Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Planning an international trip might be challenging. Flights and hotels already cost a lot, and managing expenses during the trip can make it even more difficult to stay within your budget. While you can save on your travel bookings through credit cards, figuring out how to save on money spent abroad might be confusing.

With credit cards and forex cards being the two most popular options, which one should you choose? Should you carry a forex card or rely on your credit card? Here is a detailed comparison of forex cards vs credit cards to help you make the right choice for your overseas spends.

What is a Forex Card?

What is a Forex Card?Forex cards, also known as prepaid travel cards, are quite popular among frequent international travellers. With forex cards, you can load currency before your trip and then use it for your international spends. One thing that makes forex cards stand out is that you can load multiple currencies on a single forex card and easily manage your expenses while visiting multiple countries during your vacation. Also, the exchange rate is locked-in at the time of loading, which saves you from fluctuating exchange rates. Unlike credit cards that charge a hefty fee and interest on cash withdrawals, forex cards allow you to withdraw cash at a nominal fee.

An important point to note is that you can load the foreign currency only up to a certain limit on your forex card as per RBI guidelines.

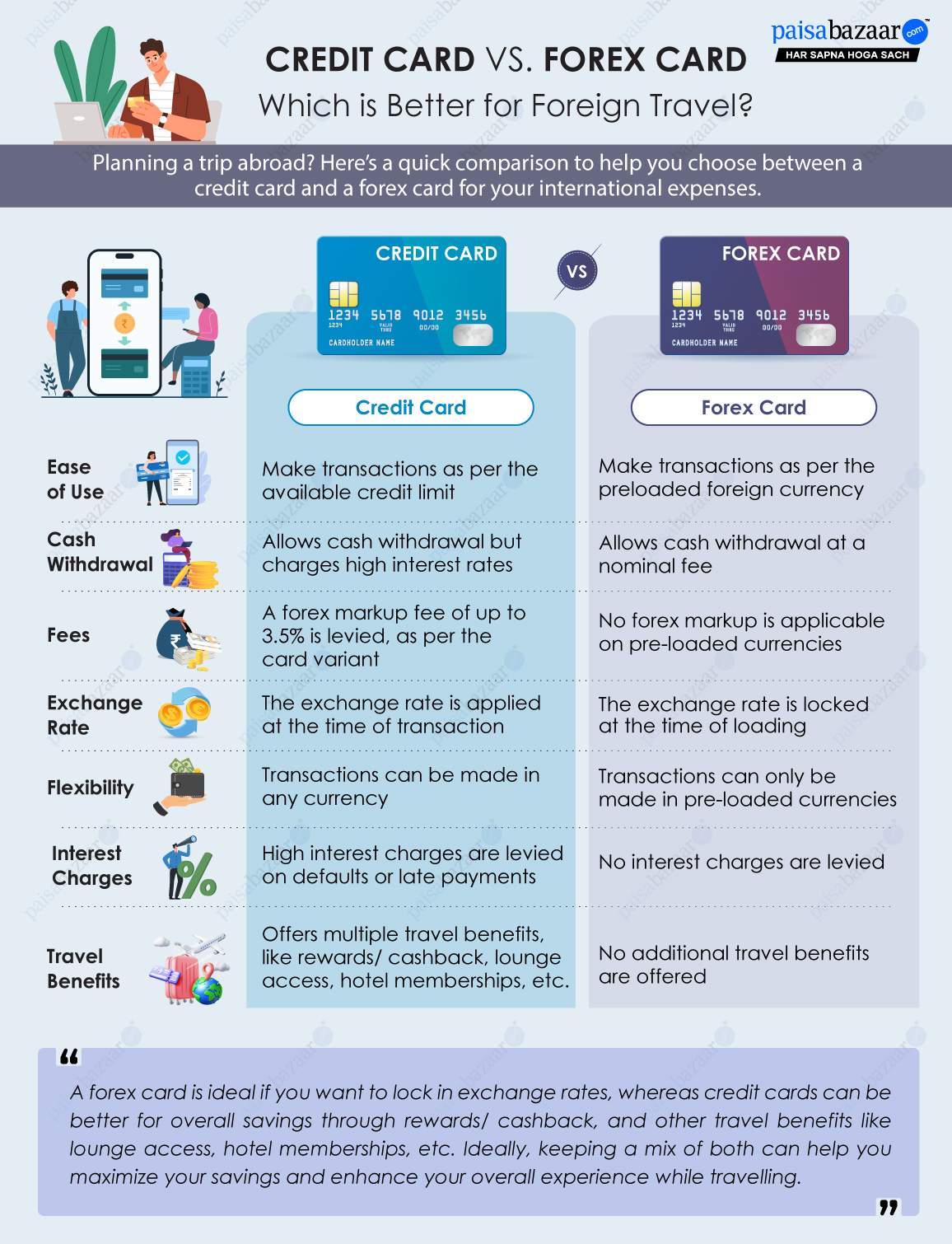

While both forex cards and credit cards allow you to make foreign currency transactions, they both come with their own terms and conditions. Given below are some of the key differences between credit cards and forex cards:

Forex Markup Fee

Credit cards charge a forex markup fee ranging from 0% to 3.5% (as per the card variant) for foreign currency transactions. Whereas forex cards allow you to load the currency and spend it without any forex markup fee, which reduces the overall cost.

For example, on spending Rs. 1 Lakh in foreign currency, you have to pay a forex markup fee of up to Rs. 3,500 (3.5%), but with forex cards, you can save on your international spends as you don’t have to pay any additional charges. However, select travel or premium credit cards also come with zero or low forex markup fee along with other travel benefits.

Rewards & Benefits

Forex cards are designed solely for loading and spending foreign currency and do not offer any additional benefits like rewards or cashback. On the other hands, credit cards offer value-back on international spends, with some cards providing accelerated value on foreign transactions. Premium cards that offer low forex markup, complimentary lounge visits, hotel memberships, etc. could provide much higher overall value than forex cards. Not only premium cards, some travel-focused cards like Federal Scapia also come with the zero forex markup fee benefit along with accelerated rewards on your travel spends, allowing you to save on both travel and international spends.

ATM Cash Withdrawal

Unlike credit cards, forex cards allow you to withdraw cash from ATMs at a nominal charge. Credit cards, on the other hand, charge a high interest rate on cash withdrawals, and you do not get an interest-free period on such transactions. The interest is charged from the very first day of withdrawal, which can lead you into a debt trap. Hence, choosing forex cards might be a better option for cash withdrawals. However, do keep a note that forex cards also charge a nominal fee for cash withdrawals.

High Interest Rate

Credit cards allow you to borrow funds up to an assigned limit and repay them later through monthly bills. However, in case of any late or default payments, credit cards attract high interest charges along with a late payment fee. Also, in case you do not repay the entire bill, the interest will be charged on the outstanding amount and on new transactions from the date of purchase. Therefore, using a forex card for international transaction would be a smarter choice if you plan to spend a considerable amount, which you may not be able to repay timely.

Exchange Rate

With credit cards, when you spend internationally, usually your transaction is converted as per the current exchange rate, and a forex markup fee is also levied. However, in the case of forex cards, the currency exchange rate is locked at the time of loading, which protects you from the fluctuating exchange rates and enhances your savings.

The choice between a forex card and a credit card depends on your preferences and requirements. If you are a frequent traveller looking to save only on international spends, choosing a forex card would be a reasonable option.

However, if you are looking for a card to save on your overall travel spends, choosing a credit card would be a smarter choice. You can save on your international spends with low or zero forex markup fee while availing multiple travel benefits, including, accelerated rewards/cashback, redemption of accumulated rewards against travel expenses, complimentary lounge access, free hotel memberships & stays and more.

Overall, credit cards turn out to be a better choice for international travel if you want to maximize your savings across multiple travel spends. However, if you only want to save on international spends, you can opt for a forex card.

Choose a Forex Card if:

Choose a Credit Card if: