Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Get your FREE Credit Report with monthly updates

Let’s Get Started

The entered number doesn't seem to be correct

Bulk PAN verification is the process by which eligible entities can verify the authenticity of permanent account number (PAN). The introduction of online bulk PAN verification has allowed eligible entities such as banks and financial institutions to reduce the time taken to check PAN for various requirements including government regulatory measures. Typically the process of PAN verification request verifies the PAN data provided by a prospective applicant against the central PAN database maintained by the CBDT (Central Board of Direct Taxes). Bulk verification of PAN involved checking hundreds and thousands of such PAN records against the Income Tax Department (ITD) database.

The online bulk PAN verification service is currently available through the NSDL e-Governance Infrastructure Limited and the UTI Infrastructure Technology and Services Limited websites. To avail the service, the individual/entity interested in performing bulk PAN verification needs to complete registration for the service on the applicable website.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

The following is a short list of entities that are eligible for bulk PAN verification registration:

| Banks and other Financial Institutions | RBI approved Payments Banks | Insurance Web Aggregators |

| Central Recordkeeping agency of National Pension System | Credit Card companies/institutions | Central/State Govt. Agencies |

| Mutual Fund | Depository Participants | Companies required to provide a Statement of Financial Transaction (SFT) or Annual Information Return (AIR). |

| Insurance Companies

|

Educational Institutions established by Regulatory Bodies | Any other entity required to furnish Annual Information Return (AIR)/Statement of Financial Transaction (SFT). |

| KYC Registration Agency (KRA) and Central KYC Registry | RBI approved credit information companies | Commodity Exchanges/ Stock Exchanges/ Clearing Corporations |

| Companies and Government deductors required to file TDS/TCS return | Non-Banking Financial Companies approved by RBI | Insurance Repository |

| Goods and Services Tax Network | DSC issuing authorities | Housing Finance Companies |

| Prepaid Payment Instrument (PPI) issuers approved by RBI | Stamp and Registration Department | SEBI approved Investment Advisor |

The key requirements when registering for bulk PAN verification include the follows:

However, do note that only companies belonging to one of the categories as mentioned above can get approved for registration under the bulk PAN verification service.

The list of key documents acceptable for bulk PAN verification registration is as follows:

Note: Only one of the above documents is required. Check the complete list of documents required.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

The following are the key steps to register for bulk PAN verification service online:

Step 1: Forward applicable documents to NSDL e-Gov including but not limited to PAN, incorporation certificate, Authorisation Letter, etc. in addition to one of the key documents mentioned in the above list.

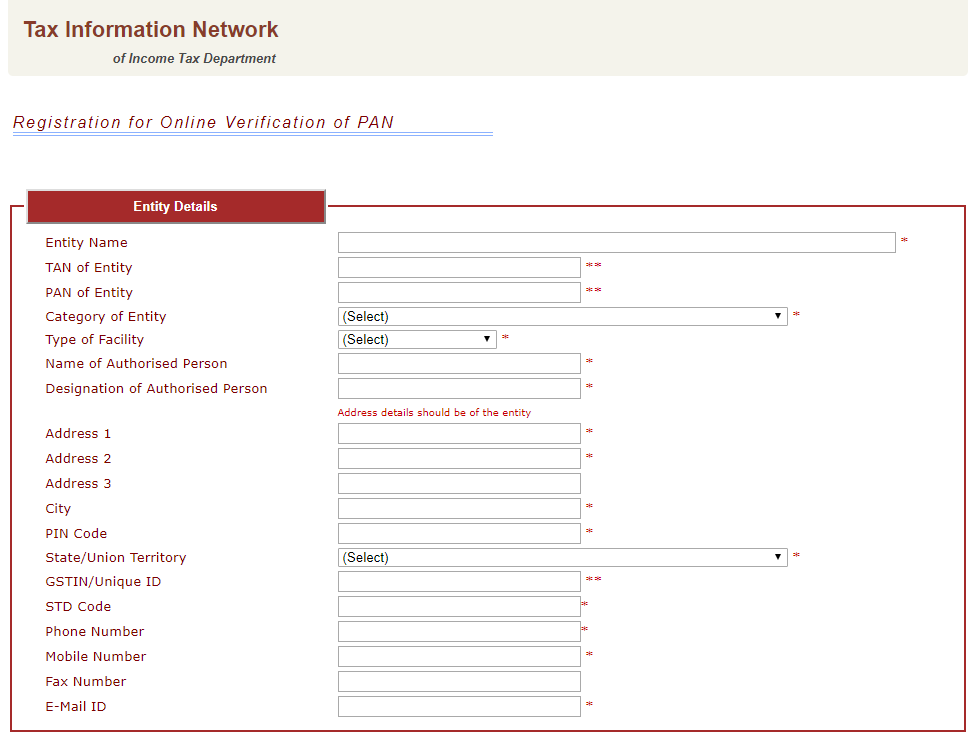

Step 2: Fill out the key details in the application form including organisation details and reason for availing the PAN verification facility. The following is a snapshot of the online application form:

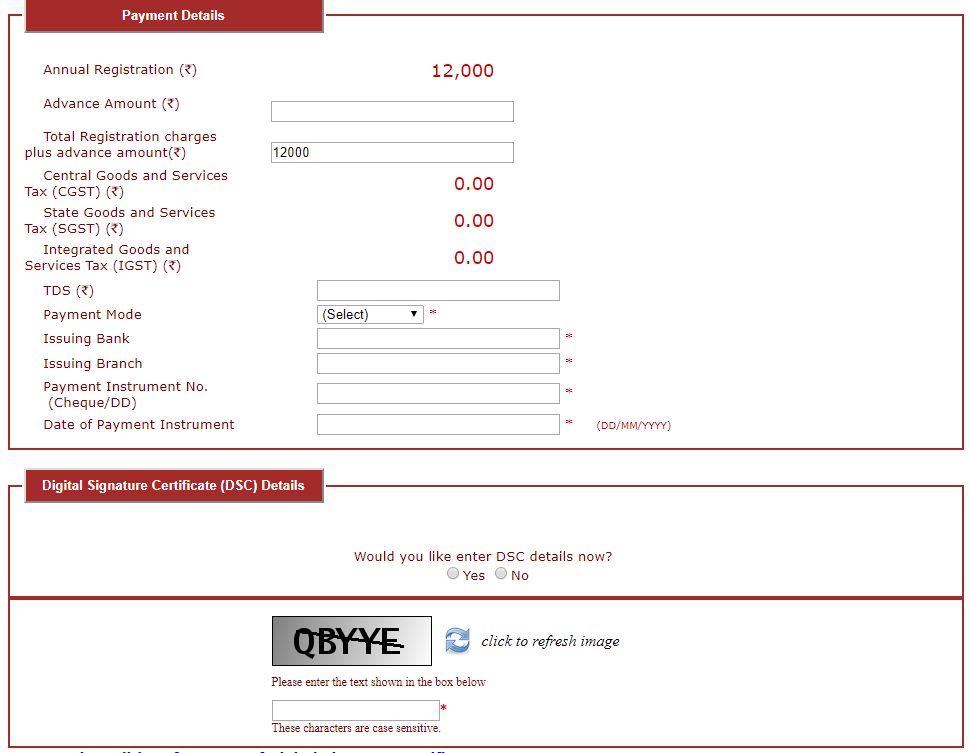

Step 3: Provide the registration fee payment details and upload DSC (Digital Signature Certificate) and upload a copy of suitable digital signature in order to complete the registration process for verification of PAN in bulk.

Currently bulk verification of PAN is available via 3 modes as follows:

The following are the common user responses to bulk PAN verification requests:

| Status of PAN | Information Available to User |

| Valid PAN |

|

| Valid PAN with merger, acquisition, etc. events |

|

| Deleted/Deactivated PAN | No additional details apart from “Deleted” or “Deactivated” status |

| Fake PAN | Just a message showing “Marked as Fake” is displayed |

| PAN not available on database | Message displayed reads “not present in ITD database”. If the PAN holder can provide proof of this PAN, such as PAN allotment letter or PAN card copy, an investigation maybe launched by the IT Department. |

The current schedule of charges for availing the bulk PAN verification services of NSDL e-Gov are as follows:

| Type of Charge/Transaction | Screen Based Verification Charges | Files and Screen based Verification Charges | API based Verification Charges |

| Annual Registration Charges (including GST@18%) | Rs.14,160 | Rs. 14,160 | Rs. 14,160 |

The following are charges for PAN verification in bulk beyond the free limit of 750 PAN checks:

| No. of PAN in File | Slab 1 (@Re 0.30) | Slab 2 (@Re 0.25) | Slab 3(@Re 0.15) | Slab 4(@Re 0.05) |

| 1-200 | Rs. 60 | Rs. 50 | Rs. 30 | Rs. 10 |

| 201-400 | Rs. 120 | Rs. 100 | Rs. 60 | Rs. 20 |

| 401-600 | Rs. 180 | Rs. 150 | Rs. 90 | Rs. 30 |

| 601-800 | Rs. 240 | Rs. 200 | Rs. 120 | Rs. 40 |

| 801-1000 | Rs. 300 | Rs. 250 | Rs. 150 | Rs. 50 |

| Slab (PANs verified during a FY) | Rate (Re.) | Maximum Daily Free Limit |

| Not exceeding 7.5 lakh PAN | Re. 0.30 | 750 |

| More than 7.5 lakh up to 15 lakh PAN | Re. 0.25 | 1,000 |

| More than 15 lakh up to 30 lakh PAN | Re. 0.15 | 1,500 |

| Over 30 lakh PAN | Re. 0.05 | 2,500 |