Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

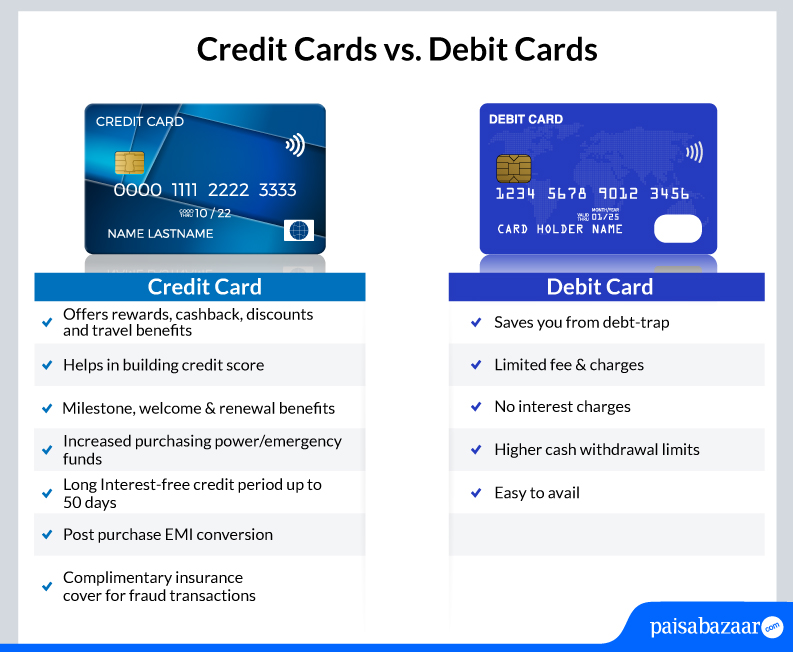

Credit cards and debit cards may look similar in appearance, but they function quite differently. While a credit card is a short-term loan offered by the card issuer (which requires repayment), a debit card allows you to spend money directly from your savings or current account. Read on to understand the key differences between a credit card and a debit card.

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Exclusive Pre-Approved Cards waiting for you

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Error: Please enter a valid number

Most young Indians, whether salaried professionals or business owners, carry at least one of these cards for everyday expenses like fuel, bill payments, and grocery shopping, as well as big ticket purchases like flight bookings, consumer durables, and more. However, not many consumers are aware of the key differences between a credit card and a debit card and which of these is better. Below, we have listed the major differences between the two.

While both debit and credit cards look the same, here’s how they differ from each other:

Eligibility

Getting a debit card is easier compared to a credit card. A debit card is issued when you open a savings, salary, or current account, with no additional credit requirements. Whereas credit card approval depends on specific eligibility criteria, such as a strong credit score, good repayment history, and stable income.

Source of Funds

The primary difference between a debit card and a credit card is where the money comes from and how much money you can use. With a debit card, the money is directly debited from your linked savings account or current account. On the other hand, a credit card lets you borrow money up to a certain limit and repay it later—allowing you to spend more than what you currently have.

Spending Limit

With debit cards you can spend only the amount you have in your linked savings or current account. Whereas, when you apply for a credit card, a separate credit card account will be opened. The credit limit available on this account is decided by the lender based on factors like your credit score, credit utilization ratio, and income. Therefore, a credit card lets you spend more than the money you have, whereas, with a debit card, you can spend only up to the amount you have in your savings/current account.

Bill Payments

Since in the case of debit cards, the amount is deducted from your savings account or your current account directly, you do not have to make any repayments on your debit card. On the other hand, with a credit card, you can borrow money and repay in monthly bill payments. You have the option of paying the minimum amount due, a little over your minimum amount due, or the total amount outstanding on your card each month. You will also have a fixed due date by which you have to make this repayment.

Impact on Credit Score

Using a credit card responsibly can help you build and improve your credit score. Timely repayments reflect positively, while defaults or delays negatively impact your score. In the case of a debit card, there is no impact on the credit ratings, as it is not a credit instrument.

Rewards and Other Benefits

Credit cards generally offer better rewards and benefits than debit cards. Depending upon the type of credit card you have, you may be eligible for several benefits, such as discounts on your purchases and free memberships. You can also earn cashback or reward points with each transaction made on the credit card that you can use to redeem on certain purchases in the future. Besides this, credit cards come in various types, catering to different lifestyle needs—travel cards offering air miles, fuel cards, shopping cards, and more. Debit cards may also offer some benefits, but they are typically limited and not as extensive as those offered by credit cards.

Safety

Credit cards provide better safety as compared to debit cards in case of lost/stolen cards or unauthorized transactions. Any fraudulent transaction via debit card means the amount is deducted from the account instantly, whereas in credit cards there is no impact on funds at hand in case of fraud. However, it must be ensured that you report any loss/misuse of the card immediately to the card issuer by contacting their customer care.

Choosing between a debit card and a credit card depends on your financial habits, goals, and spending behaviour. A debit card is ideal for those who want to avoid debt and prefer spending only what they already have in their bank account. It offers simplicity and control over your finances but comes with limited rewards and does not help build a credit history.

On the other hand, a credit card allows you to borrow money up to an assigned limit, offers enhanced benefits like cashback, rewards, and travel benefits, and helps build a good credit score—as long as you pay your bills on time.

However, one thing to note is that credit cards require financial discipline; missed payments or overspending can lead to high interest charges and can have a negative impact on your credit score.

Credit Card vs. Debit Card |

|||

| Particulars | Credit Card | Debit Card | |

| Availability of Funds | Borrowings from the card issuer | Deductions from your savings or current account | |

| Spending Limits | You can spend within your pre-fixed credit limit | You can spend only up to the balance available in your savings or current account | |

| Advantage | Short term loan as per your credibility | Saves you from debt-trap as you spend as per available funds | |

| Purchases | The card issuer pays for you purchases which you pay back by the due date | You pay directly from your bank account | |

| Statements | Billing statements for each cycle that includes all spends you make with the card | No specific billing statements; Debit card spends are mentioned in the savings/current account passbook | |

| Important Fee & Charges | Joining fee, annual fee, late payment fee, interest charges, etc | Cash withdrawal fee, annual fee (in some cases), etc | |

| Interest | Include interest rate charges in case of late payment | No interest charges are applicable | |

| Rewards and cashback | Extensive in comparison to debit cards (may vary across card to card) | Minor rewards and cashback benefits | |

| Application | You need to apply for a credit card with the issuer to have one | Often offered along a savings/current/salary account | |

| Repayment | Monthly Repayments | No Repayments | |

| EMI Facility | Mostly offered on transactions above Rs. 2,500 (may vary across issuer) | Offered on limited transaction as per vendor-bank agreement | |

| Impact on Credit Score | Impacts your credit score directly | No direct impact on credit score | |

| Additional Privileges |

|

|

|

The choice between a credit card and a debit card depends on your spending habits and financial discipline. If you prefer to spend only what you already have in your savings or salary account, a debit card is ideal. However, if you’re looking to build credit history and avail additional benefits and rewards, you can opt for a credit card as per the eligibility.

Credit card issuers generally prefer applicants with a good credit score (usually 750 or above). However, individuals who are new to credit can apply for secured or entry-level credit cards to start building their credit profile.

Yes, a credit card is generally considered safer than a debit card. Most credit cards come with fraud protection against unauthorized transactions or lost/stolen cards. Moreover, in the case of an unauthorized transaction, the money is not directly debited from your bank account, giving you time to report the issue and safeguard your funds.

Yes, you can withdraw cash using a credit card. However, it’s not advisable, as card issuers typically charge a cash advance fee of around 3.5% of the withdrawn amount—along with high interest charges from the day of withdrawal. Therefore, it’s better to use a debit card for cash withdrawals.

The primary difference lies in the source of funds. A debit card draws money directly from your savings or current account, whereas a credit card allows you to borrow money up to a pre-approved limit and repay it later in monthly billing cycles.