Until now only savings and current accounts could be linked to UPI platforms. Now, however, the Reserve Bank of India has allowed the linking of credit cards to UPI platforms.

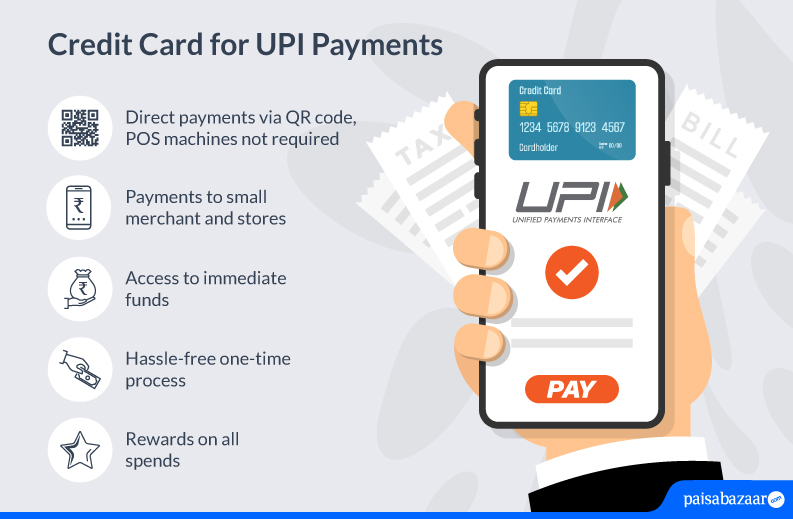

UPI payments and credit cards both come with diverse benefits. While UPI allows hassle-free, quick, and convenient options, credit cards come with rewards, discounts, and most importantly, access to immediate funds. Thereby, to offer you the best of both worlds, leading card issuers like HDFC Bank, Axis Bank, SBI Card, IDFC FIRST Bank, Bank of Baroda etc, have initiated linking of credit cards to UPI.

The procedure will begin with RuPay credit cards. This move offers more convenience to the users as they can use their mobile phone to make a payment while availing the benefits of a credit card. Users can directly link their RuPay Credit Cards with the UPI app of their choice such as Google Pay, PhonePe, Paytm, BHIM UPI, etc.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number