Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

1st Year Fee: ₹2,999* Plus Applicable Taxes

Shopping

Up to 7.5% value-back on Titan Group brands

Rewards

6 reward points per Rs. 100 spent

Lounge Access

Domestic & international visits every year

Author: Megha Khanna

Find Best Credit Card Offers

It hardly takes 2 minutes

Don't worry, this will not affect your credit score

The entered number doesn't seem to be correct

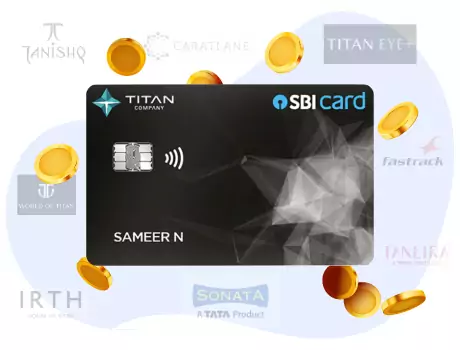

In its first co-branded card partnership, Titan launched the Titan SBI Credit Card in March 2024. Available at an annual fee of Rs. 2,999, the card provides good value across all categories but the standout feature is its accelerated value-back on gold and jewellery purchases through Titan-owned brands- Tanishq, Zoya, Caratlane and Mia. Where most credit cards have excluded gold and jewellery spends from their rewards program, getting up to 5% cashback on these spends could be quite valuable for consumers who spend a considerable amount on this category.

Additionally, it offers accelerated value-back on other Titan-owned brands including Taneira, Titan Eye+, Fastrack, Helios, Skinn, Sonata, Irth and World of Titan. Most of these brands do not belong to the ‘everyday spends’ category.

This card is not available on Paisabazaar.com. The content on this page is for information only.To express interest in this card, please visit SBI Card website.

If you spend Rs. 1 Lakh each on Tanishq and Caratlane in a quarter, you can save Rs. 3,000 on Tanishq and Rs. 5,000 on Caratlane. Savings of Rs. 8,000 on total spends of Rs. 2 Lakh may look like a small number but since most cards do not offer any value-back on these categories, putting such spends on the Titan card makes sense. Cashback of 7.5% across other brands is also higher than what other co-branded cards would offer on the associated platforms. However, an important point to consider here is that Titan Eye+, Fastrack, Skinn, etc. are not everyday brands and you may not be able to earn a maximum cashback of Rs. 10,000 every quarter, as you would have to spend around Rs. 1.30 Lakh per quarter on these brands. Reward rate of 1.5% across all other spends is decent for a co-branded card. However, unlike other cards that offer multiple redemption options across cash, product catalogue, etc., here the rewards can be redeemed only as Titan vouchers, which could be limiting for some users.

| Fee Type | Amount | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Joining Fee | Rs. 2,999 | ||||||||||||||

| Annual Fee | Rs. 2,999 | ||||||||||||||

| Finance Charges | 3.5% p.m. | 42% p.a. | ||||||||||||||

| Late Payment Charges |

|

You frequently spend on gold and jewellery purchases with your credit card

Your existing credit cards excludes gold/ jewellery spends from rewards program

You already own another card for better rewards on everyday spends

You like making frequent purchases at Titan group owned brands

Rewards3.0/5

Welcome Benefits3.5/5

Milestone Benefits3.5/5

Co-branded Benefits3.5/5

The card compensates for the joining fee charged by providing reward points worth Rs. 3,000. Also, with the accelerated benefit targeted towards brands like Tanishq, Mia, Caratlane, Zoya, Taneira, etc., the fee waiver criteria of Rs. 3 Lakh is easily achievable. For instance, a user spending around Rs. 75,000 per quarter for their jewellery purchase can easily meet the fee waiver criteria, in addition to earning up to 7.5% cashback on the quarterly spends. Additionally, where most co-branded credit cards (except those belonging to the travel segment) come with basic lounge access features,this card features much more in this category

With four different jewellery brands in the list, the card offers users more opportunities to explore options, make purchases, and earn value-back. Unlike most cards where the return is credited monthly, this card keeps it capped quarterly. On non-Titan brands, you get 1.5% value back in the form of reward points, redeemable against Titan vouchers—reaffirming the card’s co-branded identity. While this partnership is advantageous for individuals making frequent high-end purchases, it may not suit those seeking savings on everyday expenses like groceries, dining, or general online spending. So if you are looking to save on practical everyday categories, this card may not be the right choice. In comparison to other credit cards, which keep the spend threshold comparatively lower for the milestone benefits, this card keeps it quite high at Rs. 5 lakh and Rs. 10 lakh. This further indicates that the benefits can be maximized by those who like making big-ticket purchases via their credit card frequently and, in this case, preferably on the partnered Titan brands.

Everything you need to know about this credit card

Click here to know More Terms and Conditions

Megha is an experienced writer with a specialization in credit cards and personal finance. With a keen eye for detail and a passion for helping readers make informed financial choices, she creates engaging content that demystifies the complexities of credit cards, from rewards and benefits to interest rates and fees.