Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

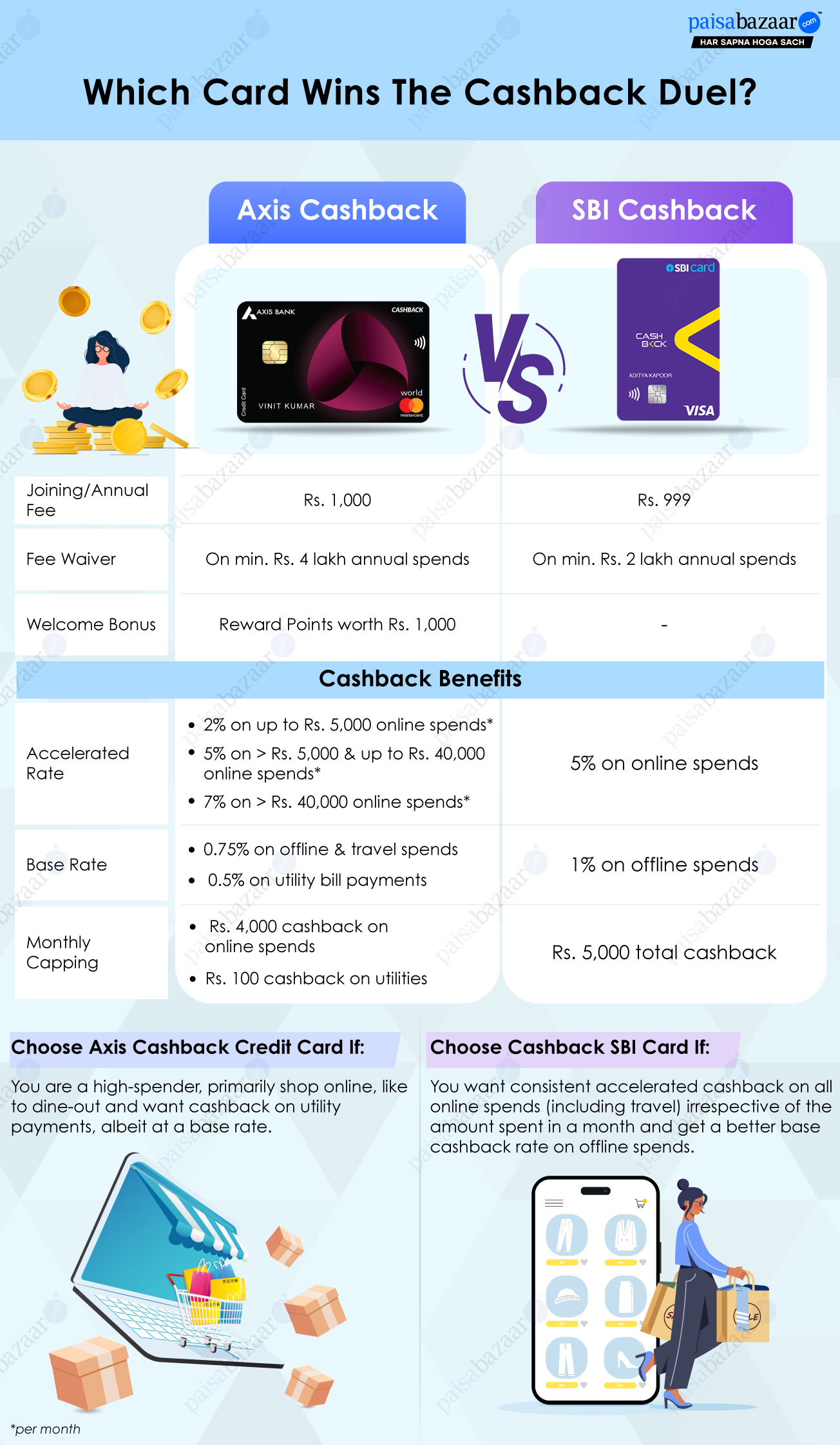

Axis Bank and SBI Card both offer cashback credit cards with accelerated value-back on online transactions and a base savings rate on offline spends at an almost same annual fee of Rs. 1,000 and Rs. 999 respectively. However, their seemingly similar cashback structures come with significant differences. Both Axis Bank Cashback Credit Card and Cashback SBI Card may require different spending strategies or suit consumers with different spending habits.

So, here is a detailed comparison between the features and benefits of Axis Cashback and SBI Cashback credit cards to help you understand how each of these cards can help you maximise your savings. Depending on your spending habits and requirements, you may decide which would be a more suitable choice for you.

Cashback Structure

Both cashback credit cards offer accelerated cashback on online spends. However, their cashback structure has some key differences as illustrated below:

| Axis Cashback Credit Card | SBI Cashback Credit Card |

| • 2% on up to Rs. 5,000 online spends • 5% on > Rs. 5,000 & up to Rs. 40,000 online spends • 7% on > Rs. 40,000 online spends |

5% on online spends |

| Axis Cashback Credit Card | SBI Cashback Credit Card |

| • 0.75% on offline & travel spends • 0.5% on utility bill payments |

1% on offline spends |

Axis Bank Cashback Credit Card: Monthly capping on cashback earning on each category spend is as follows –

Cashback SBI Card: This SBI credit card comes with a cashback capping of Rs. 5,000 on overall monthly spends. The cardholders will not get any cashback beyond this limit.

The major difference here is that SBI credit card comes with a direct categorisation of cashback rates into 2 categories, i.e. online and offline spends, while Axis credit card, though offers accelerated savings on online spends like SBI Cashback, comes with an incremental cashback rate which changes as per the amount spent in a month. So, even if you wish to match the 5% cashback rate on online spends of SBI card, you would only be able to do so on online spends made after reaching the Rs. 5,000 threshold.

Furthermore, Axis Cashback comes with a major drawback when it comes to travel-related spends as it offers only a base rate of 0.75% as opposed to the 5% on online travel and 1% on offline spends offered by SBI Cashback. However, when it comes to utility spends, SBI card falls behind as this category is excluded from its cashback program, while the Axis variant includes it instead, albeit offering a lower cashback of just 0.5%. The capping limits on both cards does not seem to have much effect on the earning capacity, apart from the utility spends made via Axis Cashback, as the limits are quite high.

In addition to the cashback benefits, both the cards offer the following features and benefits to the users:

Here, both the cards offer benefits targeting different categories. Axis Bank Cashback credit card first compensates for the joining fee charged by offering a welcome bonus worth the same amount – a feature missing for SBI Cashback credit cardholders. From second year onwards, both cards offer the annual fee waiver feature, but at different spending requirements. SBI cardholders can avail this benefit even if they are a low spender, but Axis Cashback requires you to spend a slightly higher amount. Marking another major difference in features are the dining and fuel benefits as Axis credit card comes with a considerable value-back in dining, while SBI card counters it with a basic fuel surcharge waiver.

| Categories | Amount Spent (per month) | Savings via Axis Cashback | Savings via Cashback SBI |

| Utilities | Rs. 9,000 | Rs. 45 | Nil |

| Grocery & Other Essentials | Rs. 12,000 | Rs. 100 (2%) + Rs. 350 (5%) | Rs. 600 |

| Dining | Rs. 5,000 (i.e. 2,600+900+1,500) |

Rs. 650 off + Rs. 217 | Rs. 250 |

| Entertainment | Rs. 2,000 | Rs. 100 | Rs. 100 |

| Food Delivery | Rs. 4,000 | Rs. 200 | Rs. 200 |

| Travel | Rs. 12,000 | Rs. 90 | Rs. 600 |

| Shopping | Rs. 5,000 | Rs. 250 | Rs. 250 |

| Other Online Spends | Rs. 5,000 | Rs. 250 | Rs. 250 |

| Fuel | Rs. 3,000 | Nil | Rs. 30 (1% surcharge waiver) |

| Miscellaneous Offline Spends | Rs. 10,000 | Rs. 75 | Rs. 100 |

| Total | Rs. 67,000 | Rs. 2,327 | Rs. 2,380 |

Note: All category spends other than fuel and miscellaneous offline spends are assumed to be made online.

Since both the cards come at similar annual charges and broadly offer accelerated cashback on online and base cashback on offline spends, you must analyse the details to truly compare them. You must consider features like excluded spending categories, capping on cashback earnings, and other card benefits to understand which card would suit you the best and can help you maximise your savings.