Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

ICICI Bank, like any other major bank in India, provides UPI-based fund transfer option to its customers along with other online options like NEFT, RTGS, and IMPS. However, the latter modes require you to share account details with the payer/payee, the former mode eliminates the need of sharing account details. You only need to exchange UPI ID with the beneficiary and the fund transfer can be done in no time.

Here we shall learn in detail how to use the UPI feature in the ICICI mobile banking app – iMobile Pay and other third-party UPI apps. ICICI Bank has integrated the UPI platform in its mobile banking app. Therefore, there is no special app dedicated for UPI transfers.

Unified Payment Interface (UPI) enables all bank account holders of participating banks to send and receive money from their smartphones just by entering the VPA and without entering any additional bank details. UPI service is instant and is available 24×7 even on public/bank holidays.

Your Credit Score Is Now Absolutely Free Check Now

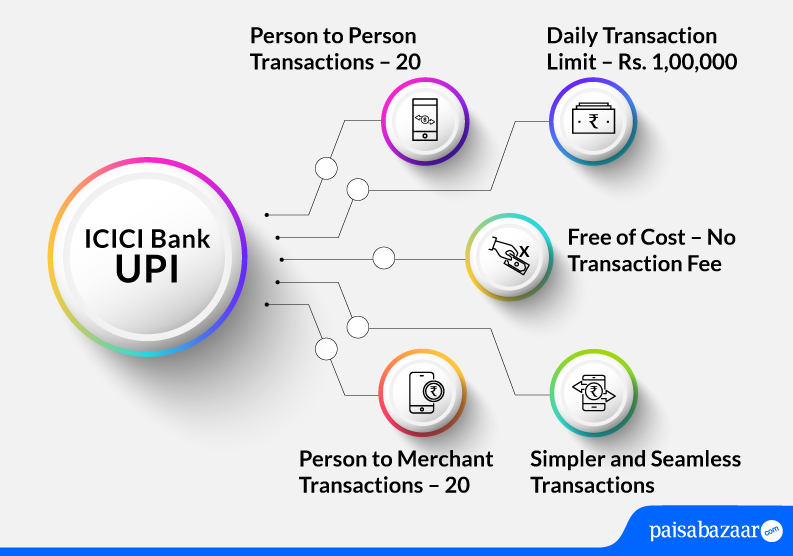

ICICI Bank does not have a separate app dedicated for the use of UPI. The feature is embedded in the bank’s mobile banking application called iMobile. Let us know about the UPI features offered by this application:

| Type of Transaction | Transaction Limit |

| Daily transaction limit | Rs. 1,00,000 |

| Per transaction limit | Rs. 1,00,000 |

| Total number of transactions allowed in a day through third-party apps | 10 |

| Person to person transactions | 20 |

| Person to merchant transactions | 20 |

| IPO limit | Rs. 5,00,000 |

| For categories like Capital Markets, Collections, Insurance, Foreign Inward Remittances | Rs. 2,00,000 |

A Good Credit Score ensures you manage Your Finances Well Check Now

Following steps explain how to register on the ICICI Bank UPI App:

Step 1: Download ICICI Bank’s mobile banking app iMobile Pay app from Google Play Store or Apple Store.

Step 2: Login to the app and tap on ‘BHIM UPI’ icon on the dashboard.

Step 3: Click on ‘Manage’ and then tap on ‘My Profile’ section.

Step 4: Input the UPI ID of your choice or pick from the suggested UPI IDs and hit ‘Proceed’.

Step 5: Link your ICICI Bank account and select your account number.

Step 6: Under ‘Set as Default’, select ‘To Send Money’ and ‘To Receive Money’ option. Click on ‘Submit’.

Step 7: Your UPI ID is successfully created.

While sending money using ICICI Bank’s iMobile Pay through UPI, you will get three options to send money namely – using any contact in your phone, using UPI ID, and using bank account number and IFSC. The below-mentioned process explains how one can send money using UPI ID from iMobile Pay:

Step 1: Login to iMobile Pay and tap on BHIM UPI on the dashboard.

Step 2: Tap on ‘Send Money’.

Step 3: Input the UPI ID of the receiver.

Step 4: Add the amount and click on ‘Proceed’.

Step 5: Enter the UPI PIN and your transaction will be processed.

Below-mentioned are the steps that will help you collect money using ICICI Bank’s iMobile Pay app:

Step 1: Login to iMobile Pay application and click on BHIM UPI option on the dashboard

Step 2: Tap on ‘Transact’. On the next page, select the option ‘Collect from Virtual Payment Address’.

Step 3: Input all the details such as the receiver’s UPI ID, Payee’s UPI ID, amount, choose from ‘Collect Now’ or ‘Collect Later’, and select the expiry date. Click on ‘Submit’.

Step 4: Tap on ‘Submit’ on the pre-confirmation page and your transaction to collect money will be successful.

In iMobile Pay application, you have the option to raise a complaint regarding UPI. Navigate to ‘Contact Us’ and tap on ‘Register a complaint regarding UPI’ section and raise a query. The customer needs to mention the following details for faster assistance:

In case customers face any issues regarding UPI, they can contact the customer care executive on the mentioned customer care number:

If the issue is related to any third-party application, he/she may contact customer care as under:

| Partner | Customer Care Contact |

| Google Pay | 1-800-419-0157 |

| 1-800-212-8552 | |

| PhonePe | 080-68727374 |

| Xiaomi | 18002586286 |

| MakeMyTrip | 0124-462-8747 |

Also Read: ICICI Bank Customer Care

Get Free Credit Report with monthly updates. Check Now

Q. What will I get my refund in case of a failed UPI transaction in ICICI Bank?

Ans. If the transaction has failed and the amount is deducted from your account, you shall receive your amount within Transaction + 2 days. However, in case you do not receive your funds within the stipulated period, you can call the bank’s customer care between 7:00 AM to 9:00 PM from your registered mobile number.

Alternatively, you can also write to the bank at customer.care@icicibank.com for further assistance.

Q. I have two accounts with ICICI Bank, do I need separate VPAs for each of my accounts?

Ans. You have the choice to link both of your accounts to a single VPA. However, you need to ensure which account you would use as your default account for debit transactions and which account would be used for credit transactions. Alternatively, you can also generate a separate VPA for each account.

Q. Is UPI active on ‘Pockets’ app by ICICI Bank?

Ans. Yes. UPI is active on ‘Pockets’ app by ICICI Bank.

Q. Where can I access my UPI transactions?

Ans. The bank records all your transactions done through UPI and you have the option to view your transactions in the ‘Transaction History’ section on the ICICI Bank mobile banking app.

Q. Is there an option to cancel UPI payment in ICICI Bank?

Ans. UPI transactions once initiated cannot be cancelled or reversed since these are real time transactions.

Q. Can I transfer money abroad using UPI in ICICI Bank?

Ans. You cannot transfer money abroad using UPI in ICICI Bank.