Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Fixed deposit is considered a safe and fruitful investment option in India. People living in India enjoy decent returns on FD thus making FD a preferred choice for risk-averse investors. But the fixed deposit is not limited to residents of India only. NRIs or the Non-Resident Indians also have this option in the form of NRI fixed deposit (FD) accounts.

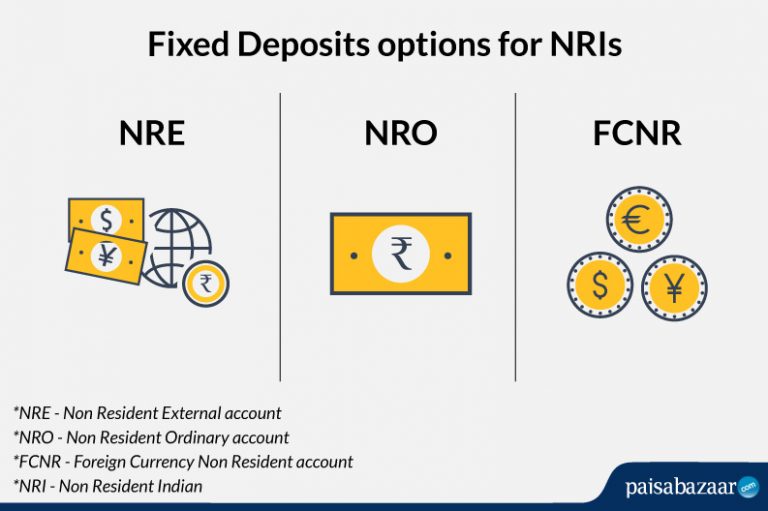

These accounts are of four different types, viz. NRE (Non-Resident External), NRO (Non-Resident Ordinary), and FCNR (Foreign Currency Non-Resident) including RFC (Resident Foreign Currency) accounts.

Here we shall make a comparison as NRE vs NRO vs FCNR to understand how these three accounts differ from each other and what purpose they solve for Indians living in foreign lands.

Manage all FDs in one place

Manage all FDs in one place

No Bank A/C Required

No Bank A/C Required

| Particulars/Type Account | NRE | NRO | FCNR |

| Deposit Currency | Foreign currency | Indian Rupee (INR) | Foreign Currency |

| Withdrawal Currency | Indian Rupee | Indian Rupee | Foreign Currency |

| Taxable in India | Not taxable in India | Taxable in India (at 30%) | Not Taxable in India |

| Exchange Rate Risk | Open to risk due to fluctuating foreign exchange rate | No foreign exchange risk involved | No foreign exchange risk involved |

| Repatriability (Transferability) | Fully and freely repatriable | Interest is repatriable; transfer of principal amount comes with certain set limits | Fully and freely repatriable |

Now let’s talk about these types of NRI fixed deposit accounts in detail:

NRE is the abbreviation of Non-Resident External Account. NRE accounts can be maintained as savings/current accounts or as fixed deposit accounts.

Purpose: To help NRIs invest their foreign income in Indian financial institutions and avail withdrawal in INR to manage expenses or other financial concerns in India.

Features of an NRE fixed deposit A/c

NRE is also known as a Non-Resident Extraordinary Account.

Suggested Read: Best NRE FD Rates in 2022

NRO is the abbreviated term for a Non-Resident Ordinary account.

Purpose: To help NRIs invest and manage their Indian income in Indian financial institutions.

Features of an NRO fixed deposit A/c

FCNR is an acronym for Foreign Currency Non-Resident account.

Purpose: To help NRIs manage their foreign earnings in Indian Banks and NBFCs.

Features of an FCNR fixed deposit A/c

Suggested Read: FCNR Deposits – Pros and Cons

RFC or Resident Foreign Currency account is designed to help residents of India manage their foreign income.

Purpose: To help R-NOR individuals maintain their foreign earning in India without having to bear the forex risks.

Features of an RFC fixed deposit A/c

All these three accounts are different from each other in ways more than one. The only common factor here is that these accounts are made to benefit Non-Resident Indians.

Where the NRE account is good for those who wish to invest their foreign income in India and use it to manage expenses in India, FCNR is better suited for those NRIs who wish to manage their expenses and investment-related issues outside India.

As far as the NRO fixed deposit account is concerned, this is suitable for those who have Indian income. They can invest this money in an NRO account.

Thus, we cannot say that any of the said deposit types score over the other. Each type of NRI FD account serves a different purpose. Thus it depends on the depositor’s requirement as to which type of NRI fixed deposit account shall be best suited for them.

Suggested Read: Income Tax on Bank FDs