit card, optimizings rewards, managing debt, or improving their financial well-being. Through her detailed insights and actionable advice, she guides readers towards smarter financial choices.