Amid the widespread panic and resultant losses due to COVID-19 pandemic, Reserve Bank of India permitted all banks and financial institutions to provide a 3-month moratorium on all term loans, including personal loans, as a temporary relief for those severely impacted by the health crisis and the lockdown.

What Does the Moratorium Mean?

The moratorium means that you are legally allowed to postpone the payment of your personal loan EMIs for the next 3 months with the due dates falling between 1st March, 2020 and 31st May, 2020. No penalty or charges will be levied for such a delay in payment however interest will keep accruing during this period.

How the Moratorium Will Affect my Loan Tenure?

Your repayment tenure for the personal loan will be extended by 90 days, if you opt for the moratorium. For example, if your loan was set to mature on 10th March, 2022, then it will now mature on 10th June, 2022.

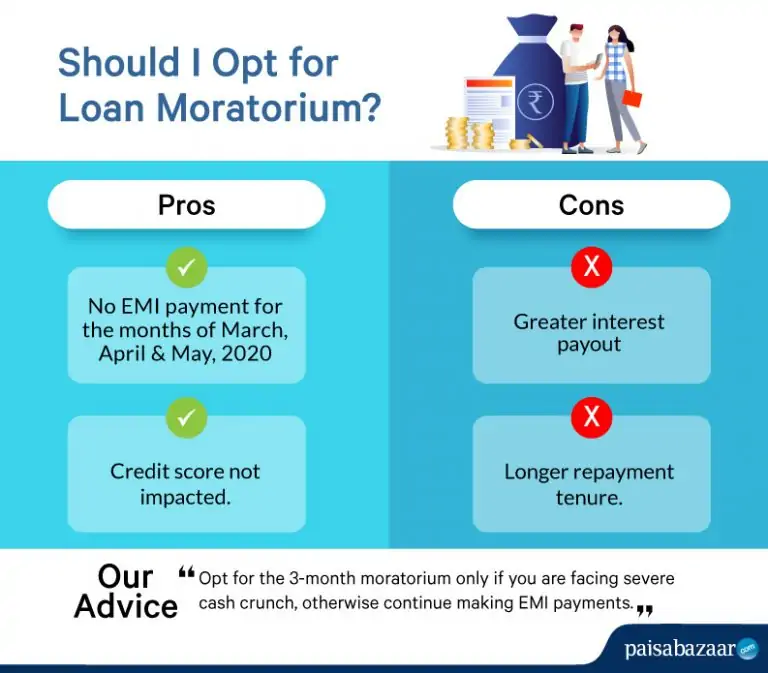

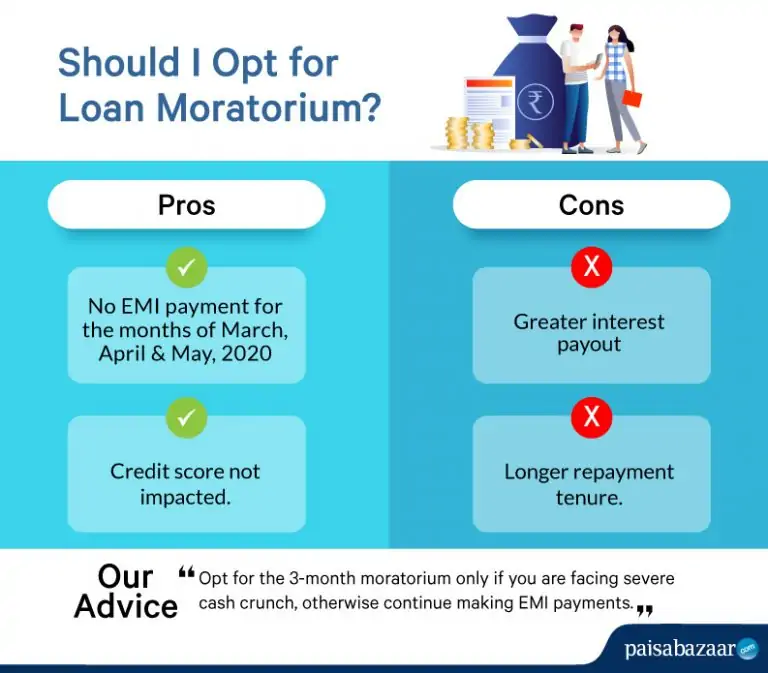

Should I Opt For the Moratorium?

The answer to this question depends on the following two factors:

- Effect of COVID-19 and the associated lockdown on your income;

- The amount of interest that will be accrued during the 3-month moratorium.

If your income and cashflow has been severely affected because of the pandemic and it is not possible for you to pay the EMIs on the designated due dates, then you may take the benefit of this moratorium. However, it should be kept in mind that the EMI payment is only being delayed and not waived off. The interest will keep accruing over the moratorium period, and hence you will have to pay slightly extra later.

For example: Suppose you have an outstanding personal loan of Rs. 5 lakh at 18% p.a. interest rate at the time of the moratorium with residual tenure of 54 months. The following are

If you do not opt for the moratorium:

| Total interest payable for 4 year 6 months loan tenure | Rs. 2.33 lakh |

| Total amount to be repaid (Principal + Interest) | Rs. 7.33 lakh |

If you opt for the moratorium:

| Extra interest incurred during the moratorium period of 3 months* | Rs. 22,840 |

| Interest payable over the remainder of the loan tenure (4 year and 6 months)** | Rs. 2.33 lakh |

| Total amount to be repaid (Principal + Interest + moratorium period interest) | Rs. 7.56 lakh |

Note: * Extra interest incurred during the moratorium period of 3 months = 7500 (Month 1 interest) + 7613 (Month 2 interest) + 7727 (Month 3 interest) = Rs. 22,840

** As your loan tenure will be extended by 3 months as a result of the moratorium you still have to pay the interest incurred for the original 4 year 6 month remaining tenure of the loan = Rs. 2.33 lakh

***The above example is for illustrative purposes only and actual values/calculation method may differ from lender to lender.

Thus in the above case you have to pay an additional Rs. 22,840 in interest just for taking the 3 month moratorium on payment. This amount can be much greater if your loan amount and interest rate are higher too. In effect your personal loan interest cost can increase significantly if you opt for the moratorium.

Will the Moratorium Affect my Credit Score?

No, the moratorium will not affect your credit score. Any delay in making EMI payment during this period (1st March, 2020 to 31st May, 2020) will not be considered as a default by the credit bureaus Rating Agencies (CRAs), and hence your credit score will remain unaffected.

How Can I Opt for the Moratorium?

The following table summarizes the procedure to opt for the moratorium with respect to the leading Banks and Non Banking Financial Companies (NBFCs).

| Bank/ NBFC | How to Opt? |

| Axis Bank | Visit the bank website and send an SMS/ email. |

| Bajaj Finserv | Send an email at wecare@bajajfinserv.in. |

| Canara Bank | -Either reply “No” to the SMS sent by the bank from the number 8422004008.

-Or, send an email to retailbankingwing@canarabank.com. |

| Central Bank of India | Automatic enrolment on missing payment. |

| HDFC Bank | -Call on 022-50042333 or 022-50042211 and follow the instructions.

-Or, submit your request on the bank’s website. |

| HSBC Bank | Apply online by clicking here. |

| ICICI Bank | Send an SMS or email to the bank. |

| IDBI Bank | Automatic enrolment on missing payment. |

| IDFC FIRST Bank | -Either send an SMS to 8007010908.

-Or, send an email to help@idfcfirstbank.com. |

| Kotak Mahindra Bank | Send an email at pay.later@kotak.com. |

| Punjab & Sind Bank | Automatic enrolment on missing payment. |

| Standard Chartered Bank | Automatic enrolment on missing payment. |

| State Bank of India | Send an email to opt for the moratorium. |

| UCO Bank | Automatic enrolment on missing payment. |

Conclusion

We advise you to defer your EMI payments on your personal loan by choosing the moratorium only if your income has been severely impacted or you want to stay conservative with your cashflow during the crisis. Otherwise, you should continue to pay your EMIs as per schedule. For those choosing the moratorium, do calculate the extra interest you would need to pay after the moratorium period.