Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

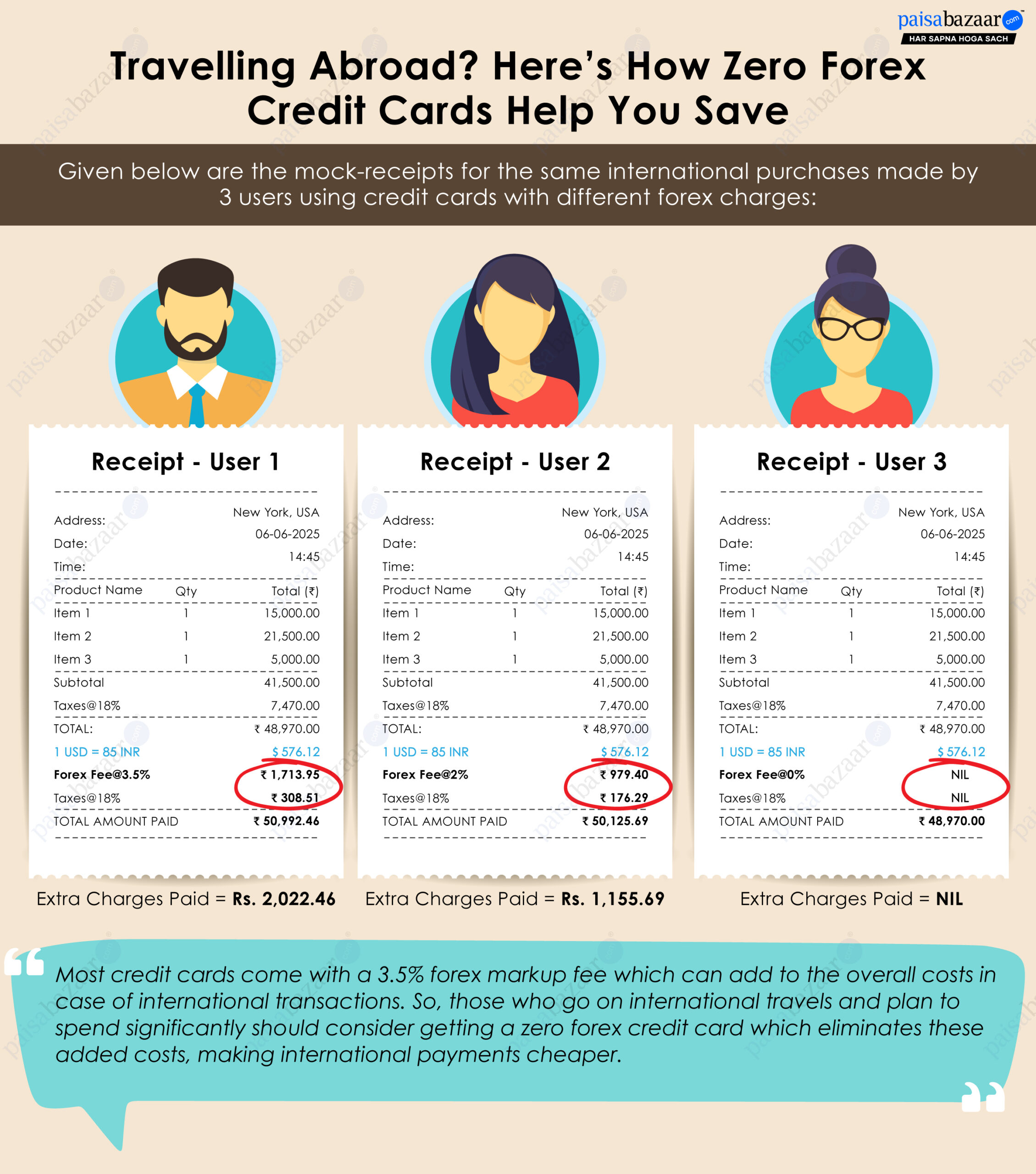

When planning to travel abroad or making purchases outside the country, it is essential to take into account the added cost of foreign exchange markup fee that is charged on international transactions. Generally, most credit cards levy a forex markup fee of around 2% to 3.5% on every such purchase. Though it might seem to be a small amount, it can accumulate with every spend, thus not only increasing the cost of every international spend, but also affecting the overall travel budget. So, it is important to understand how and when this fee is implemented to manage your expenditure during international travels.

To mitigate these additional costs, zero forex credit cards or cards with a lower forex fee can prove to be quite advantageous. These cards are designed to help reduce such additional costs or even completely eliminate them and ensure that you are not over charged on your international spends.

Given below is a comparative illustration of how forex charges can add to the overall shopping costs and how credit cards with a lower or zero forex charges help you save:

Suggested Read: Best Credit Cards for International Travel