Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get your FREE Credit Report with monthly updates

Let’s Get Started

The entered number doesn't seem to be correct

PAN or Permanent Account Number is a 10-digit unique alphanumeric code assigned to every taxpayer. Each PAN cardholder is connected with the Assessing Officer through this 10-digit unique code. The code denotes PAN Jurisdiction, Commissioner’s charge, Circle/ward and others. You can know your PAN jurisdiction and other details easily online.

There are a number of websites that provide PAN Jurisdiction of the given PAN of any individual. But, it is recommended that individuals should visit the official website of the Income Tax Department to know the PAN card jurisdiction. PAN jurisdiction gives full jurisdictional details when the PAN number is entered on the official website. Read further to know more about PAN jurisdiction, how to know you PAN jurisdiction and more.

Knowing your PAN jurisdiction provides full-fledged details of the Commissioner’s charge, Chief Commissioner Region, Joint Commissioner Range, Place and the Designation of the Assessing Officer. Also, for instance, if an individual has applied for PAN card and has been allotted PAN card by the Income Tax Department on the basis of the permanent address mentioned in the application form, he/she can also check the PAN card status.

In case an individual wants to shift/change his/her permanent address and wants to communicate with the I-T department on this change, then the individual needs to change his/her PAN jurisdiction, which lies with the jurisdictional Assessing Officer allotted to be assessed when applied for PAN card.

Here comes the relevance of knowing your PAN Jurisdiction. With PAN card jurisdiction you can shift/change your permanent address easily. Individuals can know their PAN Details by visiting the official website of Income Tax Department.

Get Free Credit Report with Complete Analysis of Credit Score Check Now

You can easily know your PAN jurisdiction in four simple steps. Below mentioned are steps to know PAN card jurisdiction:

Step 1: Visit the official website of Income Tax at https://www.incometax.gov.in/iec/foportal/

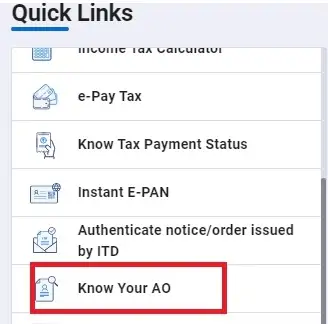

Step 2: Click on “Know Your AO”

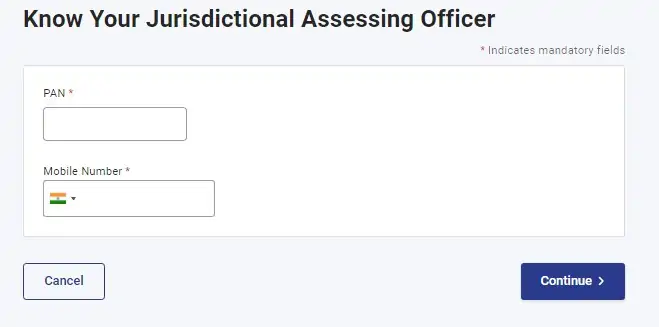

Step 3: Enter your PAN and mobile number and then click “Submit”

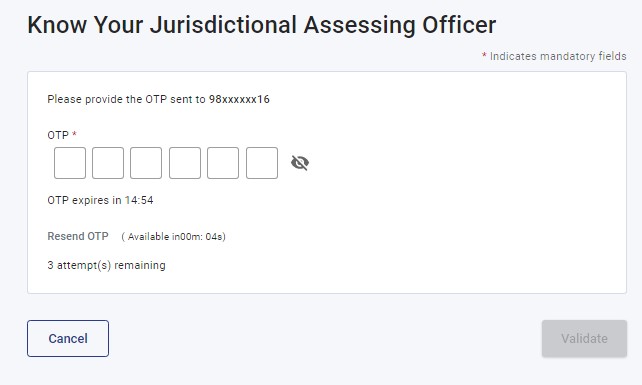

Step 4: Enter the OTP received on your registered mobile number and click “Validate”

Step 5: PAN jurisdictional details will be displayed on the screen for the concerned PAN number. N. You will get the name, area code, AO type, AO number, range code, jurisdiction, building name of the income tax ward office, email ID of the income tax award office and your PAN card status.

Individuals can change their PAN jurisdiction in case of the following situations:

When an assessee shifts/changes his/her residential area, he/she needs to change the details when filing returns. For communicating with the I-T department, the taxpayer should necessarily make the changes required. Below mentioned are the steps through which you can change the Assessing Officer due to change in your permanent address:

Step 1: Write an application to your current AO stating the reason for the change in AO as address change

Step 2: Write an application to new AO requesting him to apply to the existing AO for his AO change

Step 3: The current AO has to accept this application

Step 4: Once approved, the application is forwarded to the Income Tax Commissioner

Step 5: After approval from the commissioner, the AO is changed from the existing AO to the AO from where the application process was initiated

In case the existing AO does not approve the application request, the migration of PAN is not processed and the migration gets stuck. The new AO can do nothing to get the application approved.

There may be circumstances where your current AO may not be efficient in discharging his duties and may have an unprofessional behaviour, you can request a change in your AO. You can get this done by following the steps mentioned below:

Get Free Credit Report with monthly updates. Check Now

What are the AO codes available?

The Income Tax Department provides four primary types of AO codes. These AO codes help to identify whether the entity is a company, an individual or anything else and further manage the application with suitable tax laws.

Is AO code mandatory?

It is mandatory for applicants to mention the AO code in the PAN application. The applicant should choose the AO code under the jurisdiction he/she falls. However, the applicant should be careful when selecting his/her AO code.

Why is it essential to migrate PAN whenever the residential address is changed?

This action is necessary since it permits the new AO to initiate the assessment of returns filed by the assessee based on his new address.

What do you understand by the migration of PAN?

In simple terms, migration of PAN can be simply explained as the transfer of jurisdiction of an assessee from one Assessing Officer to another Assessing Officer.

How can I change my Assessing Officer after I have changed my residential address?

An applicant can visit the Assessing Officer under whose jurisdiction the new address falls and submit six copies of the application along with the required proof. A copy of the application should also be sent to the concerned AO, CIT and Addl./Jt.CIT. Upon proper verification, the AO is changed as per the new residence of the applicant.

Can I change my Assessing Officer on account of his/her behaviour?

Yes, an assessee can change his Assessing Officer on account of his behaviour if the AO is not performing his tasks with due diligence.

What is the process involved in changing my Assessing Officer if I am not happy with his/her behaviour?

The process of changing the AO is the same for all cases. The applicant has to mention the reason for his application for changing the AO. The letter has to be sent to the Ombudsman and has to be duly signed by the applicant and his representative. Relevant documents are required to be submitted.

How to gather information related to the jurisdiction of a new Assessing Officer?

The jurisdiction of a new AO can be checked through the www.incometaxindia.gov.in website. Once you have accessed the website, simply press on ‘Field Offices’ in which the designations, as well as contact numbers linked to all Assessing Officers, are available.

Why should you know your PAN jurisdiction and Assessing Officer (AO)?

The Assessing Officer has various responsibilities. Some of them are:

The AO also has the power to penalise and waive penalties. Each Income Tax ward or circle can have more than one designated AOs. Knowing your PAN jurisdiction and AO is helpful when you want to make an in-person visit or send a snail mail, instead of sending an email. You can also contact the AO to talk about a notice sent to you, give clarification to the notice, raise a dispute about a notice or make a complaint about any part of the Income Tax process.

To know your PAN AO jurisdiction you need to have a valid PAN. You can enter your PAN details to find out your income tax ward number or AO Code. You may have to provide these jurisdiction details when you file your income tax returns.