Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

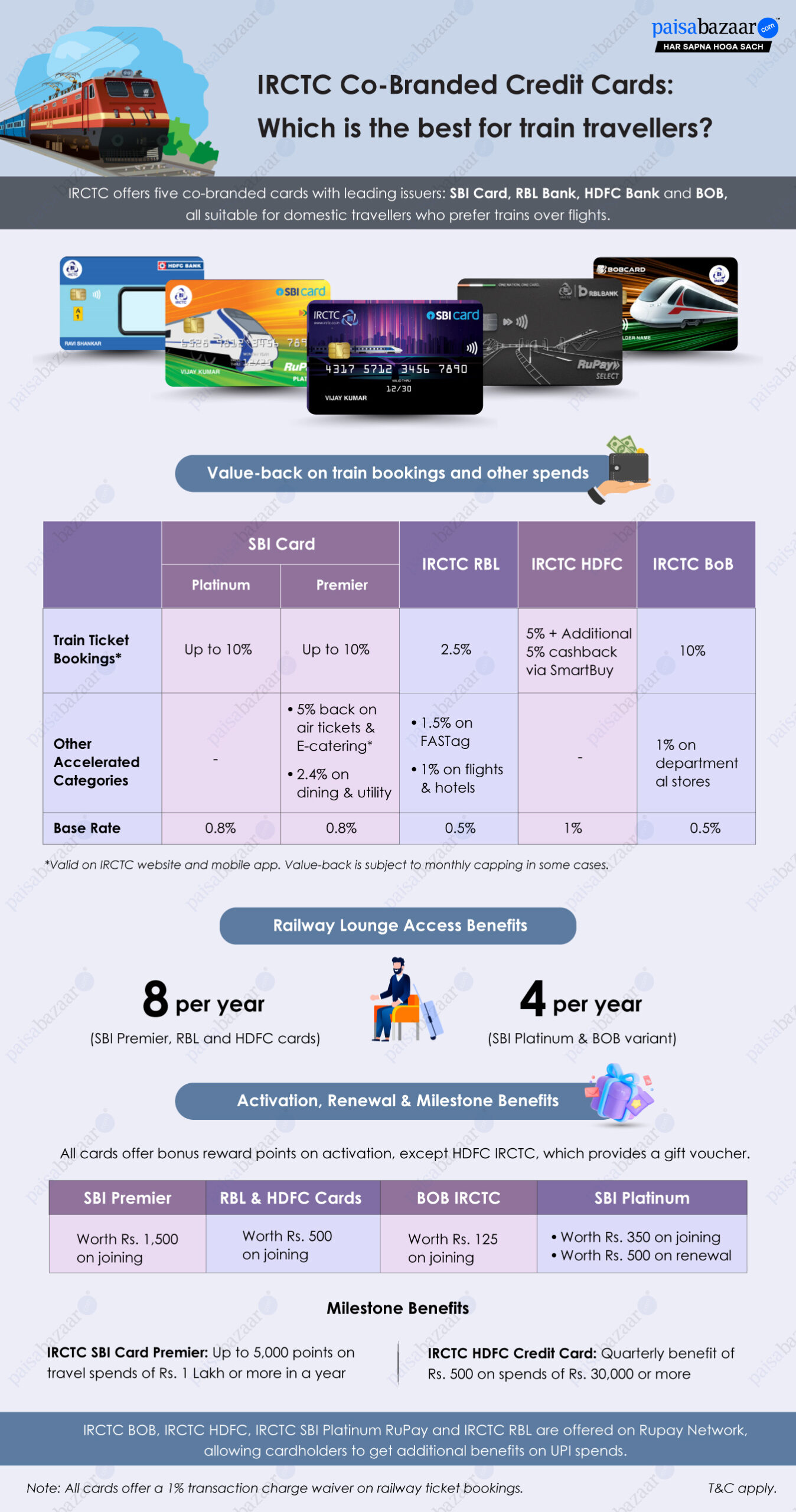

Catering to travellers who prefer train journeys, IRCTC offers co-branded credit cards in collaboration with four major issuers – SBI Card, HDFC Bank, RBL Bank, and Bank of Baroda. These cards offer savings on train bookings through accelerated value-back, while also rewarding you on everyday spends. So, if you frequently travel via trains, an IRCTC credit card could be a smart way to reduce your travel costs. On this page, we compare all five IRCTC co-branded cards to help you decide which one to pick.

Instead of direct cashback or discount benefits, these IRCTC credit cards offer reward points with a 1:1 redemption ratio redeemable across train bookings via IRCTC. However, an exception to this is the IRCTC BOB Card, which offers a low redemption value of Rs. 0.25 per reward with redemption limited to statement balance.

Here is the value-back you earn on train bookings via the IRCTC app and website:

| SBI Card | IRCTC RBL | IRCTC HDFC | IRCTC BOB | ||

| Platinum | Premier | ||||

| Value-back | Up to 10% | Up to 10% | 2.5% | 5% + Additional 5% cashback via SmartBuy | 10% |

| Breakdown of value-back | |||||

| Earning | 10 rewards per Rs. 100 | 10 rewards per Rs. 100 | 5 points per Rs. 200 | 5 points per Rs. 100 | 40 points per Rs. 200 |

| Per reward value | 1 | 1 | 1 | 1 | 0.25 |

| Base rate | 0.8% | 0.8% | 0.5% | 1% | 0.5% |

| SBI Card Premier |

|

||

| IRCTC RBL |

|

||

| IRCTC BOB |

|

||

Some points to note:

Complimentary railway lounge visits on your credit card can be a good add-on benefit, highly beneficial in times of long waiting hours at the stations. IRCTC credit cards offer lounge access benefits as follows:

Suggested Read: Best Credit Cards for Lounge Access

Though IRCTC credit cards belong to the low annual fee group, they compensate for the first-year fee with complimentary activation benefits. All of these cards offer bonus reward points on activation, except HDFC IRCTC, which provides a gift voucher.

| SBI Premier | RBL & HDFC Cards | BOB IRCTC | SBI Platinum |

| Worth Rs. 1,500 on joining | Worth Rs. 500 on joining | Worth Rs. 125 on joining |

|

Unlike other cards, BOB IRCTC and SBI Platinum offer a marginal difference in the value-back and the fee. However, SBI Platinum also offers renewal benefits every year, which no other card does.

Among these, SBI Premier and IRCTC HDFC allow milestone perks to add more to the value-back potential of high spenders.

Here, Premier offers a return of 5%, but since the spend calculation is limited to travel, this could be limiting for some consumers, especially those who own other travel cards. Comparatively, the HDFC variant offers a return of just 1.67% per year via milestone benefits, but the spends are not restricted.

| SBI Card | IRCTC RBL | IRCTC HDFC | IRCTC BoB | ||

| Platinum | Premier | ||||

| Railway Surcharge Waiver (1%) | Yes | Yes | Yes (Up to Rs. 200) |

Yes (Up to Rs. 1,000) |

Yes |

| Fuel Surcharge Waiver (1%) |

Yes | Yes | – | Yes | Yes |

| Airline Surcharge Waiver | – | 1.8% | – | – | – |

| Annual Fee Waiver | – | Rs. 2 Lakh | – | Rs. 1.5 Lakh | – |

| Others | – | Fraud Liability Cover of Rs. 1 Lakh | Rs. 5,000 Cancellation Protection | – | – |

Know more about: Credit Card Comparison

If you are a frequent domestic traveller, and prefer train journeys over flights, an IRCTC co-branded credit card can offer excellent value. The cards stand out due to their accelerated return on train ticket bookings – up to 10% value-back, which is great for a low annual fee. Additionally, many of these come with easily achievable annual fee waiver conditions, which makes them more accessible even for those who like owning multiple credit cards.

To choose the right IRCTC credit card among these, consider the following:

1. Your preferred card issuer, if any (existing relationships lead to higher chances of approval)

2. Estimate the highest value-back potential based on capping and other conditions

3. Consider non-IRCTC benefits, especially if you want to own just one best-suited credit card

4. Identify your preferred spending category, like grocery or utility, to maximize benefits

5. Check if your existing credit cards offer general travel or railway benefits

Q. Which IRCTC credit card offers the highest value-back on train ticket bookings?

A. Currently, there are four IRCTC credit cards that offer the highest value-back on train ticket bookings, which is up to 10%. These cards include IRCTC SBI Platinum, IRCTC SBI Premier, IRCTC HDFC and IRCTC BOB credit cards.

Q. Which IRCTC credit card offers the best rewards on non-IRCTC spends?

A. IRCTC SBI Premier Credit Card offers the highest value-back of up to 2.4% on non-IRCTC spends among all the IRCTC co-branded credit cards. However, this higher value-back is only limited to dining and utility bill payments. Other spends come with a lower base reward rate.

Q. What are the annual fees for IRCTC credit cards?

A. IRCTC SBI Card Premier comes at an annual fee of Rs. 1,499 and IRCTC BoB Credit Card charges Rs. 350 as its renewal fee, while all other IRCTC credit cards like SBI Platinum, IRCTC RBL and IRCTC HDFC come at Rs. 500 fee.

Q. Do these IRCTC credit cards offer railway lounge access?

A. Yes, all the IRCTC credit cards offer complimentary access to railway lounges. SBI Premier, HDFC and RBL IRCTC cards offer 8 free railway lounge visits every year, while SBI Platinum and Bank of Baroda IRCTC credit cards come with 4 free visits to railway lounges in a year.

Q. Which IRCTC credit card is the best?

A. The best IRCTC credit card for you depends on your individual needs and spending habits. Frequent train travellers can save well through IRCTC co-branded credit cards. However, while choosing the best IRCTC card, you should also consider other features and benefits offered by them and check whether they align with your requirements well enough to help you maximise your savings.

Q. How to add IRCTC credit card in IRCTC app?

A. To maximise your IRCTC credit card’s benefits, it is advised to link your card to your IRCTC user ID account. For this, you can log in to your account on the IRCTC app and then go to the loyalty account section on the menu. There, you can account by entering your IRCTC card 11-digit loyalty number and complete verification through OTP.

Q. Which card gives a discount on train tickets?

A. IRCTC credit cards available in partnership with various card providers like SBI Card, HDFC Bank, RBL and Bank of Baroda offer savings in the form of reward points on train ticket bookings. However, they do not come with any direct discount offer on train bookings. In addition to the rewards benefits, you can also avail the transaction fee waiver on IRCTC bookings through these credit cards.