Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Andhra Bank Pension Loan is designed to fulfil the personal needs pensioners facing a financial emergency or other fund requirement. From wedding in the family to medical condition and vacation to home renovation and much more, Andhra Bank Pension Loan caters to various personal needs by offering a loan amount of up to Rs. 5 lakh.

Table of Contents :

| Pension Loan Tenure | Rate of Interest |

| Up to 36 months | 11.10% onwards |

| More than 36 months to 60 months | 11.35% onwards |

Please note that the bank may ask you for additional documents apart from the ones mentioned above.

| Processing Fee | Nominal as per the guidelines in force |

| Administrative Charges | Collected at the end of every quarter as per the bank’s guidelines |

| Part Prepayment Charges | Nil |

| Foreclosure Charges | Nil |

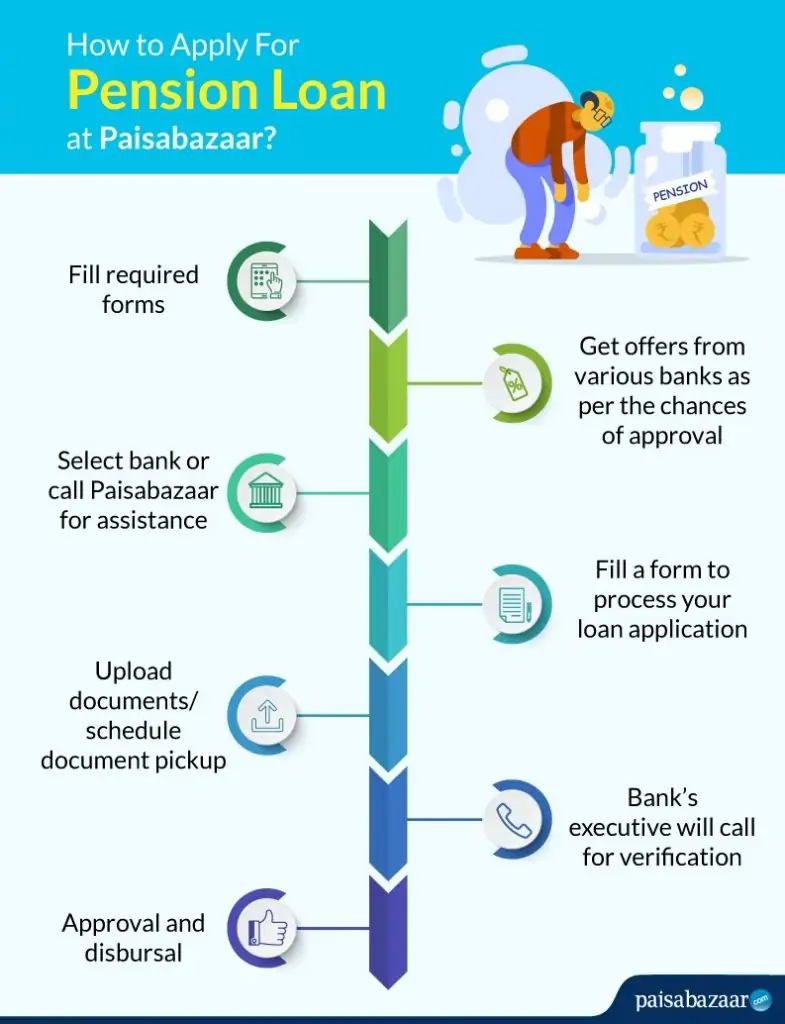

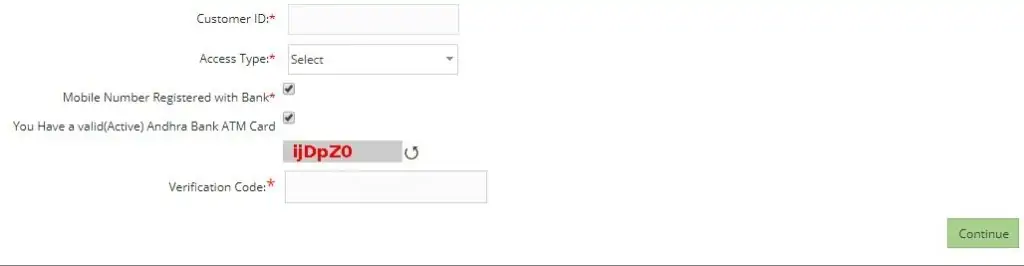

If you already have registered to internet banking, follow the steps to login:

If you are a new user, register yourself first by following the steps mentioned below:

The following table gives you an estimate how much EMI you will have to pay for your Andhra Bank pension loan for various loan amount, loan interest rates and tenures:

| Loan Amount (Rs.) and Interest Rate (p.a.) |

Monthly EMI Payout (Rs.) |

||||

| 1 year | 2 years | 3 years | 4 years | 5 years | |

| 3 lakh @ 11.20% | Rs. 26,542 | Rs. 14,010 | Rs. 9,850 | Rs. 7,782 | Rs. 6,552 |

| 4 lakh @ 12% | Rs. 35,539 | Rs. 18,829 | Rs. 13,285 | Rs. 10,533 | Rs. 8,897 |

| 5 lakh @ 12.5% | Rs. 44,541 | Rs. 23,653 | Rs. 16,726 | Rs. 13,289 | Rs. 11,248 |

The following table compares Andhra Bank pension loan to similar products by other leading lenders:

| Particulars | Andhra Bank | Bank of India | SBI | Indian Bank |

| Interest Rate | Starting from 11.20% | Starting from 9.75% | Starting from 11.30% | Starting from 11.15% |

| Tenure | Up to 60 months | Up to 60 months | Up to 84 months | Up to 60 months |

| Loan amount | Up to Rs. 5 lakh | Up to Rs. 5 lakh | Up to Rs. 14 lakh | Up to 6 lakh |

| Processing Fee | Nominal as per the guidelines in force | 2% of loan amount (Min. Rs. 500, Max. Rs. 2,000) | 0.50% of loan amount (Min. Rs. 500, Max. Rs. 2,500) | Nil for loans up to Rs. 25,000/Rs. 255 for loans > Rs. 25,000 |

Important Aspects (Things to Remember While Applying)

Q1. How do I repay Andhra Bank Pension Loan?

You can conveniently repay Andhra Bank Pension loan in EMIs at any of the bank branches. Also, you can give standing instructions to deduct the same form your savings account.

Q2. Can I foreclose my Andhra Bank Pension Loan?

Yes, you can foreclose your pension loan without any foreclosure charges.

Q3. Who can be my co-applicant for Andhra Bank pension loan?

Your co-applicant for a pension loan from Andhra Bank can either be your family pensioner or a nominee.

Q4. Are there any foreclosure charges for pension loan from Andhra Bank?

No. Andhra Bank pension loan is currently offered with zero foreclosure charges.

Q5. How long does disbursal of pension loan take?

Typically Andhra Bank disburses pension loan within 5 business days of receiving all applicable documents. This time period can however be longer depending on key factors such as loan amount and applicant profile.