Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get your FREE Credit Report with monthly updates

Let’s Get Started

The entered number doesn't seem to be correct

Permanent Account Number (PAN) is a mandatory requirement for almost all Indian citizens and commercial entities, especially those who pay income tax and are identifiable under the Income Tax Act, 1961. It’s a 10-digit unique alphanumeric identification code through which all the monetary transactions are tracked. Hence, it helps to reduce tax evasion by keeping a record of all financial transactions. PAN card is also issued to foreign nationals (such as foreign investors) who are permitted with a valid visa.

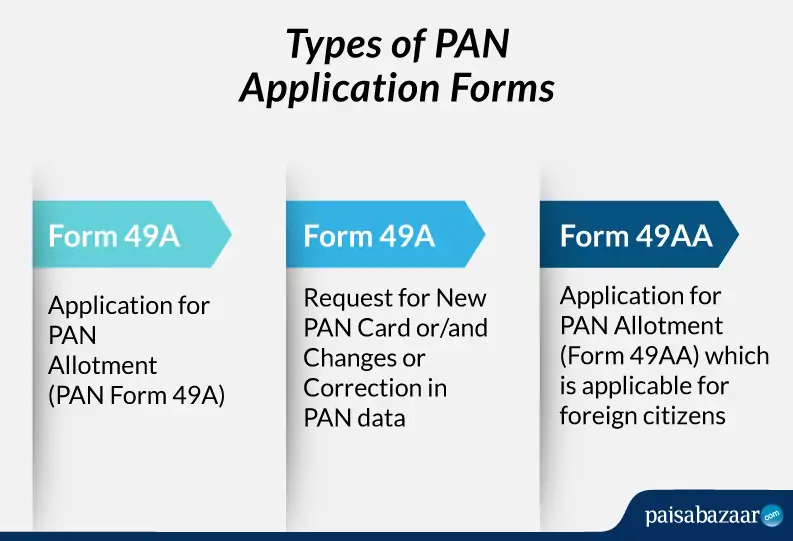

The Income Tax Department of India offers three types of PAN Card application forms. They are:

| Download PAN Application Form | Description |

| Form 49A |

|

| Form 49A |

|

| Form 49AA |

|

Let us now understand all the types of forms in detail.

In case you have never applied for a PAN Card and want to apply for a new PAN Card, you need to fill the form 49A for the allotment of PAN.

Know more on PAN card Form 49A

This form is basically for the foreign citizens who have never applied for a PAN Card and want to apply for a new PAN Card.

For all three forms, you need to visit the official website of TIN-NSDL and choose your application type and fill the form as required.

Read more on PAN card Form 49AA

You need to attach documents for PAN Card along with the Form 49A a Proof of Address (POA), Proof of Identity (POI) as well as Proof of Date of Birth for the PAN application such as:

Citizens outside the country are supposed to submit necessary documents along with Form 49AA for Proof of Identity and Proof of Address. Below mentioned are the documents required to submit with the application form:

Also Read: How to Apply for a PAN Card Online?

For instance, if you wish to apply for a new PAN Card, you need to follow the steps mentioned below:

Step 1: Visit the official website of NSDL

Step 2: Select the ‘Application Type’ i.e. New PAN – Indian Citizen (Form 49A)

Step 3: Select the ‘Category’ as applicable

Step 4: Now, you need to fill in all the mandatory details like your name, date of birth, mobile number, etc.

Step 5: Once you successfully fill the form, you will get a notification regarding your registration along with your token number

Step 6: You need to click on the ‘Continue with the PAN Application Form’ button

Step 7: You have to enter details such as your contact details, etc.

Step 8: Enter your Area Code, AO Type, and other details

Step 9: You don’t have to attach the documents along with the form as all the details will be taken from your Aadhaar Card automatically. Tick mark the declaration to proceed further

Step 10: In case there are any errors in the form, it will appear on the screen. If no changes, click on the ‘Proceed’ button

Step 11: You will be redirected to the payment section where you have to make payment through payment options like demand draft/net banking/debit/credit card

Step 12: After the payment is successfully done, an acknowledge form will be sent along with the 15-digit acknowledgment slip to track the status of your PAN Card

Note: The digital submission of the form i.e. the paperless online application for updating PAN Card, the facility of e-KYC and e-Sign (i.e. Aadhaar based e-Signature) and Digital Signature Certificate (DSC) has been provided to enable PAN applicants to furnish the application for PAN online. (Please refer to step 6)

As per provisions of Section 272B of the Income Tax Act., 1961, a penalty of Rs. 10,000 can be levied on possession of more than one PAN.

Once the Aadhaar authentication is successfully completed, a One Time Password (OTP) will be sent on your registered mobile number/email ID linked with Aadhaar Card to generate the Aadhaar-based e-Sign.

Also Read: How to track the status of PAN Card?