Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

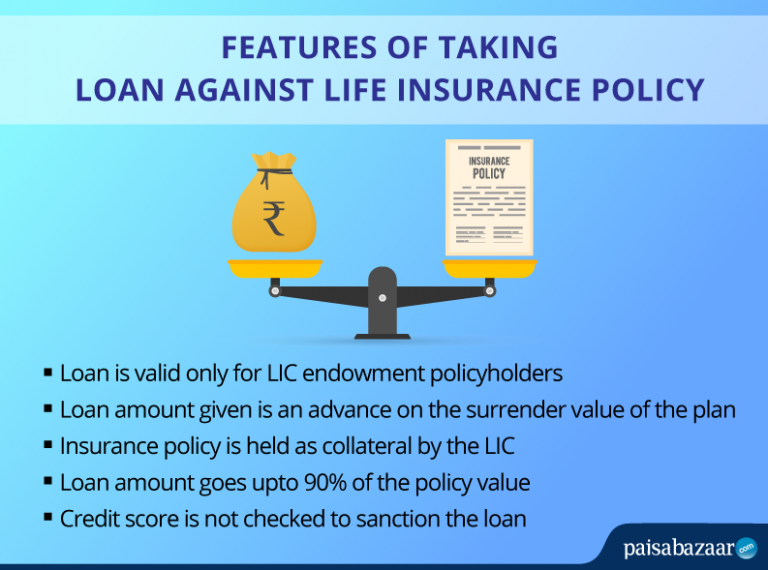

A life insurance policy is a reliable and useful investment option as it not only offers protection cover but also provides additional benefits including taking a loan against the policy. At the time of financial crises, one can consider taking a loan against Life Insurance Policy as it is easier to get and is secured against your policy for which you have been paying premium. Also, unlike loan against shares and gold, the value of Life Insurance Policy does not change with change in market.

List of Top Banks/NBFCs in India Offering Personal Loans at Low Interest Rates Click Here

A Life Insurance Policy is taken to provide financial security to the loved ones. However, if you wish to avail a loan against the policy, do it only when there is an emergency situation and there is no other option left. Also, make sure to avail a loan for 6 months or maximum 1 year so that you can restore the benefits of the policy.